Ten things to understand about SVB’s and SBNY’s failure and the US financial system

1. BOTTOM LINE: Friday’s closure of the US’s 16th largest bank worried investors already on edge with rising interest rates and recession risks. Additionally, banks can pose unique risks to the broader economy that other sectors do not. But the challenges at Silicon Valley Bank and Silvergate Capital were not broad based or systemic. This is not 2008. The US financial system is well capitalised. Asset quality is strong. This saw the Federal Reserve and FDIC well-positioned to manage the situation, announcing a full deposit guarantee for SVB and Signature Bank depositors, and a $25 billion liquidity support program to help the system. This won’t remove all issues for all banks, but will remove any systemic US banking system concerns.

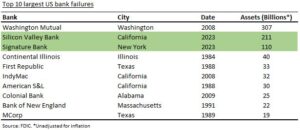

2. WHAT HAPPENED: Silicon Valley Bank (SVB) was closed by regulators Friday, March 10th. This followed Silvergate Capital (SI) announcing its voluntary liquidation on Wednesday, March 8th. SVB was a tech and startup-focused bank and 16th largest in the US with $209 billion of assets. SI was a crypto and digital assets-focused bank with $15 billion of assets. Both are headquartered in California. In response, on Sunday, March 12th the Fed, FDIC, and Treasury Department announced that 1) New York’s Signature Bank (SBNY), the nation’s 30th largest with $110 billion of assets, had also been intervened after facing similar issues, 2) that all uninsured deposits at both banks were now guaranteed and available for withdrawal, and 3) a $25 billion liquidity support program available (BTFP) to support the financial system.

3. WHY IT HAPPENED: Banks typically fail for one of two main reasons. Bad asset quality or low liquidity. Asset quality remains strong with the economy robust and few past-due-loans. The focus is liquidity. Sharply higher Fed interest rates reduced the value of many banks bond portfolios. SVB was especially and uniquely exposed here with a disproportionately large and unhedged portfolio. This then scared withdrawals from also unique deposit base, of large non-retail investors focused on tech sector.

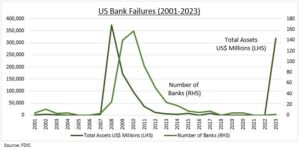

4. ROLE OF THE FDIC: The Federal Deposit Insurance Corporation (FDIC) supervises US banks, insures customer deposits, and manages any banks placed into receivership – like SVB now. The FDIC insures customer deposits up to $250,000. This was raised from $100,000 during the 2008 global financial crisis. This is backed by the ‘full faith and credit’ of the US government and no depositor has ever lost insured deposits. This is well-tested as FDIC has managed 563 bank failures since 2001 (see chart).

5. UNINSURED DEPOSITS: Deposits over the $250,000 insurance cap are often – but not always – fully recovered. But this can take time which creates other problems. In the SVB case, depositors were to be paid an immediate advance payment equal to part of the uninsured deposits. With a certificate issued for the remainder that will periodically repaid depending on the timing and success of the FDIC selling the failed bank assets. Successfully selling SVB is the FDIC focus. The quicker the better. On March 12th the authorities decided to guarantee ALL depositors, with funds available for immediate withdrawal if wanted.

6. TWO EXAMPLES: The 2008 collapse of Washington Mutual (WAMU) was the largest bank failure in US history. With 43,000 employees, 2,200 branches, and $307 billion of assets. It was quickly bought by JP Morgan (JPM) and no depositor lost money. By contrast IndyMac, the fifth largest failure (see below), took six months to resolve, with losses for uninsured deposit holders when sold to OneWest. Both took place in a tougher environment, with twin huge asset quality and liquidity concerns of the GFC.

7. BANKS ARE DIFFERENT: Investors were especially nervous the SVB failure given 1) the relatively recent history of the global financial crisis, 2) the centrality of the financial system to the broader economy, and 3) the unique sensitivity of banks to deposit outflows, and their potential speed. This makes the banking system different from all other sectors and explains the heightened regulatory oversight. Financials is the 3rd largest stock market sector in the US, and the largest in Europe.

8. STOCK IMPACTS: Immediate concerns were focused on the startup and tech sectors, those with significant uninsured SVB deposits, and their ability to meet short term needs like wages. Those disclosing SVB exposures ranged from Roblox (RBLX), Roku (ROKU), Rocket Lab (RKLB), and Unity Technologies (U), to Circle, owner of the USDC stable coin. But they may have sufficient funds elsewhere, receive assistance from VC backers, or loans against issued SVB receivership certificates. On March 12th the authorities decided to guarantee all depositors, and give immediate access if wanted.

9. BUCK STOPS WITH FED: The US Federal Reserve is ultimately responsible for US banking regulation, the stability of the US financial system, as well as regulating interest rates. It has many tools at its disposal to manage this situation, from protecting depositors to providing liquidity, as seen in the GFC. On Sunday, March 12th the Fed, FDIC, and Treasury Department announced that all uninsured deposits at SVB and SBNY were now guaranteed and available for withdrawal, and a $25 billion liquidity support program available (BTFP) to support the financial system.

10. SOLID FINANCIAL SYSTEM: There are 4,700 regulated banks in the US, with total assets of $23.6 trillion. They reported $263 billion of net profits last year. Unrealized losses on securities – that contributed to the SVB collapse – totalled $620 billion – equivalent to 2.5% of total assets. This compares to a risk-weighted capital ratio of 14.9% for the overall banking system, which is well above the regulatory minimum of 8%. Asset quality is also sound, with 0.27% of loans written off for being past due and reserves at 227% of estimated past-due-loans.