Good morning everyone,

President Trump took drastic action on Wednesday night, shutting off travel between the US and Europe (excluding the UK) for 30 days, in a move expected to rattle markets and has sent them further into bear market territory. All three major US indices are flirting with the 5% limit down circuit breaker once again – down over 4.5%. The travel ban is somewhat unexpected, but it is evident that monetary policy alone has not been enough to stem the bleeding in financial markets. Whilst this is still a far cry from the restrictive measures that China put in place, it was clear something more needed to be done.

Trump took action as the number of cases in the US – and around the world – continued to climb, with the UK’s emergency COBRA team also expected to meet today to confirm a move to the ‘delay’ phase of its own plan to combat the virus. In response, oil markets are in the doldrums once more, with the price of US crude down another 4% this morning below $32 a barrel.

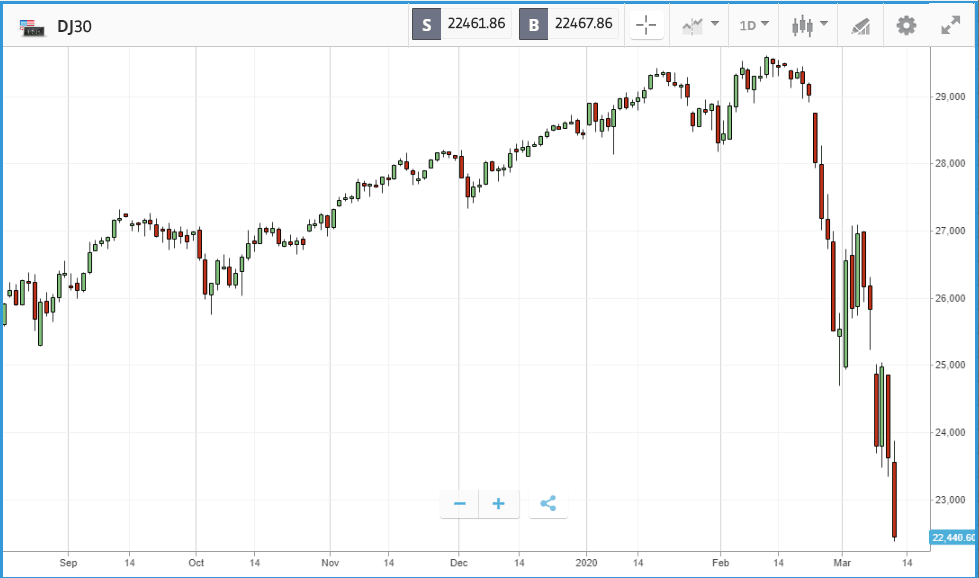

The latest moves come after another rough day in markets. The Dow Jones Industrial Average, which comprises 30 large US companies including Apple and Nike, officially passed the 20% loss threshold that denotes a bear market. The index fell 5.9%, bringing to a close a decade-long bull market in US stocks.

Every stock in the Dow finished the day in the red, with 26 of them falling by more than 3%. Boeing was the only firm to fall double digits, closing 18.2% down after announcing a hiring freeze and revealing customers – including Air Canada – have cancelled orders for the troubled 737 Max Airliner, taking net orders for February to a negative 28. Boeing stock is now down 42% year-to-date and 50% over the past 12 months and has been overtaken by Tesla in terms of its market cap. Boeing’s dismal session drove the $700bn market cap aerospace and defense industry to a 9% loss for the day overall. The S&P 500 is also very close to bear market territory, with the index of America’s largest companies down 18.9% over the past month.

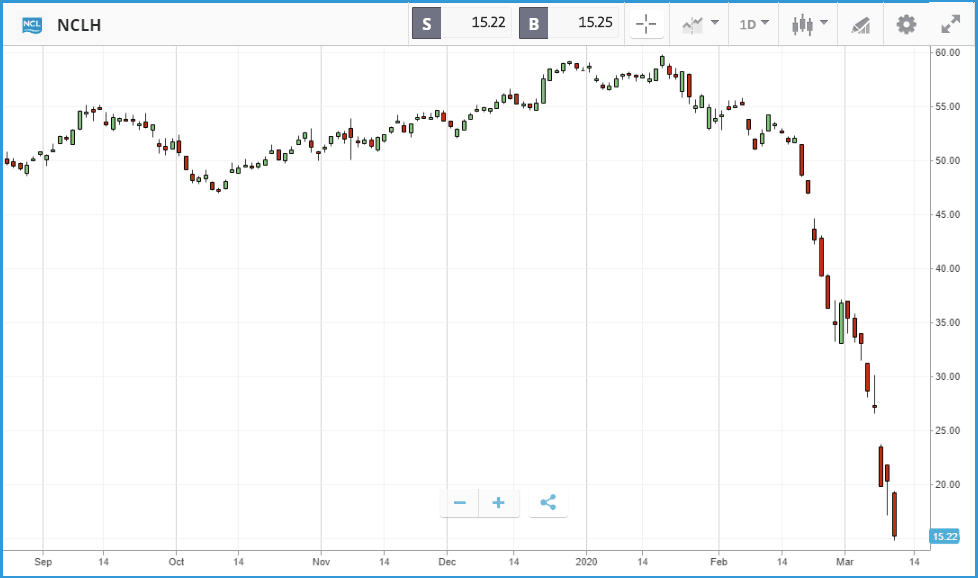

Norwegian tanks 27% after reports it trained salespeople to lie about coronavirus

