Hi Everyone,

Well, it finally happened…

This shouldn’t come as much of a surprise to anyone who’s been watching the space. I must admit that even I have several times been BitMEX Rekt. That place is like a black hole for bitcoin. Glad to see that someone is finally investigating them.

eToro, Senior Market Analyst

Today’s Highlights

- Another Fed Mistake

- Earnings on Track

- Tangle in Taipei

Please note: All data, figures & graphs are valid as of July 19th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

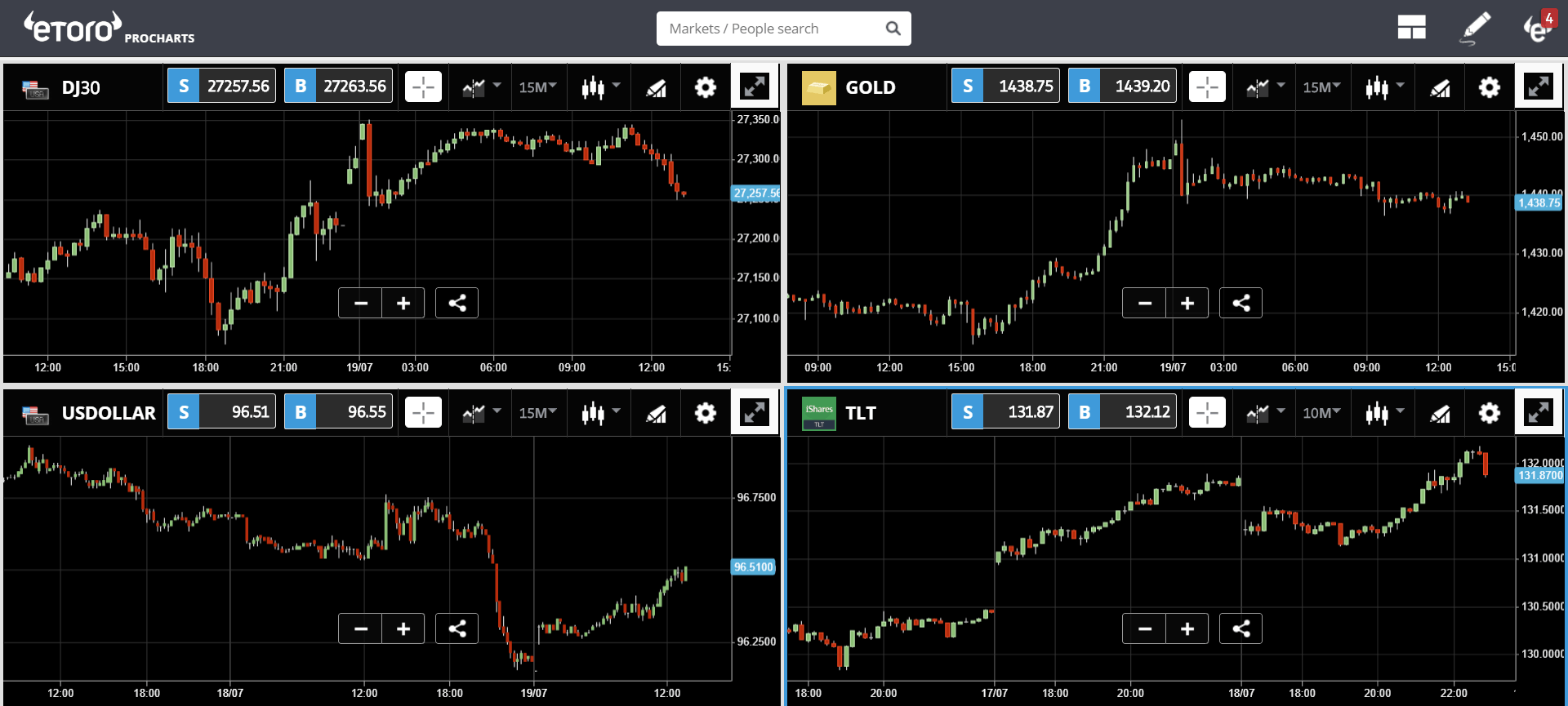

This evening, Federal Reserve members will enter the blackout period. From tomorrow and until the meeting on July 31st, they will not speak publicly about monetary policy.

That’s OK though because yesterday they did more than enough talking.

In this article, you can see how a speech from one Fed member caused the markets to think that a 0.5% rate cut was likely at the end of the month.

To me, it doesn’t seem like John Williams was intentionally leading the markets on, but that’s what ended up happening. The market reactions were quite clear.

Earnings Season

Well, we’re one week in and so far things are going pretty well. There’s an old game on Wall Street, set the forecasts so low that when the news comes out, it exceeds expectations.

One company that managed to fail at this yesterday was Netflix, whose price suffered its worst drop in three years.

Another surprise came from Bank of America, who managed to put out a fantastic report, despite the current economic environment. As we’ve been discussing, times are tough for investment banks at the moment as they are being forced to compete with the Central Banks who are buying bonds with much lower yields.

How’d they do it?

Well, by focusing on retail and digital customer experience. By doing so, they were able to take advantage of the strong economy and consumer spending that we’ve been talking about.

Still, the reaction in BAC’s shares was notably muted for something being touted as a huge win.

Tangle in Taipei

It’s been a long time since fundamental news has really had any effect on the crypto market but over this past week, that’s exactly what’s been happening.

The media circus that is the Libra congressional hearings has had a very noticeable impact on the price of bitcoin and the alts. The hearing in the Senate on Tuesday was quite harsh and many lawmakers did take out some of their frustrations on Facebook. The price of bitcoin reacted quickly by dropping below $10,000.

The hearing in the House on Wednesday, however, seemed a lot more constructive and though Congress had some very valid questions about the Libra most of them seemed quite open to creating a friendly environment for crypto assets in the United States. The next morning, bitcoin was back above $10,000.

We’ve already shown clearly how the tweets from Donald Trump and emergency crypto briefing from his Treasury Secretary had both had a very positive initial reaction.

For your entertainment, this weekend, make sure to catch the Tangle in Taipei. This is the debate that we spoke about two weeks ago between Nouriel Roubini and the CEO of BitMEX Arthur Hayes. It seems that Arthur lost so badly that BitMEX withheld the tapes for some time but they’ve finally succumbed to social pressure.

It’s important to note that Hayes is not acting as a representative of the crypto community and most of the critical arguments that he used were clearly in defense of himself as an alleged illegal casino operator and not the typical arguments one would use in favor of free and fair money.

It’s quite possible that this debate was the catalyst that motivated the US to probe BitMEX as mentioned in the breaking news above.

So, here it is: https://youtu.be/qlZukhN_C6c

Wishing you a wonderful weekend ahead.

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/matigreenspan

LinkedIn: https://www.linkedin.com/in/matisyahu/

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.