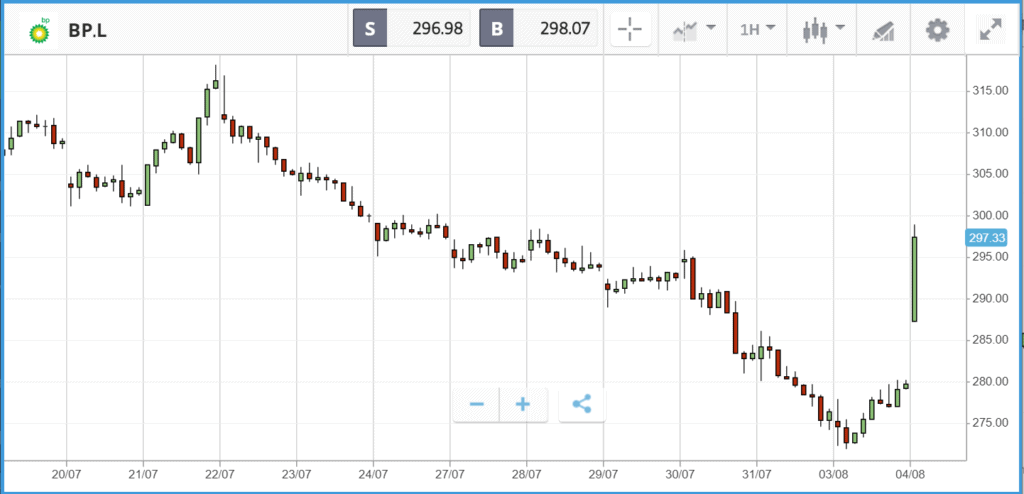

Oil giant BP reported its Q2 results this morning which included its first dividend cut in a decade. The dividend was halved as the company had reported a record quarterly loss as Covid-19 decimated energy demand across the globe. Despite these numbers not reading particularly well, shares are actually up over 5% this morning as the company announced its intention to cut its fossil fuels output by 40% by 2030. To do this, they have pledged $5 billion a year spending in the same period to boost the energy generated by renewable sources.

Across the pond, Twitter is reportedly being investigated by the Federal Trade Commission for alleged privacy violations, shortly after the accounts of several high profile figures, including Barack Obama and Elon Musk, were hacked and used for a Bitcoin scam. According to Bloomberg, the FTC is looking into the company for using phone numbers users provided for security purposes to target people with advertising. Twitter said that the investigation could lead to a “probable loss” of $150m to $250m, meaning it is expecting to have to pay up to resolve the accusations. Twitter stock fell by close to 2% in after-hours trading following the news, taking its year-to-date gain down to 13.5%, lagging behind the tech heavy Nasdaq Composite index.

Microsoft’s attempt to buy TikTok’s US operations also made headlines again on Monday, after President Trump said that the US government should receive “a very large percentage” of the sale price, just after dropping his opposition to the deal. One former Treasury official told The WSJ that it is unlikely any payment would stand up to legal scrutiny, and that “there is no situation where either Microsoft, the Chinese, TikTok or ByteDance will be sending a cheque to the US government, except in the normal course of their regular tax obligations”. Microsoft stock was buoyed by the deal progress, closing the day 5.6% higher.

Varian Medical Systems sold for $16.4bn

Led by Microsoft, the Nasdaq Composite jumped once again on Monday, finishing the day out 1.5% higher. Other big name winners included Tesla, which added 3.8%, plus chipmakers Qualcomm and Nvidia, which gained 3.8% and 3.7% respectively. Tesla stock was potentially aided by the success of CEO Elon Musk’s other venture SpaceX, which successfully brought two astronauts back from the International Space Station. The big winner in the S&P 500 on Monday was $15.8bn market cap Varian Medical Systems, which climbed 22% after announcing it has agreed a deal to be acquired by Siemens Healthineers for $16.4bn. Under Armour brought up the back of the index, dropping 8.1%, after analysts at Susquehanna Financial Group upgraded their rating on the stock but called out management for diluting the “premium” nature of the brand through a hefty presence at discount retailers.