The $5.7trn market cap healthcare sector was the only sector in the S&P 500 that turned in a Wednesday loss of less than 4%, according to Fidelity data. Within the sector, healthcare technology and biotechnology firms delivered the best day, while pharmaceutical stocks fell 6.2% on aggregate.

Alongside Boeing, energy, oil and cruise firms were the biggest losers of the day. Norwegian Cruise Line plummeted 26.7%, taking its one month loss past 70%, after reports that the company has been training salespeople to downplay the risks of the coronavirus and mislead customers in order to secure bookings. Among energy names, oil exploration firms Apache and Noble Energy both fell by more than 20%, taking Apache’s loss over the past week to 67.2% and its market cap down to $3.1bn. The company is now in a precarious position, as it is sitting on more than $8bn in debt and reported a $3bn loss in Q4 2019.

At the top end of the market, Gilead Sciences continued its strong performance through the crisis. It climbed 1.9% after it was confirmed that the company’s experimental Covid-19 treatment is being used in the United States under rules allowing unapproved drugs to be used in situations where all other options have been tried.

S&P 500: -4.9% Wednesday, -15.2% YTD

Dow Jones Industrial Average: -5.9% Wednesday, -17.5% YTD

Nasdaq Composite: -4.7% Wednesday, -11.4% YTD

Rate cut and fiscal promises fail to stop the bleeding, at least for now

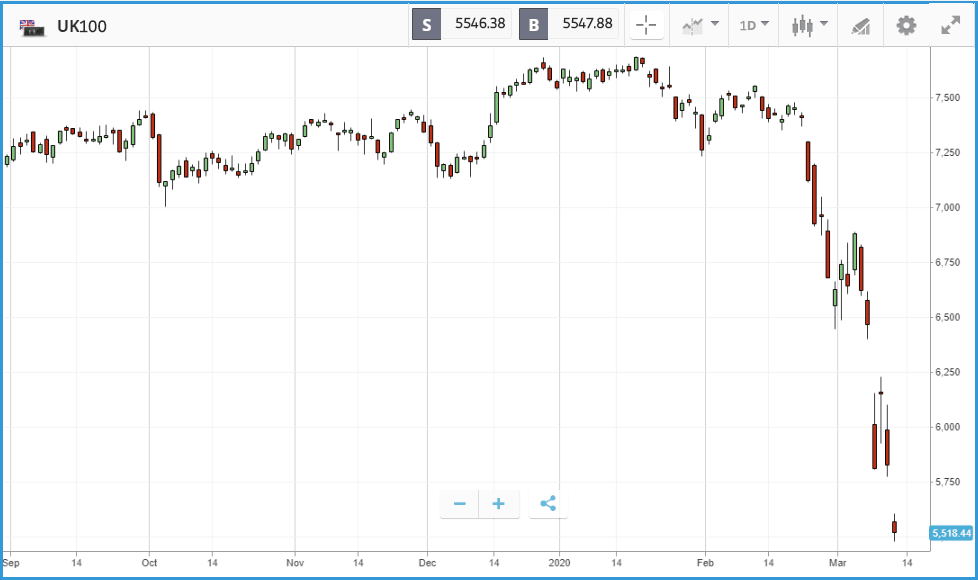

UK markets continued their decline this morning, with the FTSE100 going as low as 5463 overnight, this is lower than the intraday trough of 5498 we saw back in February 2016 when China slowdown fears and another oil price war weighed on the market.

This decline comes despite the Bank of England’s emergency rate cut from 0.75% to 0.25% (matching the cut in the US last week) and a £30bn stimulus package from the new Chancellor. The fiscal and monetary response from the government failed to reassure investors, mirroring the US reaction to a rate cut. Many felt that central bank action reinforced the idea that a significant economic hit is coming down the pipeline. However, the measures taken by the government may well help dampen the impact of the virus as the pandemic continues.

