Five things to understand about UBS’s takeover of Credit Suisse, and the European financial system

Switzerland’s biggest bank UBS (UBS) is set to buy its smaller cross-town rival Credit Suisse (CS) in an all-share transaction for US$3.2 billion. The deal was overseen by the country’s central bank, the Swiss National Bank (SNB), and financial market regulator (FINMA). Both banks are among the 30 most significant globally. This comes just a week after the US authorities closed down Silicon Valley (SVB) and Signature (SBNY) Banks. The spread of bank contagion to Europe has unsettled markets.

But we believe these problems remain individual and not systemic. Credit Suisse’s issues are longstanding. Whilst Switzerland’s dramatic response partly reflects its own unique position. The legacy of the 2008 global financial crisis and 2010’s eurozone crisis is that the continent’s banks are now more tightly regulated, with higher liquidity, and greater capital buffers. Additionally, the global authorities are now responding quicker, more forcefully, and with more to come if needed. Regardless, banking sector concerns are accelerating our 2023 view. This is tightening global financial conditions, will cool economies and inflation faster, and hasten the end of this interest rate cycle.

1. CREDIT SUISSE: With assets of US$573 billion it is nearly twice the size of the combined SVB and SBNY US regional bank failures, and much more globally interconnected. It is one of only thirty banks deemed ‘globally systemically significant’ (see below). But it’s problems have been long-standing. This is reflected in its share price underperforming the Euro Stoxx Bank index by 68% the past year and by 63% the past five years. It is being taken over by UBS, which has over twice its total assets, at US$1.1 trillion. This will create a Swiss giant of around US$1.7 trillion asset size. But still leave it less than half size of JP Morgan’s (JPM) US$4 trillion of assets, by comparison.

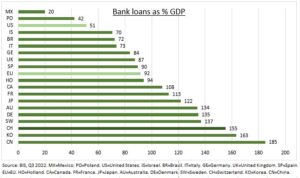

2. SWITZERLAND: The rapid and decisive response from the Swiss authorities in supporting a domestic takeover reflects the unique size of the banking sector relative to the size of the economy. It is a global outlier. Credit Suisse assets alone are equivalent to more than twice Switzerland’s US$200 billion GDP. Total Swiss bank assets/GDP are over 500%. Whilst Swiss bank loans/GDP are 150% (see chart). The authorities previously provided US$50 billion liquidity support to CS, and have pledged US$110 billion liquidity assistance for the deal.

3. G-SIB: Credit Suisse is one of only thirty banks classified as globally systemically important (see chart). So to is UBS. The list is determined by the Financial Stability Board (FSB), an international body established after the 2008 global financial crisis, by reference to the banks size and international significance. Banks are allocated to buckets 5-1 depending on their importance, and required to have proportionately higher capital buffers than other banks. They also have higher supervision and ‘living wills’ resolution plans.

4. SUPPORT: Global authorities have moved quickly and decisively to prevent individual bank problems spreading to the broader financial system. The US Fed has provided $300 billion of liquidity to US banks, including $12 billon from its new BTFP programme. The SNB over $150 billion of support to Credit Suisse. The ECB announced it stands ready if needed. China cut banks required reserve ratio (RRR) to provide an extra $80 billion in system liquidity. Also, the US’s largest banks provided $30 billion deposits to regional lender First Republic (FRC).

5. LESSON: The manner of UBS takeover at a US$3.1 billion valuation, well below recent share price levels, is a reminder of authorities and regulators priorities and focus in such situations. Their first priority is to protect the broader financial system and depositors. Not necessarily shareholders or bondholders. The US Federal Reserve for example was set up in 1913 directly to protect the financial system, not to manage interest rates.