UK shares made solid gains this morning amid the enforced countrywide lockdown, with investors following the lead set in Asian markets which climbed sharply. Investors are rushing back to stocks after the Federal Reserve’s announcement yesterday that it will buy unlimited amounts of government debt to keep the economy going and jobs safe.

The unprecedented new measures, which also include the Fed buying up corporate debt, took the FTSE 100 back above 5,000 points, up nearly 4% at 5,187 points by 8:15am. Asian markets also posted solid gains, with Japan’s Nikkei closing up a huge 7.1%, and Hong Kong’s Hang Seng up 4.4%, with US stock futures also pointing higher ahead of its open later today.

It comes after a dramatic Monday evening in the UK where Prime Minister Boris Johnson announced stricter restrictions to slow the spread of coronavirus as the death toll passed 350. Public gatherings of more than two people who don’t live together are now banned across the UK, and shops selling non-essential goods have been told to shut. Chancellor Rishi Sunak has come under pressure to broaden his support for workers during the pandemic to the self-employed, with the Independent Workers Union of Great Britain claiming that their exclusion from new measures amounts to discrimination and announcing legal action.

The unprecedented action comes after a torrid day for markets, with all three major US equity indices posting a negative day. Markets are torn between stimulus measures and a log jam in the US Senate which is voting on the proposed stimulus bill – after two days of debating, it fell well short of the threshold 60 votes required during voting on Sunday. With Monday delivering no resolution, pressure is now mounting for the Senate to pass the bill. Democrats are still contesting that the package fails to deliver in many areas, while Republicans accuse them of slowing down needed assistance, with tension spilling over into arguments on the Senate floor. The situation in the US has been escalating, with more than 20,000 cases of the virus confirmed in New York so far and more than 40,000 nationwide. To add more confusion to the mix, House of Representatives (Congress) Speaker Nancy Pelosi has revealed her own $2.5trn stimulus bill that contains assurances that federal relief money will go to workers and not stock buybacks.

Semiconductor names a standout as stocks continue slide

While the S&P 500 sank 2.9% on Monday, with ten of its 11 sectors in the red, chip makers were a rare bright spot. The semiconductors sub-sector of the Information Technology sector gained 4.1%, led by names including Intel, Advanced Micro Devices and Nvidia which rose 8.2%, 5.1% and 3.4% respectively. The rally followed supply updates from AMD and Intel, the sector faces increased demand as huge numbers of people stuck at home place pressure on network infrastructure. Both firms have said recently that they have enough processors to meet the demand and deliver them on-time. The performance of semiconductor stocks helped carry the Nasdaq Composite to a comparatively slim 0.6% loss, further increasing the gap between the tech heavy index and the S&P 500/Dow Jones Industrial Average in terms of year-to-date performance. The Nasdaq Composite is now down 23.5% YTD, to 34.9% for the Dow. On Friday, the Dow sank by 3%, dragged lower by names including United Technologies, Chevron and McDonalds. Fast food giant McDonald’s sank 7.7% after announcing it is shutting down all of its UK restaurants completely, taking its one month loss to 35.8%.

