Good morning everyone,

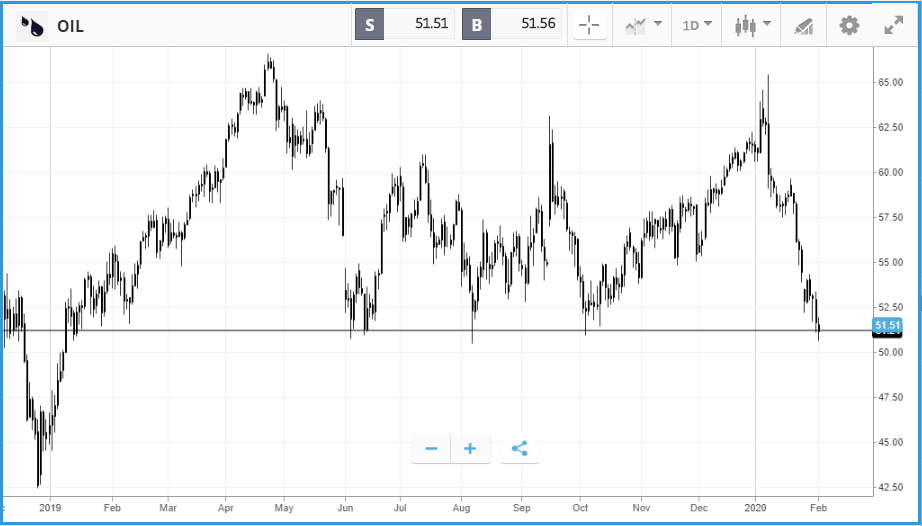

On the first day back trading after the extended Lunar New Year holiday, investors fled Chinese stocks en masse. The Shanghai composite was down almost 8%, thousands of stocks hit their 10% daily limit loss and the yuan weakened past the 7 per dollar mark. Commodities have also had a tough time over fears of the outbreak denting China’s demand, particularly oil which was trading at 12 month lows, close to a key level of support.

China responded by cutting interest rates, injecting 1.2 trillion yuan worth of liquidity into money markets and limiting short selling. It’s clear this move from the central bank, as well as the rush to build hospitals and other facilities to control the outbreak, indicates Beijing’s urgency to limit the total damage of the outbreak both as a medical hazard but also economically.

A fresh inversion of the US 3-month and 10-year yield curves have also begun to fuel speculation that the Federal Reserve may have to consider further cuts of their own. The S&P, Dow and Nasdaq futures are indicating a ~0.3% higher open.

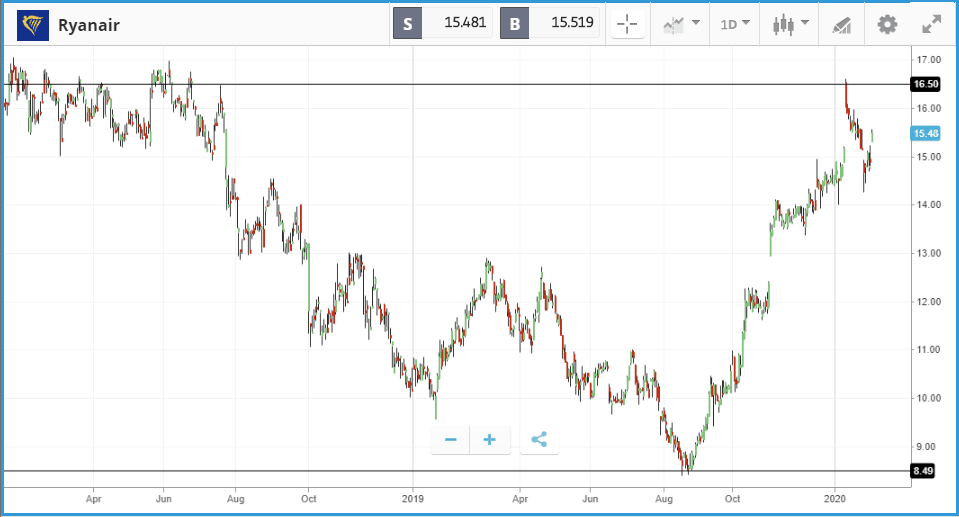

Ryanair beats estimates but warns on Boeing fallout

Ryanair will take longer than expected to reach its long-term target of flying 200 million passengers per year due to delays in the delivery of Boeing’s 737 MAX jet, the Irish airline announced this morning. Despite this, their shares are up almost 4% after Q3 revenues came in ahead of expectations. This has seen Ryanair’s shares change hands a whopping 80% higher than in August 2019.

Ryanair had planned to reach the 200 million passengers mark in the year to March 2024, but now expects to take until at least 2025 or 2026, as the airline accommodates the issues over new aircraft.

The company, which suffered alongside all other airlines last week despite having no exposure to China via its own routes, still expects to ferry 154 million people in its current year to March 2020.

United Airlines, Delta Air Lines and American Airlines have all announced they are suspending flights between the US and mainland China for periods ranging from two to three months. Share price wise, United was hit hardest, falling 8.7% during the week, versus 5.2% for Delta and 2.9% for American.