In other headlines, Apple is gearing up for a stock split, where it will divide its shares up into a greater number each with a lower price per share. The move changes nothing about the value of Apple stock, and the dawn of fractional share trading should dampen any impact it has on the psyche of DIY investors. In the past, the ability to buy a single share of Apple for a lower price might have opened up the company to previously hesitant retail investors, but investors now have the capability to buy fractions of shares readily available.

S&P 500: +0.7% Monday, +2% YTD

Dow Jones Industrial Average: +0.9% Monday, -6.6% YTD

Nasdaq Composite: +1.5% Monday, +21.5% YTD

Lloyds leads FTSE 100 higher as HSBC drops after profit slump

London-listed stocks jumped on Monday, with the FTSE 100 up 2.3% led by banking and finance names such as Lloyds Banking Group finishing 6% higher and NatWest Group up 4.8%. The gains came amid the news that rival HSBC is planning to accelerate its plans to cut 35,000 jobs as the pandemic has decimated its profits. HSBC stock closed the day 2.9% lower after the news came out as part of an earnings report, in which it said profits in Q2 2020 were 80% down on the prior year. The bank was the biggest loser in the FTSE 100, and the only stock to close the day more than 1% lower. In the FTSE 250, small cap favourite Games Workshop helped take the index to a 1.3% daily gain, after adding 5.9% itself. The gaming miniatures maker has added 53% year-to-date, buoyed by a loyal fan base that has largely been stuck at home for months. Over the past 12 months, the stock is up 110%.

FTSE 100: +2.3% Monday, -20% YTD

FTSE 250: +1.3% Monday, -21.6% YTD

What to watch

The Walt Disney Company: It has been a mixed year for Disney stock. On one hand, the company is dealing with theme park shutdowns and disruptions to the production of its film and television content, but it has also brought a streaming service to market during a period where such services are being used heavily. Disney+ has already attracted more than 50 million subscribers, and progress there will be a key part of the firm’s quarterly earnings report today. Plans for theme park reopening, and progress on getting back to normal operations in regions where reopenings have begun, will also be key features of the earnings call. Disney stock is down close to 20% year-to-date, and Wall Street analysts are split between buy and hold ratings.

Activision Blizzard: As publisher of the hugely popular Call of Duty franchise, the latest iteration of which has proved a major hit, Activision Blizzard has been a beneficiary of widespread lockdowns. Its share price has jumped more than 40% year-to-date, and is up by 84% over the past 12 months. How the company plans to sustain growth as Americans return to work and have less time for video games, plus the share of the company’s sales that happened digitally, will be key features of its Tuesday earnings report. Analysts overwhelmingly favour a buy rating on the stock.

Legal & General: London-listed insurer and asset manager L&G delivers its quarterly earnings report on Wednesday, where the sustainability of its dividend – which is now at 8% – is likely to be a key focus. The company’s share price is down 27% year-to-date, similar to many financial names, as rock bottom interest rates make it far harder for the company to turn a profit. Currently, the firm is trading at a trailing twelve month price-to-earnings ratio of just seven, roughly half the average ratio for the broader market.

Crypto corner: First Swiss Bank opens to crypto operations

Swiss Banks may be better associated with taking care of the offshore needs of the ultra-wealthy, but now one bank is set to begin the country’s first crypto banking operation. according to Finews.

Swiss cantonal bank Basler Kantonalbank (BKB), a state-run entity, has become the first in the country to begin developing cryptoasset operations. BKB’s subsidiary Bank Cler is reportedly working on offering services that allow customers to trade and store cryptoassets. Cler is owned by BKB but it holds a separate banking licence.

Although BKB did not specify which cryptoassets it would provide services for, a spokesperson confirmed it was going ahead with plans thanks to increased demand for such services. While there is no timeline for Swiss customers to access the services yet, it will be the first cantonal bank to offer such services in Switzerland, where currently only crypto banks Seba and Sygnum operate.

All data, figures & charts are valid as of 04/08/2020. All trading carries risk. Only risk capital you can afford to lose.