Good morning everyone,

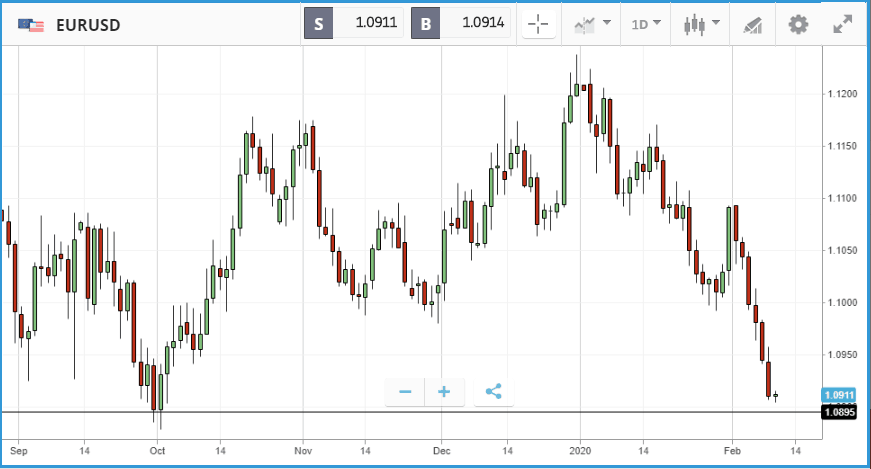

Asian stocks have continued their move higher as much of China got back to work after the extended Lunar New Year break, albeit at a significantly reduced level due to self quarantine rules. Many factories have been slow to reopen, resurfacing fears that growth could take a noticeable hit in Q1 – as much as 1% annualised. Despite this the markets are going up, seemingly pricing in additional stimulus from Beijing as well as more cuts from the Fed. Jerome Powell is expected to deliver an update to Congress today in which he will likely address the effects of the coronavirus outbreak. European Central Bank President Christine Lagarde will also speak today. Addressing the European Parliament she will likely include any economic impact from the coronavirus and all ears will be on any indication of additional stimulus as a response. Meanwhile, we have seen the euro plunge close to 4 month lows vs the dollar with investors opting for the relatively high yield of the greenback.

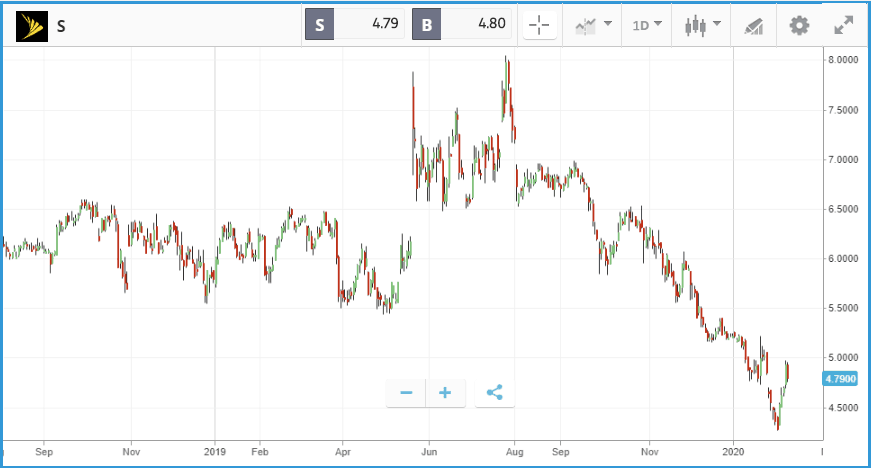

Sprint surges 70% on merger deal

Mobile network Sprint’s share price surged by around 70% in after-hours trading after a federal judge was said to be poised to approve its merger with T-Mobile. The deal has been in the works for two years, and over the past six months Sprint stock has sunk heavily amid fears the merger would be blocked. T-Mobile and Sprint are the third and fourth largest mobile service providers in the US respectively, and the deal faced significant antitrust scrutiny. Without being absorbed by T-Mobile, Sprint faced a bleak future. Its own chief executive Michael Combes said in December that it offers “an inferior product” that has trapped it in a “vicious cycle” of customer losses and a lack of resources to improve the situation. T-Mobile shares jumped 8% in after-hours trading following reports of the ruling. The decision, and potentially more details around the concessions the two firms might have to make, is expected to be officially announced today.

Ocado earnings hurt by warehouse fire

Supermarket and technology platform Ocado reported that its annual earnings had fallen by a quarter last year because of a fire which destroyed a hi-tech flagship warehouse. Ocado, whose shares have risen 35% over the period thanks to it securing overseas deals with supermarket chains including Coles in Australia, said on Tuesday it made earnings of £43.3m, down 27.2%. However, the figure was ahead of analyst forecasts of £42m, with the issues caused by the Andover warehouse fire well flagged. Research by Kantar also showed that Ocado sales in the 12 weeks up to the 26th January were up over 11% on the same period last year. The biggest growth in market share for any UK grocer, including the German discounters Aldi and Lidl. Shares initially dipped at the open but are now up 2% at the time of writing.

Chipmakers soar, driving Nasdaq to 7.3% YTD gain

Chipmakers Nvidia and AMD led the way yesterday with gains of 5.1% and 4.5% respectively, riding a wave of investor optimism ahead of Nvidia’s earnings update on Thursday. Along with names such as Amazon, Microsoft and Tesla, which all delivered share price gains of more than 2% on Monday, the pair helped take the Nasdaq Composite to a 1.1% gain for the day and 7.3% year-to-date. Corporate news drowned out the continued spread of coronavirus, with more than 40,000 cases now confirmed and the death toll closing in on 1,000. The Sprint/T-Mobile merger was not the only piece of M&A news to hit the headlines, as Xerox increased its offer to acquire HP to $24 a share with the promise of a public takeover bid to come early next month. Investors still have clear doubts about Xerox’s ability to make the deal work, even after securing more than $20bn in debt financing, as HP shares increased by less than 1% following the news of the higher offer.

