Litecoin adds 10% as established altcoins rally

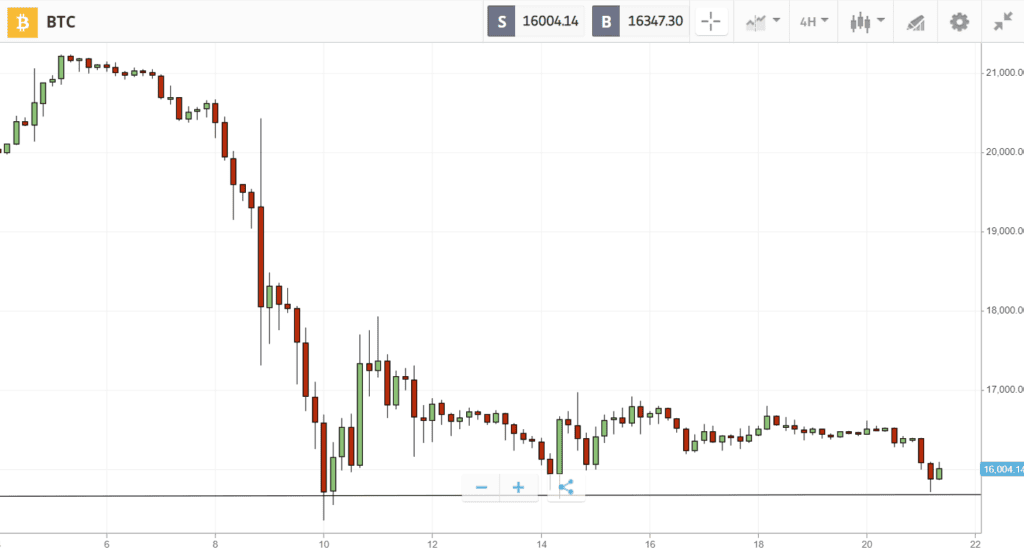

As the fallout from the recent exchange collapse casts uncertainty over the market, Bitcoin continues to hover above $16K.

Shockwaves from the event are still being felt across the industry, leading to concerns about one of the largest crypto firms. Nevertheless, Bitcoin is showing resilience. The leading crypto continues to drift sideways, and some of the most notable industry figures — including Edward Snowden and El Salvador’s Nayib Bukele — are now turning bullish.

Meanwhile, the hottest altcoins of 2017 are attempting a resurgence. Litecoin has rallied 10% on positive comments from Bitcoin investor Michael Saylor, while XRP has added 4%. Elsewhere, certain DeFi tokens are also defying the market downturn, including Yearn which is up 5%.

This Week’s Highlights

– Chiliz rises 30% ahead of World Cup

– DeFi tokens hold strong in wake of CeFi collapse

Chiliz rises 30% ahead of World Cup

Chiliz, the token powering fan token platform Socios, rallied 30% earlier in the week before retreating again as sellers stepped into the market.

The rising prices came ahead of the FIFA World Cup 2022, which kicked off on Sunday with a match between Qatar and Ecuador. This marked the start of a tournament which will last until December 18th.

As the leading soccer-themed token, Chiliz enables fans to purchase team tokens and participate in their teams’ management decisions on the Socios platform. These activities could be expected to grow in popularity as the World Cup continues.

DeFi tokens hold strong in wake of CeFi collapse

As most altcoins show losses in the wake of the downfall of a major exchange, certain DeFi tokens are staying in the green.

Although category leader Uniswap has fallen 9%, Synthetix and Yearn are both showing small percentage gains. This could be the result of growing demand for DeFi, with data from Nansen showing that most DeFi protocols have recently experienced double-digit percentage growth in users and transactions.

According to blockchain analytics firm Chainalysis, what’s really driving DeFi growth is not organic demand, but a popular bot that aims to profit by front-running transactions.

Week ahead

Uncertainty is likely to remain the predominant market sentiment in the week ahead, with investors treading carefully amidst fears of another crypto firm collapsing.

On Wednesday, the Federal Reserve will release minutes from the last FOMC meeting, which could reveal clues about the size of the next interest rate hike in December.

In the altcoin market, Theta Network could move into the spotlight ahead of the launch of its Metachain on December 1st.