The coronavirus scare has the world “on the edge of its seat,” impacting everything from business activity to travel. The virus’ impact on the global economy is noticeable, yet, the full scale of its effects remain to be seen. However, reports of a growing number of infections outside China have significantly impacted markets around the world.

One prime example of the virus’ impact is the recent cancellation of the Mobile World Congress (MWC) in Barcelona. The MWC is considered the most important mobile technology event in the world and its cancellation will, no doubt, impact mobile technology companies planning announcements and unveilings at the conference.

So far, around 80,000 people around the world have been infected, with the vast majority in China, where the virus is thought to have originated. Of the people infected, around 2,800 have died (at the time of writing). But what is next? And how will the virus impact the global economy?

The Importance of China

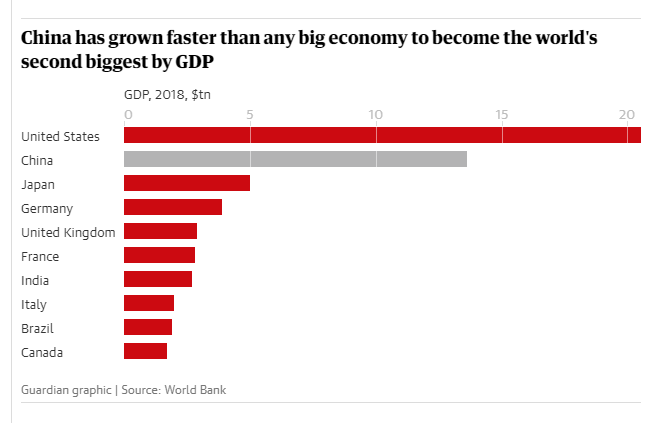

China is both the world’s second largest economy by GDP and the backbone of global manufacturing. In fact, it is the fastest country ever to reach second place, with the US holding a commanding lead. There are numerous companies, across multiple industries around the world which are dependent on Chinese manufacturing to stay in business. Therefore, it is no wonder the virus is having such a deep impact on the global economy.

Source: The Guardian

Naturally, this means that the impact of the virus on production in China spreads far beyond the country’s borders. Numerous international corporations have production facilities in China, including fashion brands such as GAP and Abercrombie & Fitch, telecommunications giants such as AT&T, tech companies such as Apple and many others.

Many of these brands, such as sporting goods manufacturers, Nike and Adidas also rely heavily on income from retail in China. Nike, for example, produces 20% of its products in China and 17% of its revenue comes from sales in the country.

Moreover, the epidemic has impacted travel to and from China, as many airlines have cancelled flights to China across the board. In fact, passenger numbers have dropped by 55% as compared to last year. This does not only damage the travel industry in the form of flights and hotel reservation cancellations, but also significantly reduces tourist spending in the country.

The Initial Scare

When reports of a new, deadly virus surfaced in late January, the market initially panicked. Markets in China, which were just returning from the Lunar New Year holiday vacation, tumbled 10%, as many indices and ETFs showed dramatic declines. Moreover, a general shutdown of factory activity was put into effect across the country. To keep the market balanced, Beijing injected $174 billion into the market.

The impact was not limited to Asian markets, as many US-based companies are dependent on Chinese factories to manufacture their products. This was seen especially in the technology sector, which is why many tech companies were also on the decline in early February, dragging main Wall Street indices down with them. In addition, as China is the world’s largest oil importer, the black gold also suffered a significant blow, dropping around 16%.

How will the virus impact Q1 profits?

In mid-February, Apple, one of the world’s largest companies, which relies heavily on Chinese production, issued a revenue warning. According to the company, the factory shutdown in China has damaged its production to such an effect that it will not be able to reach its iPhone manufacturing targets in Q1, 2020.

Apple is just one of many companies that have such a reliance on Chinese manufacturing, and it is very possible that other technology companies may also make such announcements. Several other high-profile companies issued similar warnings, including MasterCard, Coca-Cola and Procter & Gamble.

Gold on the rise

Traditionally, when global markets are down, safe-haven assets show gains. This time around, it is evident that investors are flocking to gold to hedge their investments, as the precious metal has risen in price tremendously, reaching levels not seen in eight years.

In mid-February, gold hit the psychologically important $1,600 mark and has continued to climb since. Some analysts believe that as long as the coronavirus continues to impact markets, gold prices could rise as high as their all-time high of nearly $1,800, set in 2011.

Future Impact

It is not possible to fully predict how the virus will impact markets. At the moment, markets are declining around the world, as more and more cases of the virus are being reported outside of China, including several deaths reported in Italy.

Currently, markets are falling around the world, with Wall Street going through dramatic dips, such as $1.77 trillion, which was erased from the SPX500 in just two days. The impact is not limited to the US and Asia, as the UK100 index, GER30 and FRA40 have also suffered significant blows. Oil has also suffered heavy losses, dropping well below the $50 mark and reaching price levels not seen since January of last year.

Whether or not the bearish trend will continue, remains to be seen, but investors and traders should be extra cautious at this time. The extreme volatility might be tempting, but can also present a significant risk to their capital.