S&P 500: +0.7% Monday, +3.8% YTD

Dow Jones Industrial Average: +0.6% Monday, +2.6% YTD

Nasdaq Composite: +1.1% Monday, +7.3% YTD

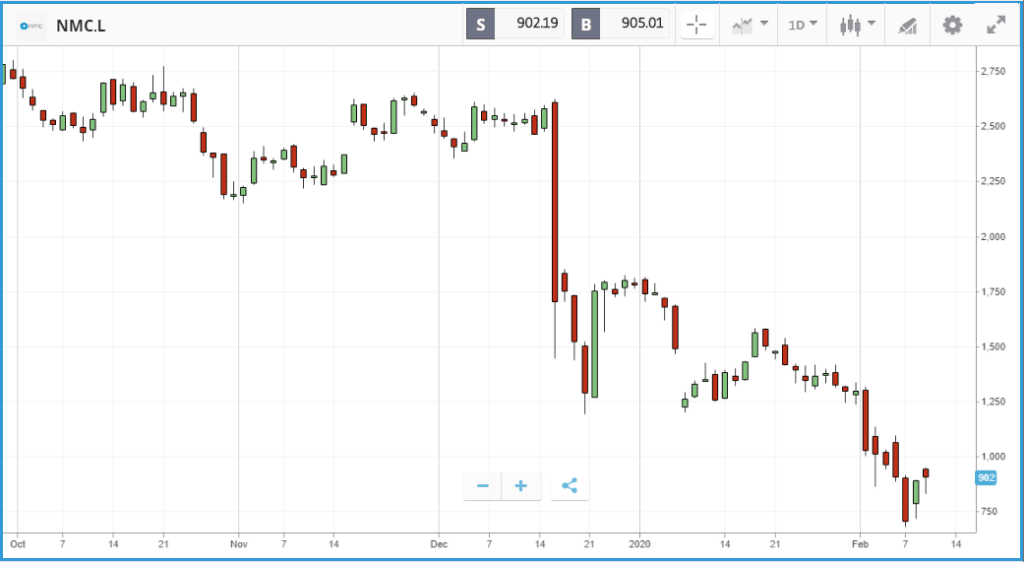

A glimmer of hope for NMC?

Without major corporate news as a distraction, coronavirus was on investors’ minds in the UK yesterday, with some of the usual travel suspects – cruise line Carnival, InterContinental Hotels Group and easyJet – all lower. The FTSE 100 closed 0.3% lower, while the FTSE 250 was flat. For NMC Health investors, the rollercoaster continued after it was reported that two potential bidders have made approaches for the firm, sending the stock higher. The gain came despite the news that the company’s founder is carrying out a legal review to verify his holdings, which has triggered a probe from the City watchdog. NMC’s share price still remains more than 60% below where it stood before the attack from short seller Muddy Waters began late last year. In the FTSE 100, behind NMC homebuilder Barratt Developments and food service firm Compass Group were yesterday’s top performers, climbing 3.1% and 2% respectively.

FTSE 100: -0.3% Monday, -1.3% YTD

FTSE 250: 0% Monday, -1.8% YTD

Stocks to watch

Exelon: Exelon is a Chicago-based energy company, with its operations including nuclear plants, wind turbines, natural gas fired power stations and more. The company’s shares have lagged the broader market, gaining just 1.1% over the past 12 months. Exelon is currently the subject of a grand jury investigation over its lobbying activities, and former CEO Anne Pramaggiore retired suddenly late last year, in addition to stepping down early from her position as chair of the Federal Reserve Bank of Chicago. Expect the investigation to be a focus for analysts when Exelon holds its Q4 earnings call this morning at 9am Chicago time.

Hilton Hotels: Hotel chain Hilton’s share price has jumped by 50% over the past 12 months and despite its China exposure has gained 1.9% over the past month. The impact of coronavirus on its business is certain to be a significant feature of the firm’s earnings call today, as travel is one sector where the lines can be most clearly drawn between the epidemic and company bottom lines. Currently, the average 12-month analyst price target on the stock is $113.89, versus its $111.37 close on Monday.

Lyft: Following Uber’s reveal last week that it expects to deliver a profit in the final quarter of 2020, Lyft is in the hot seat today with its own quarterly update. Similar to Uber, Lyft faces serious questions about its route to profitability, although analysts are broadly backing its share price prospects. Currently, 26 Wall Street analysts rate it as a buy or overweight, 11 as a hold and one as a sell, with an average 12-month price target of $65.63 versus its $53.72 Monday close.

Crypto corner

Cryptoassets edged lower overnight and continued to slide marginally this morning, with investors taking stock of the situation following the strong run year-to-date.

With gains of more than 30% year-to-date – leaving it at a current value of $9,706 – Bitcoin has been one of the standout assets to own in 2020. Peers Ethereum and XRP have enjoyed similar runs. Ethereum, which is down 2% at $216 this morning, is up over 70% year-to-date, while XRP is up 40% at $0.266.

Trump’s new budget would see Treasury have more crypto oversight

Trump’s new budget proposal would give the Treasury more supervision powers over the crypto space and see the Secret Service carry out investigations to fight crypto related crimes such as money laundering and terrorist financing. Treasury Secretary Steven Mnuchin has previously warned of the risk of Bitcoin and other cryptoassets becoming like “anonymous Swiss bank accounts”. However, it appears it will be back to the drawing board for the budget as it got a frosty reception from Democrats over proposed cuts to healthcare and housing among other safety-net programmes.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.