US stocks see 2020 gains wiped out after shares sink

US shares plunged by around 2% for the second time in a week on Friday, taking the S&P 500 and Dow Jones Industrial Average into negative territory in 2020 so far, thanks to a continued escalation of the coronavirus epidemic. Beyond the epidemic, it’s worth noting that last week was also a big one in terms of US corporate earnings. Of the companies in the S&P 500 that had reported by Thursday, 62% have topped earnings expectations according to Credit Suisse. Companies including Amazon, Apple and JPMorgan have posted big earnings beats, and there is a chance that overall Q4 corporate income might have improved year-over-year (something that did not happen in the first three quarters of 2019).

S&P 500: -1.8% Friday, -0.2% YTD

Dow Jones Industrial Average: -2.1% Friday, -1% YTD

Nasdaq Composite: -1.6% Friday, +2% YTD

Coronavirus slide overshadows Brexit day

UK shares were also dented severely by the coronavirus last week, with the FTSE 100 dropping 1.3% on Friday after the first two UK cases of the virus were confirmed. The news came as the UK officially left the European Union on Friday night. While having no impact on markets on the day itself, it does put a sharp focus on the tight time period the UK now has to negotiate trade deals. In 2020 so far both the FTSE 100 and FTSE 250 are now down 3.4%. British Airways cancelled direct flights to and from China, and shares in International Consolidated Airlines Group sank 8% over the course of the week. Even budget airlines easyJet and Ryanair, which have no direct exposure to China, found themselves in the firing line – falling 6% and 2% respectively – due to concerns that the epidemic will lead to a broader drop off in international travel.

FTSE 100: -1.3% Friday, -3.4% YTD

FTSE 250: -0.7% Friday, -3.4% YTD

Stocks to watch

Alphabet (Google): Google has big acts to follow when reporting its Q4 earnings today, as fellow giants Apple, Microsoft and Amazon have all emphatically beaten earnings expectations. Alphabet stock is up roughly in line with the broader market over the past year, gaining 28%. The earnings call will be its first since announcing Sundar Pichai is becoming CEO of Alphabet overall, rather than just Google. Analysts will be interested in what that means for the prospects of other technologies the company has been working on in the background. Currently, 42 Wall Street analysts rate the stock as a buy, and five as a hold, with no sell ratings.

NXP Semiconductors: Nasdaq-listed NXP is headquartered in the Netherlands and was the subject of an acquisition attempt by Qualcomm that fizzled out in mid-2018 after it failed to secure approval from Chinese regulators. The stock had soared after the deal attempt was first announced in 2016, then fell sharply once it fell through, helped along by the broader market selloff at the end of 2018. Over the past 12 months, NXP stock has moved past the deal, climbing by 44%. The chipmaker reports earnings today post-market close, with its analyst call to follow tomorrow morning. Analysts currently have an average 12-month price target on the stock of $139.5, with a range from $115 to $160, versus is $126.9 Friday close.

BP: Oil giant BP will be reporting its latest set of quarterly earnings on Tuesday morning London time, after a year that has seen its share price fall by double digits. The fall has pushed its dividend yield close to 7%, a key factor in a stock widely owned for its payouts. BP has a complex relationship with the oil price, as its downstream business – refining and distributing oil derived products – can actually benefit from being able to buy oil at lower prices. The dividend is certain to be a point of focus on the earnings call, with the firm’s free cash flow numbers in particular watched closely by analysts. American peers Exxon Mobil and Chevron both sunk after giving lukewarm outlooks on demand for their products.

Can Facebook become a trillion dollar company?

With Microsoft and Apple comfortably into trillion dollar territory and Google and Amazon both teetering around the edge, there is a big drop down market cap wise to the next contender: Facebook. The social media giant is sitting on a $575bn market cap, after gaining 22% over the past 12 months. Scale is both an advantage and a potential barrier to Facebook reaching the trillion dollar mark. It has more than two billion daily users and dominance over messaging through its acquisitions of services including Instagram and WhatsApp. It has used its position to expand into non-core areas such as virtual reality – with its acquisition of Oculus in 2014. But the company also finds itself as a focal point of concerns over user privacy, data security and the role of social media in democracy, all of which will only intensify as it grows larger. The company is also still heavily dependent on advertising revenue, and “must demonstrate the ability to monetize its user base beyond just selling ads”, according to Baker Avenue Wealth management chief strategist King Lip.

Crypto corner

Another positive weekend for cryptoassets has seen them either set, or trade near multi-month highs. Having jumped to $9,500 on Friday, Bitcoin remains close to that level, trading at $9,312 this morning.

Meanwhile Ethereum and XRP also experienced further shifts upwards, with Ethereum up at $188.4 this morning having passed through $190 for the first time since November over the weekend. XRP made it above $0.25 before dipping marginally to trade at $0.247 this morning.

Bitcoin usage up among merchants

One of the key criticisms of Bitcoin is that you can’t actually spend it. However, the numbers tell a different story. Coinbase Commerce processed $135 million worth of cryptocurrency payments for merchants in 2019, with many actually citing they prefer to receive payment in crypto as it’s more secure. Whilst this number will be dwarfed by total credit card payments and crypto speculation volume for the foreseeable future, it’s positive to see this stream of crypto adoption take a major step forward.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.