Hi Everybody,

We have a short but busy week ahead of us due to the US Labour Day holiday today. Trading activity on financial markets is likely to be slow, especially in the afternoon during the normally very liquid and busy US trading session. Over in the UK, we should be on the lookout for a potential vote of no confidence in the UK government which could impact already very fluid Brexit scenarios. The end of the first trading week of September will finish with the release of US nonfarm payrolls and unemployment data which could impact volatility across US equities and also US dollar currency crosses.

The week ahead

Economic data this week starts with manufacturing data from Japan, China, and the Eurozone today. Tomorrow we should be on the lookout for the Royal Bank of Australia’s rate decision and statement and US ISM manufacturing PMI data. Australia’s GDP, and services PMI data from Japan, China, the Eurozone & the UK, as well as the US trade balance figures and Canada’s rate decision and monetary policy statement will be closely watched on Wednesday. On Thursday, the main point of interest is Australia’s trade balance and the US ADP employment figures in addition to the services and ISM non-manufacturing PMI data. Friday will bring probably the most anticipated data release of the week with the US nonfarm payrolls, unemployment rate, and average earnings data. Eurozone GDP and employment data are also due for release.

Traditional markets

Link: Reuters Article

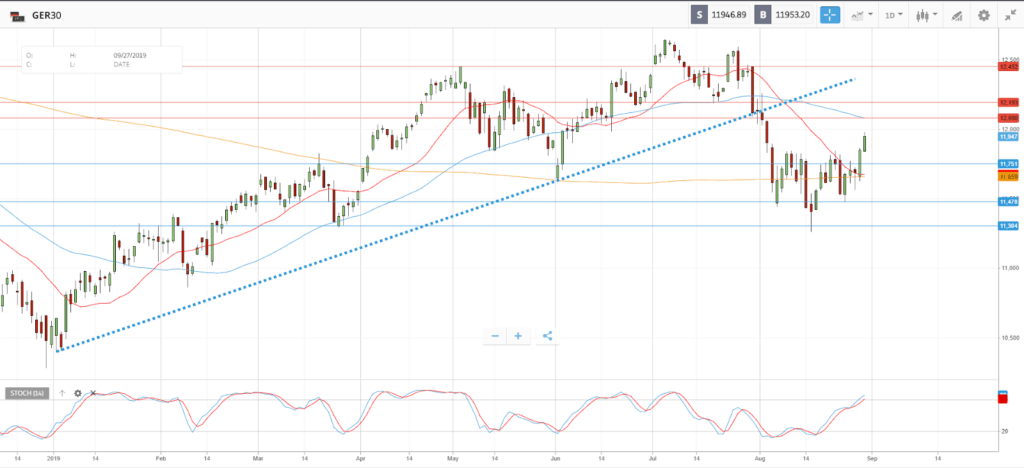

European equity markets are likely to be in focus today. Due to the US Labour Day holiday, US and Canada trading activity is likely to be slower than usual. Let’s take a look at the Germany 30 equity index.

The DAX Index is range trending in the daily and 4 hourly timeframes capped by 50 day moving average (DMA) and supported by 20 and 200 DMAs. The price appears to be in consolidation range, creating lower highs and lower lows. The daily price action is supported by 11,840. The upside is capped by initial resistance at 12,080. A confirmed breakout above 12,080 appears bullish targeting resistances at the psychologically important 12,200 followed by 12,450 and 13,000. Alternatively, a confirmed loss of 11,840 could support a bearish outlook targeting additional downside supports at 11,750 initially, followed by 11,660 and 11,480.

Macro

US-China trade talks are still impacting the global financial markets. On Friday, China’s Foreign Ministry said that Chinese and US trade negotiating teams are maintaining effective communication. US officials also confirmed that the face-to-face talks between Chinese and American trade negotiators scheduled for Washington in September are still happening “as of now.”

Despite these signs of progress, Trump announced that the US government will begin collecting 15% tariffs on $112 billion in Chinese imports starting on 1st September. China decided to retaliate with higher tariffs on US goods, rolled out in stages. With the US markets closed today for the Labour Day holiday, the real impact of these actions will be visible tomorrow when US trading restarts.

Link: Bloomberg Aticle

Crypto

Coinbase has sent a notification to its users stating that if the UK leaves the EU without a deal on 31st October then they will no longer be able to provide e-money services through it’s UK based payments subsidiary and will have to transfer the relationship to an EU based Coinbase entity.

Link: Cryptoslate

Last week, Binance announced that they had launched Binance X, an innovation platform for developers to create products using blockchain technology. They see this as a way to engage and support the community to ultimately boost wider crypto adoption.

Link: Blockonomi

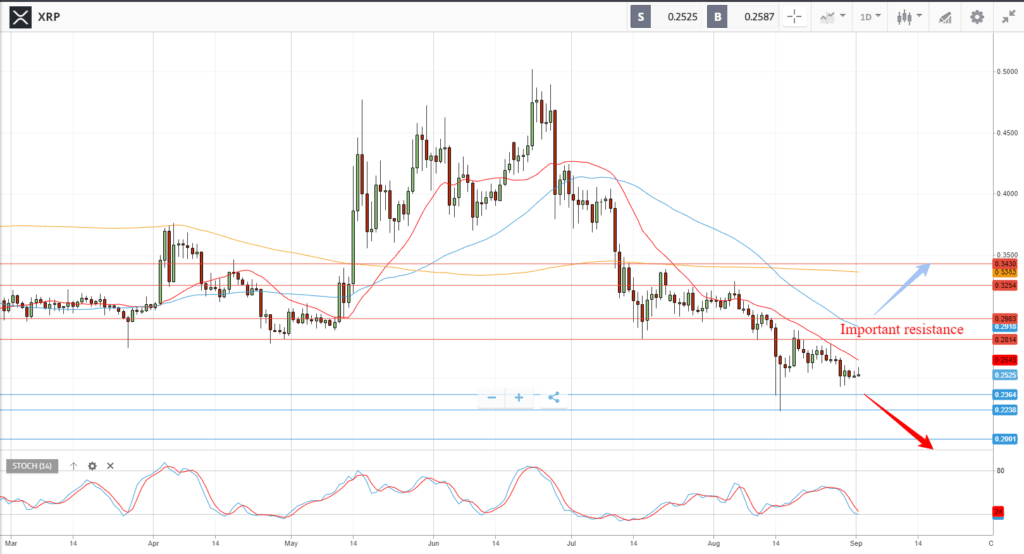

XRP is range trending in the daily and 4 hourly timeframes, creating sideways price action. The key trading level is at the previous swing low, at 0.2364. The upside is capped by initial resistance at 0.2815 (20 DMA). A confirmed breakout above 0.2814 appears bullish targeting resistances at 0.3000 (50 DMA) followed by 0.3260 and 0.3370 (200 DMA). Alternatively, a confirmed loss of 0.2364 would support a bearish outlook targeting additional downside supports at 0.2240 followed by 0.2000.

All data, figures & charts are valid as of September 2nd. All trading carries risk. Only risk capital you can afford to lose

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.