S&P 500: -2.9% Monday, -30.8% YTD

Dow Jones Industrial Average: -3% Monday, -34.9% YTD

Nasdaq Composite: -0.6% Monday, -23.5% YTD

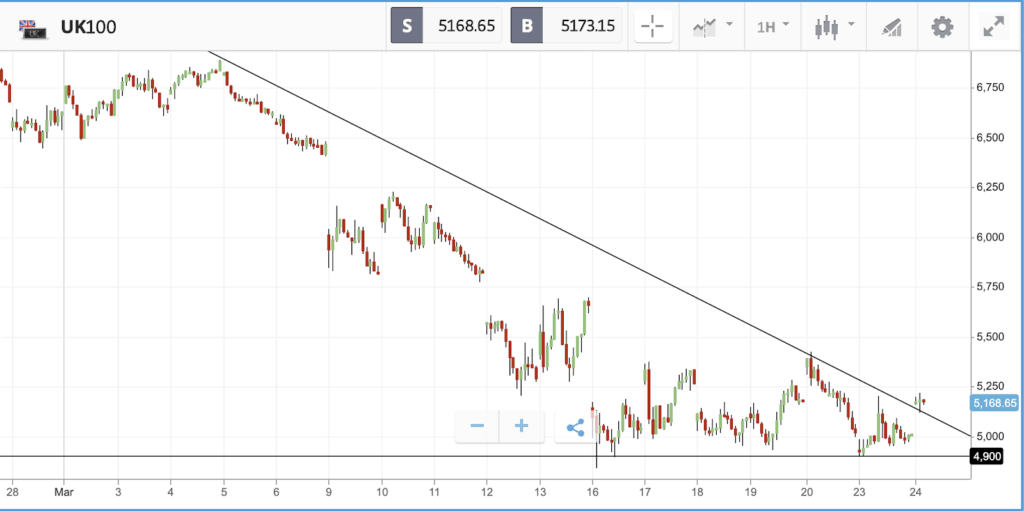

Rollercoaster day for London-listed stocks

Monday was another rollercoaster day for London-listed stocks. Having sunk immediately after the market opened, the FTSE 100 reclaimed almost all the lost ground at lunchtime before selling off again rapidly in the afternoon. Both the FTSE 100 and the FTSE 250 ended the day 3.8% down, taking the latter’s year-to-date loss past 40%. A lack of progress on the US’s stimulus deal was a likely factor sending stocks lower, in contrast to the €750bn stimulus deal approved by the German government on Monday.

Finance names were among the biggest fallers in the FTSE 100 yesterday, with brokerage Hargreaves Lansdown, wealth manager St. James’s Place and Legal & General Group all posting double-digit losses. High street clothing brand Next also suffered a poor day, falling 11.2%; as the market closed, the firm announced that it is temporarily closing all 700 of its stores until further notice due to the coronavirus. BP and Royal Dutch Shell were among the handful of firms to make gains on Monday after oil prices rose.

FTSE 100: -3.8% Monday, -33.8% YTD

FTSE 250: -3.8% Monday, -40.2% YTD

What to watch

Nike: Sportswear firm Nike’s Tuesday quarterly earnings update will be one of the highlights of the week, given that the firm has first-hand experience of managing a global supply chain, a presence in a huge number of countries, and insight into how consumers are spending in the face of a bear market. Analysts will likely probe management on how well consumer discretionary spending is holding up, and how the closures of its China stores — and now its stores in a variety of cities in varying stages of lockdown — will impact its bottom line. Nike’s share price has fallen in line with the Dow over the past month.

Manufacturing and services data: Investors will get some of the first economic data for March on Tuesday, with flash purchasing manager indices for the manufacturing and services sectors scheduled for release in the US. Figures below 50 indicate a sector is contracting, while figures above 50 show expansion; the data is based on surveys of purchasing managers. Last month, the US manufacturing PMI was at 50.7, while the services PMI came in at 49.4, having fallen from 53.4 in January. The data being released on Tuesday covers a chunk of the period where the coronavirus disruption kicked into high gear and will be watched closely. Expectations are for the figures to plummet.

Crypto corner:

Cryptoassets continue to rally off lows, with Bitcoin now nearer $7,000 than $6,000, and Ethereum and XRP also charging higher.

The levels of volatility have been extreme – Bitcoin was trading below $5,000 eight days ago but has gained more than 30% in the last week, trading at $6,626 today. Ethereum and XRP have endured a similar journey down and back up, with the currency up 3.1% today at $135.9, while XRP is up 1.2% today at $0.159.

A ‘digital-dollar’ provision was included in a draft stimulus bill put together by US Democrats as a means to make stimulus payments. This stops short of the party proposing to create a cryptocurrency for this purpose, and it is unclear whether it will make the final bill, but their definition is “a balance expressed as a dollar value consisting of digital ledger entries that are recorded as liabilities in the accounts of any Federal [R]eserve bank; or an electronic unit of value, redeemable by an eligible financial institution (as determined by the Board of Governors of the Federal Reserve System).”

Elsewhere, Intermex, who partnered with Ripple last month, have now said they will not use Ripple solutions to facilitate payments in their core market of Mexico. This is due to long standing relationships in the country with other providers. This will come as a blow to those who thought that the door was being opened for XRP to be used in the huge volume of transactions that take place between the US and Mexico. Instead, these solutions will be used in ‘newer’ markets.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.