Bringing up the back of the FTSE 100, which fell 1.4%, were Aveva Group, Coca-Cola HBC and easyJet, which lost 9.3%, 8.4% and 7.6% respectively. Industrial software firm Aveva has already warned that coronavirus is impacting its sales in China, and it has a large number of customers in the oil sector, and so is suffering knock-on effects from the oil price war. Airline easyJet is under continued pressure from lower travel demand and travel restrictions but was upgraded to a buy rating by UBS on Wednesday due to the severity of its share price slump. In the FTSE 250, G4S was one of the big fallers, sinking 22.6% after reporting that it swung to a loss in 2019.

FTSE 100: -1.4% Wednesday, -22.1% YTD

FTSE 250: -1.2% Wednesday, -20.8% YTD

Stocks to watch

Adobe: California-based software giant Adobe is one of several technology names reporting earnings on Thursday. So far, the firm has held up better than the broader 2020 market, as have many technology names, since demand for its services is not as susceptible to disruption by the epidemic as firms dealing and shipping physical goods. Last year the firm’s share price gained more than 40%, outpacing the S&P 500, as its quarterly earnings numbers consistently beat expectations. Investors will be watching for a continuation of that momentum, with an eye on growth in recurring revenue, and how the firm is weathering the epidemic. Currently, among Wall Street analysts, 18 rate the stock as a buy or overweight, and 10 as a hold.

Oracle: Oracle, which specialises in cloud systems, database technology and business software, also reports its latest quarterly earnings update on Thursday. Its share price performance year-to-date and through the recent sell off has been closer to the broader market, with the stock down 19.8% over the past month. The firm was already trading significantly below its 2019 peak before recent events and posted a mixed set of results for its fiscal Q2 (calendar Q3) in December; showing increased profits driven by its cloud business but revenue below expectations. Analysts overwhelmingly favour a hold rating on the stock and are anticipating an earnings-per-share figure for its fiscal Q3 of $0.96.

Slack: Business messaging service Slack, which went public last year, has fallen 15% over the past five trading days but is still in the green year-to-date. Its Thursday earnings will be an interesting one to watch, given that the firm potentially stands to benefit from a rise in employees working from home and utilising its service. The firm is yet to turn a profit, although its loss last quarter was only $0.02 per share, if it were to beat expectations by a similar amount this time round, we could see it enter into profitable territory. Analysts have been shifting in favour of the stock, with the analyst count recommending a buy increasing from seven to 10 freelance over the past three months.

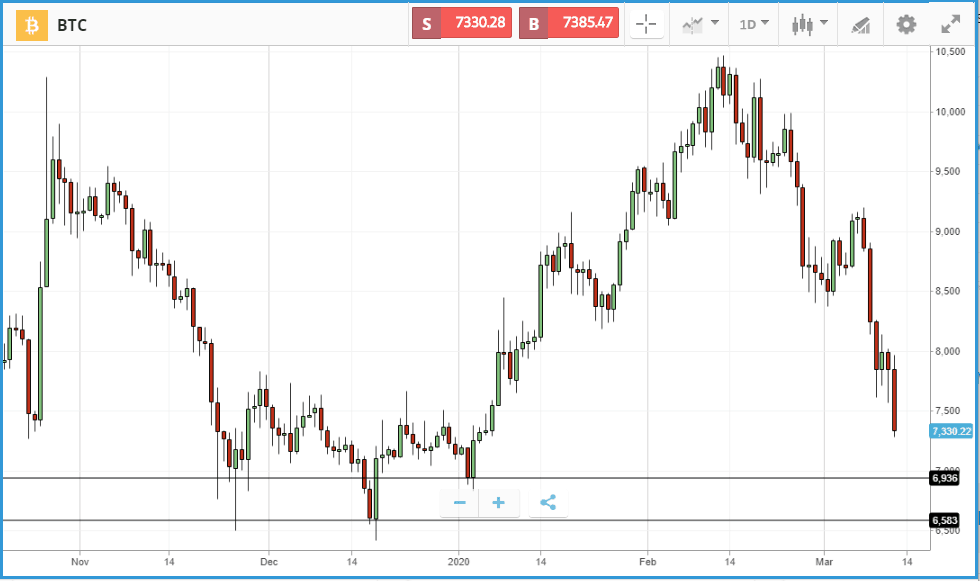

Crypto corner:

Cryptoassets are also feeling the brunt of the risk-off trade in markets, with steep falls across the board as prices continue to retrace their gains for the year and head back to January lows.

Bitcoin is down another 5% overnight, trading at $7,340 this morning, while Ethereum is off 10% at $169, its lowest level for six weeks. XRP, is off 8% at $0.186. Unless there is a material change in the global situation, selling pressure shows no sign of abating as bitcoin challenges and breaks down from support levels. We could now see the psychologically important $7000 level challenged with 2020 lows of $6,936 just below, followed by $6,583.

CME Group will suspend trading in Chicago from tomorrow, a precautionary measure due to the potential spread of coronavirus. Aside from bitcoin futures, the exchange also trades a whole host of other commodities including metals, agricultural products and also other derivatives.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.