Hi Everyone,

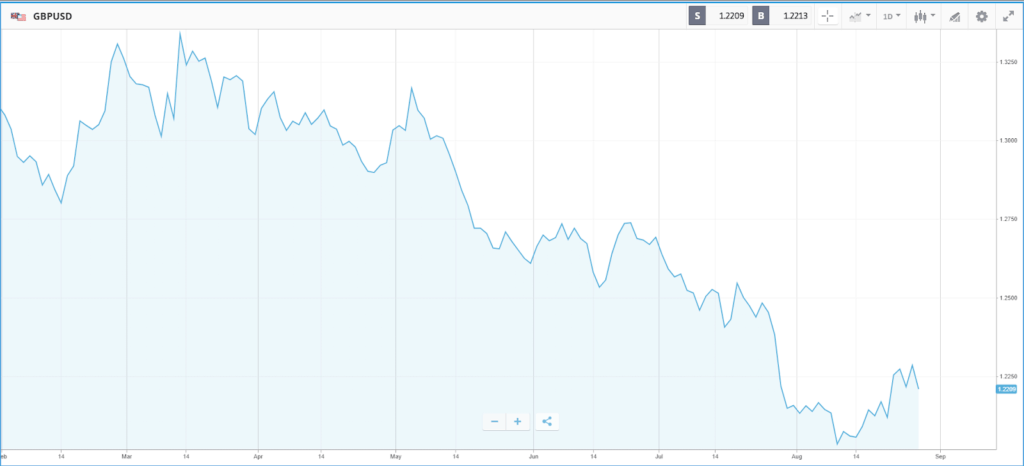

GBP fell against the US Dollar yesterday after the UK Prime Minister Boris Johnson confirmed that he had obtained necessary authorisation from the Queen and would suspend Parliament until a formal reopening on 14 October.

This is a highly-controversial move that would restrict parliamentary time before the Brexit deadline and increase the chances of the UK leaving the EU with no deal. While the government has said that the five week suspension will still allow sufficient time to debate Brexit, others see it as a tactical move. It has prompted a furious backlash from MPs and opponents of a no-deal Brexit. There have been protests across the UK, an online petition has already secured over 1 million signatures and a legal challenge has been submitted.

With the prospect of a no-deal Brexit seeming more and more likely, analysts have cut forecasts for UK stocks for year-end. Estimates for the FTSE100 level at the end of 2019 are coming in at 7300, 200 points lower than when the same question was asked in May. Combine this with the US-China trade war raging on it appears to be a mammoth task for any amount of central bank dovishness to overturn.

Link: CNBC Article

Link: Reuters article

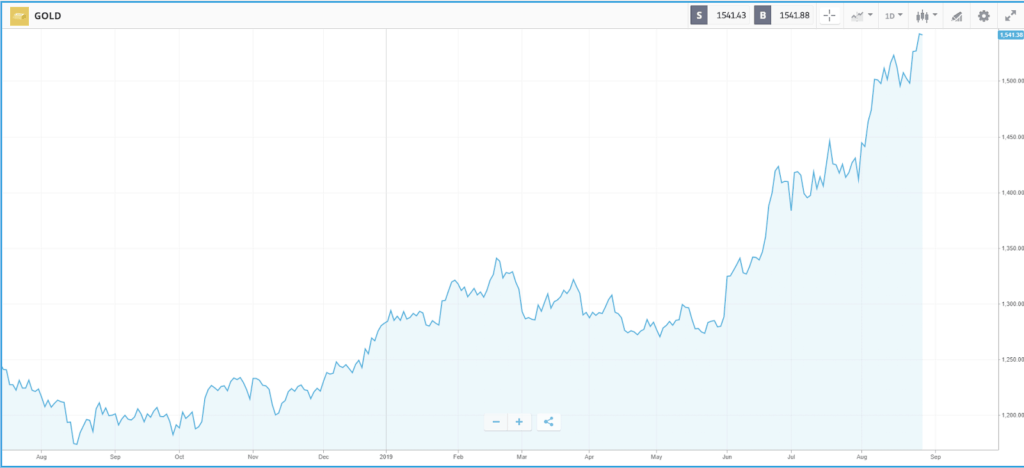

Recent financial market volatility is pushing the gold price to multi-year highs.

The precious metal has always been considered by many as a safe haven. The recent discovery of gold bars, fraudulently stamped with the logos of major refineries, is making headlines. The aim of which is to launder smuggled or illegal gold.

Link: Reuters Article

The Day ahead

We have a busy day ahead for economic data releases today including Germany’s preliminary CPI and unemployment data for August and France’s final Q2 GDP and consumer spending for July. The Eurozone consumer confidence data for August is also due. In the US, we should be on the lookout for preliminary Q2 GDP numbers, the advance goods trade balance, retail inventories, wholesale inventories and pending home sales data, as well as the latest weekly initial and continuing claims data.

