Hi Everyone,

A great success was seen in India today as they have now launched a groundbreaking mission to the moon.

The pilotless rocket is scheduled to land on the moon’s south pole in approximately 23 days. The milestone is being hailed as a significant step forward for India but not necessarily one of ingenuity.

As we know, the country has been shunning innovation on many fronts. The one I’ve personally been watching is in regards to cryptocurrencies. One year ago, India’s central bank has imposed a blanket ban on all banks from dealing with any crypto-related companies. This ban is currently being contested in the high court but progress is very slow.

Additionally, the government has been working on a draft bill that would bring clarity to the market but that doesn’t seem too promising either. According to this leaked version of the bill, it includes a stipulation that will send cryptotraders to prison for up to 10 years.

The incoming Minister of Finance Nirmala Sitharaman offers little hope that this status quo will change any time soon. Despite the frantic calls from India’s twitter community showing how much crypto can help the nation, it seems the government is determined to prolong their virtual monopoly in the banking and payments sector at the expense of her citizens.

Today’s Highlights

- Deal for the Debt

- Eurozone Data Print

- The Bermuda Circle

Deal for the Debt

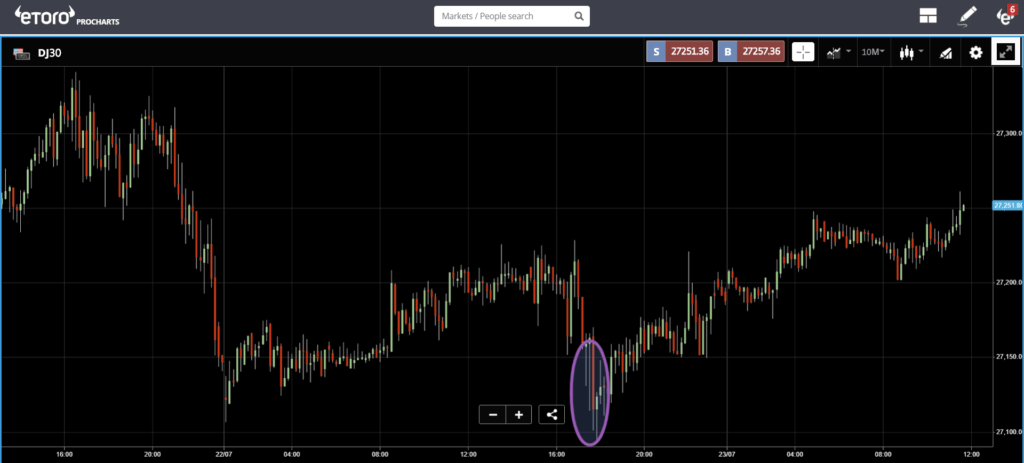

The debt ceiling debate is usually a time of political wrangling in the United States so to see the President agree to a deal that will push it off the table for two whole years is simply shocking.

Needless to say, the markets have responded quite positively to this news. Here’s the Dow Jones yesterday with the approximate time of the news in the purple circle.

Euro Data Print

Tomorrow morning the EU will publish some critical PMI data that could move the markets quite a bit. The PMI reading is based on a survey of purchasing managers across the union and is designed to give a good indication of the strength of the economy.

This will be especially important ahead of the ECB’s rate decision on Thursday. The European Central Bank has been hinting to the possibility that they’ll be starting a new round of quantitative easing (read: money printing) shortly.

If the manufacturing numbers end up coming out weak, as economists currently expect them to, it will strengthen the case for further stimulus and could help push the markets higher.

What a time to be alive.

The Bermuda Circle

As you’ll recall, Circle are the owners of the Poloniex exchange and are currently owned by none other than Goldman Sachs. So it’s quite remarkable to see them taking crypto to a global audience.

Still, even with Bakkt’s test launch and all the other great news, it seems the market is simply not responding. At this point, volumes across the board are at their weakest levels in about a month, which creates a bit of a dangerous situation for prices.

Lower volumes usually mean less volatility but it could also mean greater price reaction should a whale decide to place a large buy or sell order.

This is something we discussed last night in our weekly interview with Molly Jane from CoinTelegraph. Make sure to catch that here.

Also, would like to note that the crypto lunch with Warren Buffett that we discussed yesterday has effectively been postponed as Justin Sun isn’t feeling well. He has however confirmed that the payment to charity has already been sent and that the Oracle has agreed to make the lunch at a later date.

Have an excellent day ahead!

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.