Hi Everyone,

Sometimes things seem so far away but in reality, they might be much closer than we think. We’ve been talking about the possibility of a Bitcoin ETF hitting Wall Street for almost three years now and the latest indication is that it might be right around the corner.

In an interview on CNBC earlier this week, the Chairman of the United States Securities and Exchange Commission (SEC), who seems to be the one man standing in the way of the BTC ETF, confirmed that we are getting closer and progress is being made but that he still has two main concerns.

1. “How do we know that we can custody and have hold of these cryptoassets? That’s a key question.”

2. “An even harder question, given that they trade on largely unregulated exchanges, is how can we be sure that those prices aren’t subject to significant manipulation?”

From what it seems, these are the last two roadblocks in the chairman’s mind for this to be approved. Now, if that’s true, we could be extremely close at this point. In fact, both of these concerns should be easily assuaged with just a little bit of knowledge and understanding.

1. Bitcoin was born to solve the custody question. In fact, verifying ownership is kind of what crypto does best.

2. The decentralized nature of price discovery in the crypto market is another one of its star qualities and makes it far more resilient to price manipulation.

If indeed these are the only two roadblocks to a bitcoin ETF, then we are probably much closer than you think.

Today’s Highlights

- Somber Market

- ECB Shakeup

- Litecoin Hash Drop

Please note: All data, figures & graphs are valid as of September 11th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

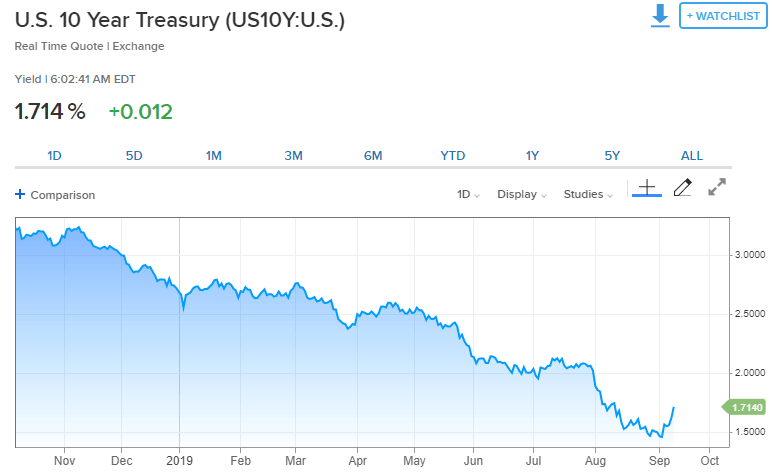

ECB Tomorrow

Whatever’s funk the markets are in right now is very likely to be snapped tomorrow though as the European Central Bank delivers their interest rate announcement and subsequent press conference.

From what it seems, several analysts are expecting the ECB to cut their interest rates tomorrow as well as deliver some sort of stimulus, most likely one that will be good for banks. Most bankers are no doubt very frustrated by the low-interest-rate policy as it cuts directly into their profits so if Mario Draghi wants to save himself from a mutiny he might need to throw them a bone if rates are indeed cut.

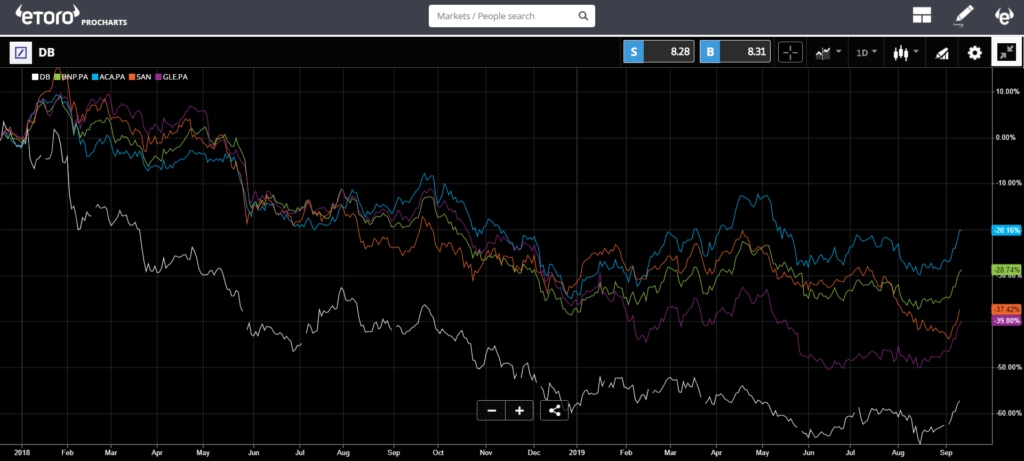

Here we can see a group of several predominantly European banks, who’ve been suffering over the last two years. Check out that sharp turn upward in the last few days. Almost resembles the chart above…

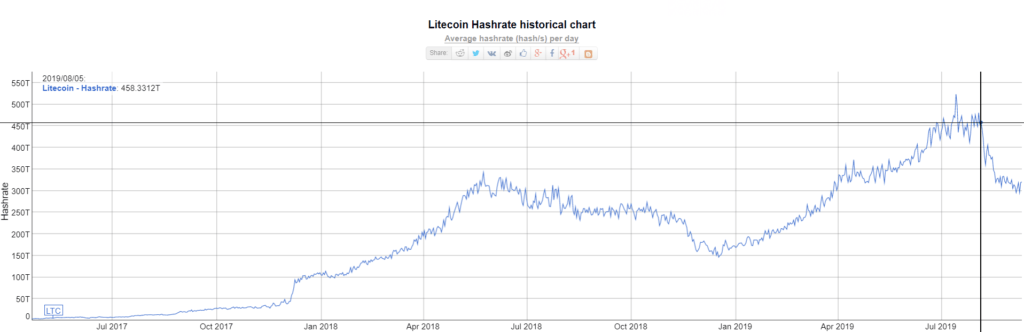

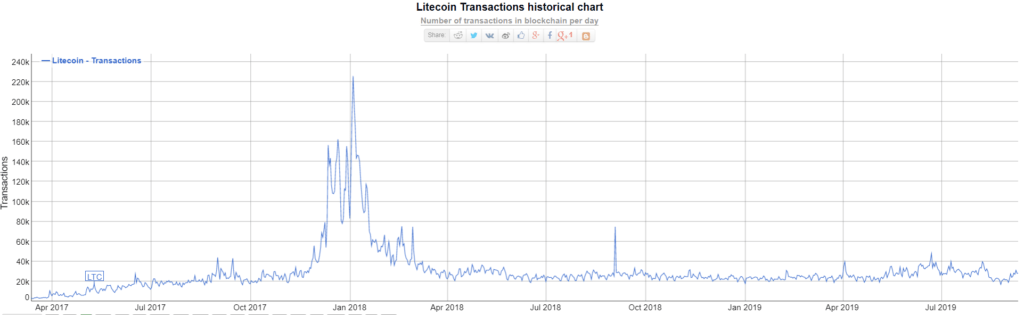

Lite Hash Drop

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.