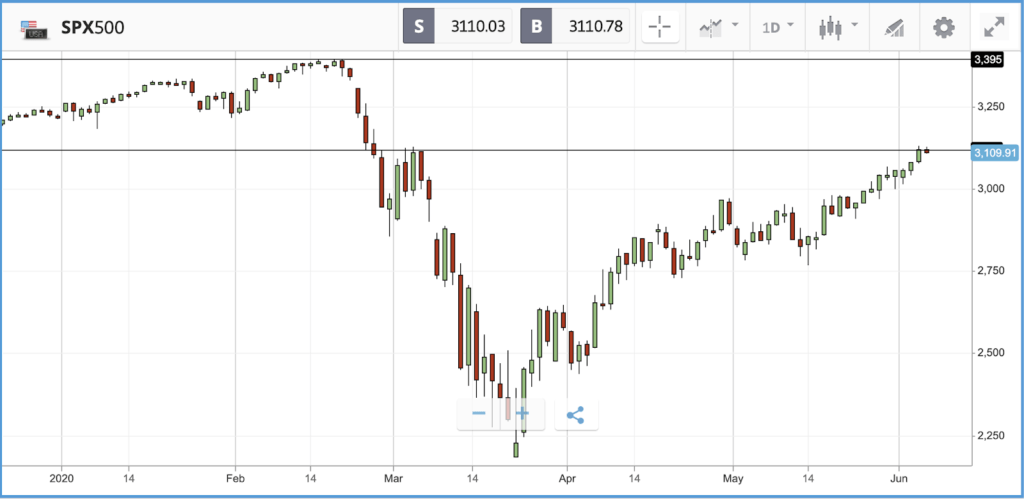

A fairly flat European open this morning after more gains yesterday. Investors continued to ignore widespread civil unrest in the US on Wednesday and escalating US-China tensions, with stocks soaring around the world. The S&P 500 closed 1.4% higher, and is now up by close to 10% over the past month, while the FTSE 100 jumped 2.6% and major indices in Europe and Asia also soared.

Protests about police brutality continued in cities across the US, with curfews in force in many locations, despite reports that most protests remained peaceful. Investors were buoyed by a better-than-expected US private sector jobs report from payroll software provider ADP, with private payrolls only falling by 2.8 million in May versus the 8.8 million expected. The manufacturing sector was hit hard, losing 719,000 workers. In other economic data, the ISM non-manufacturing index beat expectations on Wednesday, coming in at 45.4, an improvement on April although still in contraction territory.

Tensions also continued to rise between the US and China on Wednesday, with Beijing refusing requests by US airlines to resume flights to China, and the US announcing that it will be banning all passenger flights from China.

Double digit gain for Boeing as Dow jumps 2.1%

Of the three major US stock indices, the Dow Jones Industrial Average climbed the most on Wednesday, closing 2.1% higher and taking its year-to-date loss to just 8%. The index was led by embattled aerospace giant Boeing, which jumped 13% on news that a significant order for its grounded 737 Max airliner had been deferred rather than cancelled, and that the firm had reached a compensation deal with airline TUI over delayed deliveries of the aircraft. Boeing was a top performer in the S&P 500 too, where United Airlines, Gap and MGM Resorts also posted double-digit gains. The stocks have all been hit hard by the pandemic and their surging share prices are indicative of investors’ broader optimism about economic recovery in addition to sector-specific issues. In earnings news, Campbell Soup sank 6.1% despite posting significant sales gains and beating analysts’ earnings expectations, as consumers emerging from lockdown may curtail demand as they return to normal shopping habits. The firm did raise its full year guidance however, pointing to an increase in demand across all brands during the crisis.

