Market shrugs off regulatory onslaught to reach prices not seen since May

Cryptoasset prices are accelerating higher as U.S. regulators put Bitcoin in the spotlight and Ethereum celebrates a successful network upgrade.

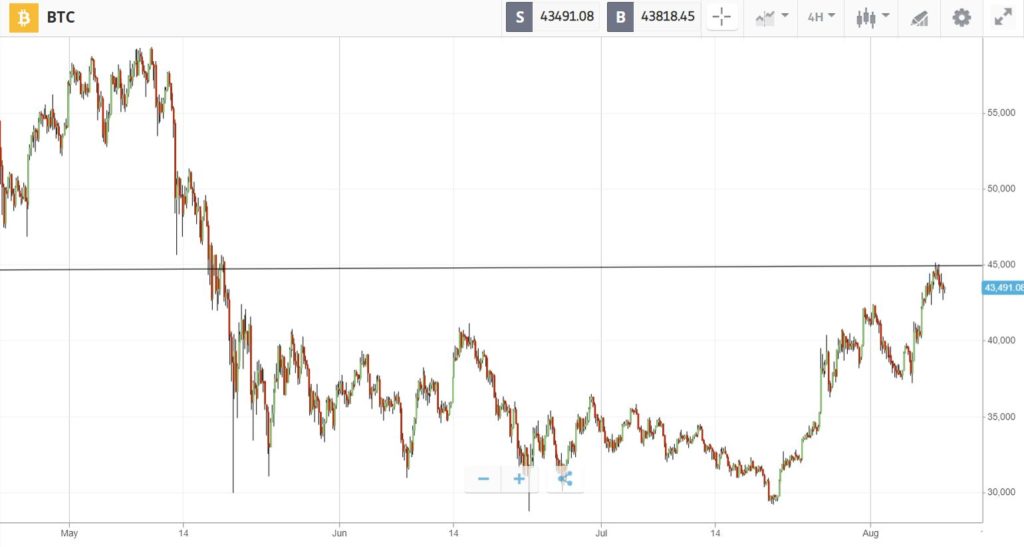

Crypto has become the most hotly debated aspect of Biden’s $1 trillion infrastructure bill, and prices across the market are lapping up the publicity. Bitcoin touched $45K on Sunday as the community rallied against contentious tax reporting proposals, while Ethereum surpassed $3K on successful completion of the London hard fork.

Ethereum’s upgrade appears to have reinvigorated the DeFi market. Token prices for decentralized protocols are surging and Compound and Uniswap have both made double-digit gains over the last week, rivalling Dogecoin and Shiba Inu which are racing neck and neck, both rising 15%.

This Week’s Highlights

- Buyers scoop up Ethereum on London hard fork

- Bitcoin climbs higher as regulators close in

Buyers scoop up Ethereum on London hard fork

Ethereum is proving more appealing than ever after this week’s upgrade, with buyers greedily scooping up the cryptoasset and pushing prices above $3K for the first time since May.

The London Hard Fork went off without a hitch on Thursday, introducing a new fee burning mechanism that makes Ethereum more deflationary by removing coins from circulation each time a transaction is made. This marks a new and exciting chapter for the second-largest cryptoasset, and brings the network one step closer to launching Ethereum 2.0.

Bitcoin climbs higher as regulators close in

Since U.S. Regulators introduced sweeping new rules for digital assets to the $1 trillion infrastructure bill last week, disputes over the proposed legislation have dominated headlines.

Senators worked through the weekend to negotiate disagreements, while #Don’tKillCrypto trended on Twitter, and the crypto community was galvanized in opposition to the proposals that could prove disastrous for the U.S. cryptoasset market.

Nevertheless, Bitcoin pushed higher. Prices of the digital gold touched $45K as the debate intensified, reflecting growing recognition in the highest levels of society about the importance of appropriate cryptoasset regulation.

Week ahead

Infrastructure bill developments are likely to remain the primary focus for the crypto market in coming days. The final vote in the Senate is likely to happen on Tuesday, before the Bill moves into the House.

Elsewhere, U.S. inflation data is due to be released on Wednesday and Thursday. This could trigger volatility across global markets by showing how permanent rising prices are, and indicating the future direction of Federal Reserve policy.