Hi Everyone,

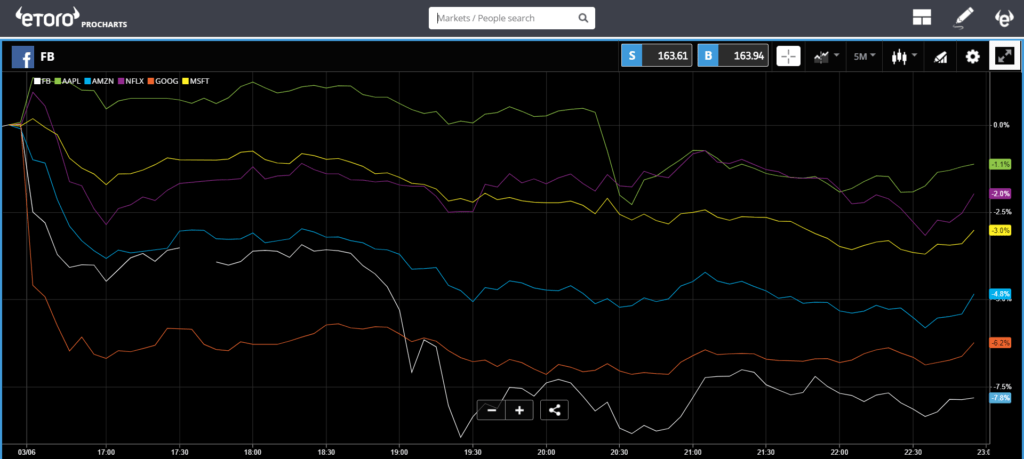

Wall Street received a considerable shock yesterday as the precious FAANG stocks took a massive hit.

Facebook fell 7.8 Google dipped 6.2%, and Amazon dropped 4.8%. For those of you who trade crypto, these numbers might seem benign but for the stock markets, these are gut-wrenching losses.

The latest woes for the tech giants come as the US government is reportedly ramping up its efforts to crack down on the respective monopolies that these colossal companies currently enjoy.

As many in the market have been treating these top stocks as a store of value over the last few years, investors are now scrambling to figure out where to turn next.

Today’s Highlights

- Look at Faangs

- Sharp in Crypto

- Bitcoin Pullback

Traditional Markets

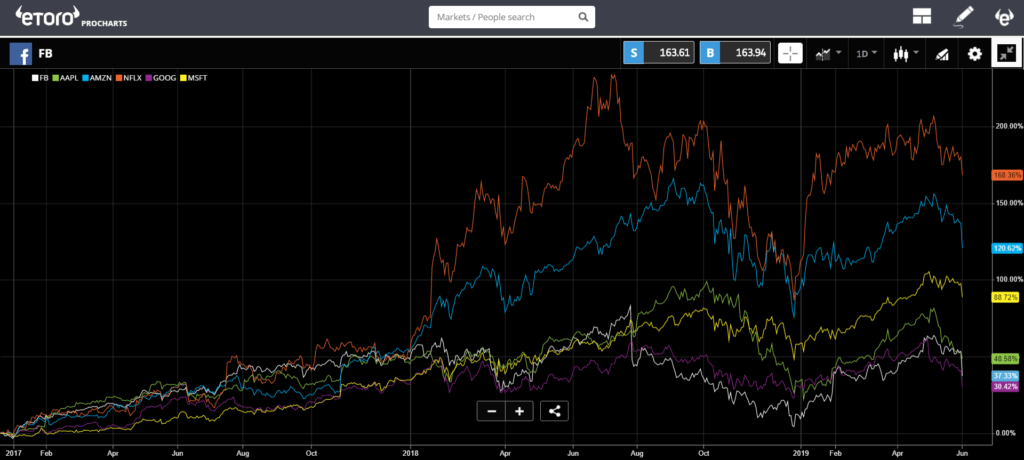

To put things into perspective, if we zoom out on the charts, it’s clear that all the stocks mentioned above are still seeing nice profits since the beginning of the year. However, year-to-date numbers might not be the best measuring point. If you’ll recall, the entire market took a large dip at the end of last year, which was recovered early 2019.

To really get a better look, we might want to zoom out to the beginning of 2017, when the stellar Faang trend was at its peak and Fed policy was more dependable.

The questions going forward are how deep will the government crackdown go?… and how much of their perceived value will these shares lose?

The buzzword that I saw floating around this story was “bipartisan.” This term is rarely deployed in Washington DC and the fact is that the #BreakUpBigTech movement has until now been mostly a liberal movement. So if the Republicans are getting involved things could indeed get ugly.

Question two is a bit more difficult to foresee. For the moment, the Faang stocks are likely priced beyond perfection. Some might say the valuation more accurately represents what the companies would be worth once they achieve global domination.

This afternoon, Fed chair Jerome Powell is due to speak at a special ceremony. It will be interesting to see if/how he addresses this topic.

Crypto is Sharp

There’s never a dull moment in the crypto sphere but yesterday evening things became really heated as several huge stories hit social media all at once.

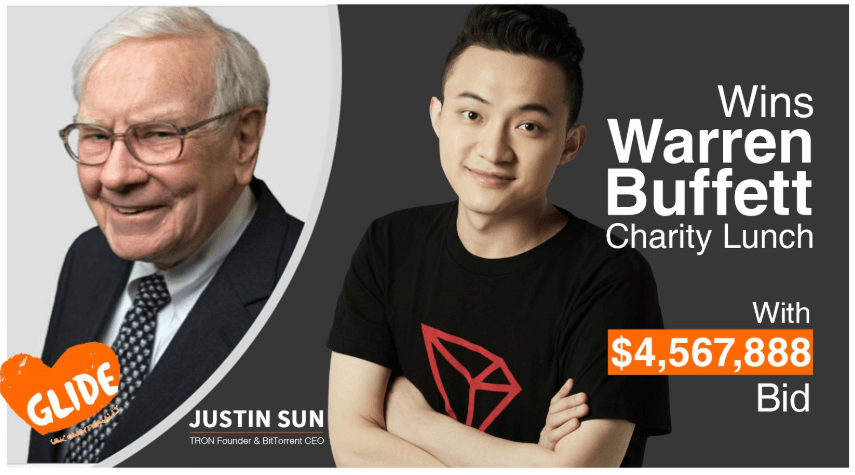

First the puff. It looks like Warren Buffett will now need to sit through a crypto sales pitch by Tron Founder Justin Sun and seven crypto advocates of Justin’s choosing. Good luck Warren!

Crypto Pullback

There’s a bit of red on the board in crypto land today. Please note that this is probably not the time to panic. Bitcoin rose a total of 107% in two months (April & May) so a pullback here, even by 30%, could be quite healthy.

In our weekly interview with CoinTelegraph, I outlined two bullish scenarios for bitcoin. The aggressive one has now been broken as we’ve lost some momentum. The conservative one looks something like this…

Note that the blue rectangle represents a major support zone from around $6,400 to about $7,100 per coin.

What’s most interesting to note is that the latest leg down comes with elevated volumes on exchanges. Messari’s ‘real 10‘ indicator is reading about $1.5 billion. However, volumes on bitcoin’s blockchain have continued to decline.

Long-term traders are likely to see this as just noise.

Wishing you an astounding day.

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.