S&P 500: +1.4% Wednesday, -3.3% YTD

Dow Jones Industrial Average: +2.1% Wednesday, -8% YTD

Nasdaq Composite: +0.8% Wednesday, +7.9% YTD

FTSE 100 and 250 soar in lock step

Both of the UK’s major indices jumped 2.6% on Wednesday, with the FTSE 250 now up 12% over the past month. London-listed stocks remain well behind their US counterparts but have been making solid progress in recent weeks. The gains reflect investor optimism about both the UK and global economies reopening, as FTSE 100 firms make around 70% of their revenues overseas. The FTSE 100 was led by a trio of air travel names, with International Consolidated Airlines Group up 11.4%, Rolls Royce gaining 9.3%, and easyJet finishing 8.3% higher. Finance names were also close to the top of the index, with insurers Legal & General Group and Aviva, plus banks Standard Chartered and Lloyds, all up more than 5%. Lloyds stock is now up 10.3% over the past month, although remains down by around 50% year-to-date. The FTSE 250 was led on Wednesday by 20% plus gains from technology firm Chemring Group, which is a Boeing supplier, and property developer Hammerson. Hammerson stock is down 55.4% year-to-date but has soared by 168.9% over the past month and 85.4% in the past five trading days alone. The company is the landlord for many shopping centres, so found its rental income under pressure as the lockdown hit its tenants’ businesses, which in turn has hurt its ability to reduce its hefty debt burden.

FTSE 100: +2.6% Wednesday, -15.4% YTD

FTSE 250: +2.6% Wednesday, -18.2% YTD

What to watch

Broadcom: Semiconductor and software firm Broadcom’s stock is close to parity year-to-date, and has jumped 17.2% over the past month amid a broader rally for chip stocks. The firm will report its latest set of quarterly earnings on Thursday, where investors will be watching for signs that it is benefiting from an acceleration in uptake of cloud-based solutions with people stuck working from home, plus efficiency gains from acquisitions. In March, the company froze M&A activity, which has been a major way that it has driven growth over the years, and announced it is keeping a wireless chip business that had been on the auction block after landing a $15bn deal with Apple. Currently, 21 Wall Street analysts rate the stock as a buy, three as an overweight and seven as a hold.

Docusign: Digital contracts firm Docusign has skyrocketed in 2020, gaining 99% so far, taking its 12 month gain to north of 175%. Unlike retailers where demand will likely drop back to normal once the pandemic is over, investors will be hopeful that Docusign can lock in businesses, who have made the change to digital signing permanent. That may be especially true if companies choose to enact social distancing guidelines for an elongated period. The firm reports its first quarter 2020 earnings on Thursday, where expectations are for an earnings per share figure of $0.10, up from the $0.08 anticipated three months ago.

Slack Technologies: Business communications platform Slack, which offers internal messaging and video calling services for companies, has seen its share price jump by over 75% as demand for its services has been accelerated by working from home. As with other stocks that have seen their values soar as a result of the pandemic, key questions on investors’ minds when the company reports its quarterly earnings on Thursday will be the stickiness of the new customers it has picked up during this crisis period. Analysts are anticipating the firm will still have made a loss during the quarter, but currently 13 rate the stock as a buy or overweight, eight as a hold and three as a sell.

Crypto corner: Bloomberg report positive on Bitcoin

Commodities analysts at Bloomberg have listed Bitcoin alongside traditional commodities such as gold as ‘ones to watch’ for 2020.

The June 2020 commodities report from financial analyst Bloomberg has highlighted Bitcoin alongside gold as the “top candidates to advance” in 2020. The report cites the $9000-$10,000 trading range of BTC as an indication of the cryptoasset’s foundations amid wider stock market selloffs. The report adds:

“We view the benchmark crypto as a resting bull that likely needs something to change significantly in its 10-or-so-year history to not just resume doing what it was doing: appreciating. If the stock market rolls over, gold and Bitcoin should gain buoyancy.”

Elsewhere Bitcoin rose just over 1.2% yesterday, trading around $9631 this morning. Ethereum was up more strongly around 2.6%, trading around $242 this AM. Finally, XRP increased 1%, and is now around $0.20 in early trading.

All data, figures & charts are valid as of 04/06/2020. All trading carries risk. Only risk capital you can afford to lose