Traditional markets

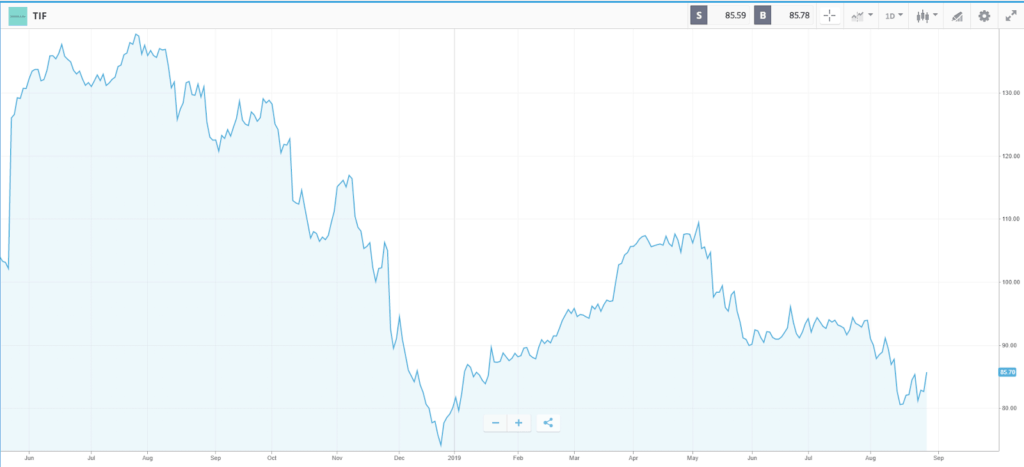

Tiffany (TIF) – the luxury goods retailer earned $1.12 per share for its latest quarter, beating estimates by 8 cents. Revenue and comparable stores were below estimates, but Tiffany reported double-digit growth in mainland China and also maintained its full-year sales and earnings outlook.

JetBlue (JBLU) – In what Deutsche Bank labels a ‘catalyst call’, it ‘recommended investors buy shares in the airline, saying a 15% pullback over the past three weeks provides an attractive entry point.’ It also notes that JetBlue has a good balance sheet and a solid market position.

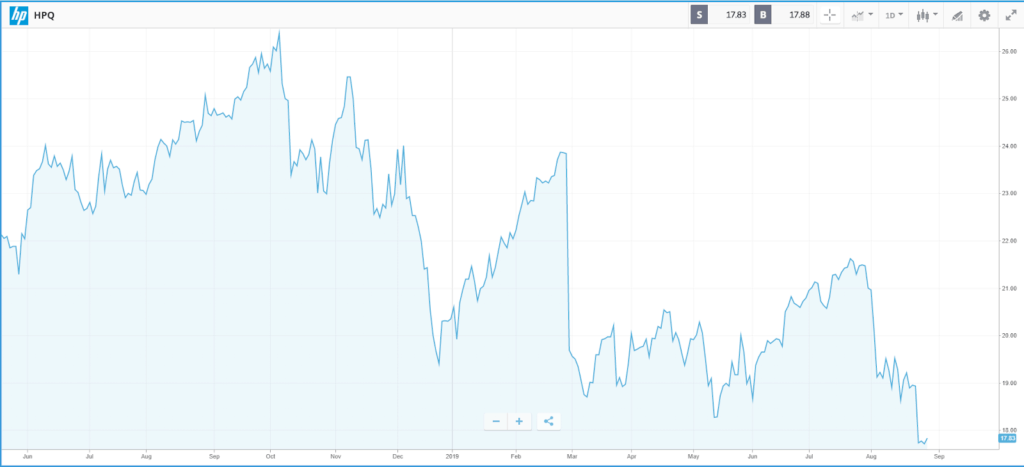

Hewlett Packard Enterprise (HPE) – the enterprise technology company reported an adjusted quarterly profit of 45 cents per share, 5 cents above estimates, although revenue did come in slightly below estimates. HPE said the computer and storage markets are showing signs of softness in the current quarter.

Toyota Motor (TM) – Toyota said it would form a capital alliance with fellow Japanese automaker Suzuki to help accelerate technological development. Toyota will take a 4.9% stake in Suzuki as part of the deal, while Suzuki will receive around 0.2% of Toyota’s outstanding shares.

Intel (INTC) – The chipmaker and its private equity partners may list cybersecurity company McAfee this autumn at a valuation of at least $8 billion, according to a Bloomberg report.

Autodesk (ADSK) – the maker of computer-aided design software reported an adjusted quarterly profit of 65 cents per share, 4 cents above estimates. Revenue come in above Wall Street forecasts, however, the stock is under pressure after Autodesk lowered its fiscal 2020 earnings forecast and narrowed its sales outlook, pointing to trade and economic uncertainty.

Hershey (HSY) – the chocolate manufacturer is buying nutrition bar maker ONE Brands in a deal worth about $325 million, complementing its existing Oatmega nutrition bar business. Hershey expects to complete the deal by the fourth quarter of this year.

Monster Beverage (MNST) – The beverage maker was named a ‘top pick’ at Credit Suisse, which points to upbeat trends for Monster’s Reign performance energy drink.

Link: CNBC

Macro

China prepares for the worst. The majority of negotiators in Beijing tasked with navigating trade tensions with the US are less than convinced that a deal will actually materialize ahead of the 2020 U.S. elections, according to Chinese officials familiar with the talks.

Trump’s on-again, off-again attitude towards China is being seen as a real obstacle, they said, in a signal that they are concurrently preparing for decoupling from the world’s biggest economy. They added that it is dangerous for any official to advise President Xi Jinping to sign a deal that Trump may eventually break. Trump’s recent assertion that Beijing had over the weekend made a phone call to his administration to discuss trade is yet to be confirmed by China and is the latest in a series of claims that have added to Chinese scepticism.

Link: Bloomberg Article

Crypto

The pro-democracy, anti-government protest movement in Hong Kong is encouraging wider adoption of cryptoassets according to Yahoo Finance. The political upheaval in the city, which has now entered its 12th week is prompting several local businesses and individuals to switch to using non-sovereign and decentralized digital currencies.

Link: Bloomberg Article

Crypto

The pro-democracy, anti-government protest movement in Hong Kong is encouraging wider adoption of cryptoassets according to Yahoo Finance. The political upheaval in the city, which has now entered its 12th week is prompting several local businesses and individuals to switch to using non-sovereign and decentralized digital currencies.

Bakkt – Bakkt will begin providing secure crypto storage services on September 6th ahead of the daily and monthly futures to be launched on September 23rd. These contracts will enable physical delivery of Bitcoin with end-to-end regulated markets and custody.

Link: Cointelegraph article

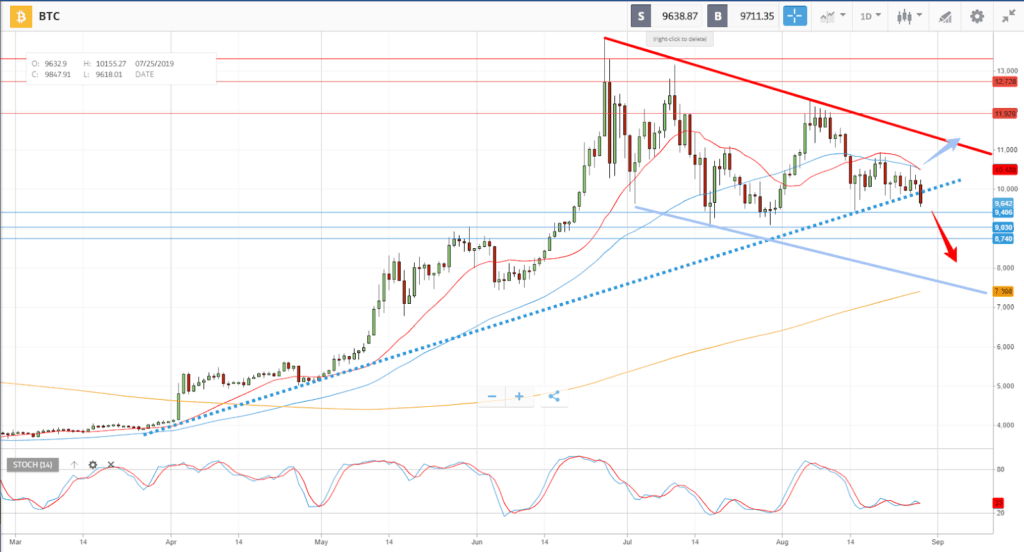

BTC is range trending in the daily, 4 hourly timeframes, capped by the 20 and 50 daily moving averages (DMA) and supported by the 200 DMA. The price appears to be in a consolidation range, creating lower highs and lower lows. Intraday price action is bearish, supported by 9,400. Upside is capped by initial resistance at 10,000. A confirmed breakout above 10,000 appears bullish targeting resistances at the psychologically important 10,400 followed by 11,000 and 12,000. Alternatively a confirmed loss of 9,400 would support a bearish outlook targeting additional downside supports at 9,030 initially, followed by 8,750 and 8,400.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.