Ethereum sinks 25% despite successful Merge test

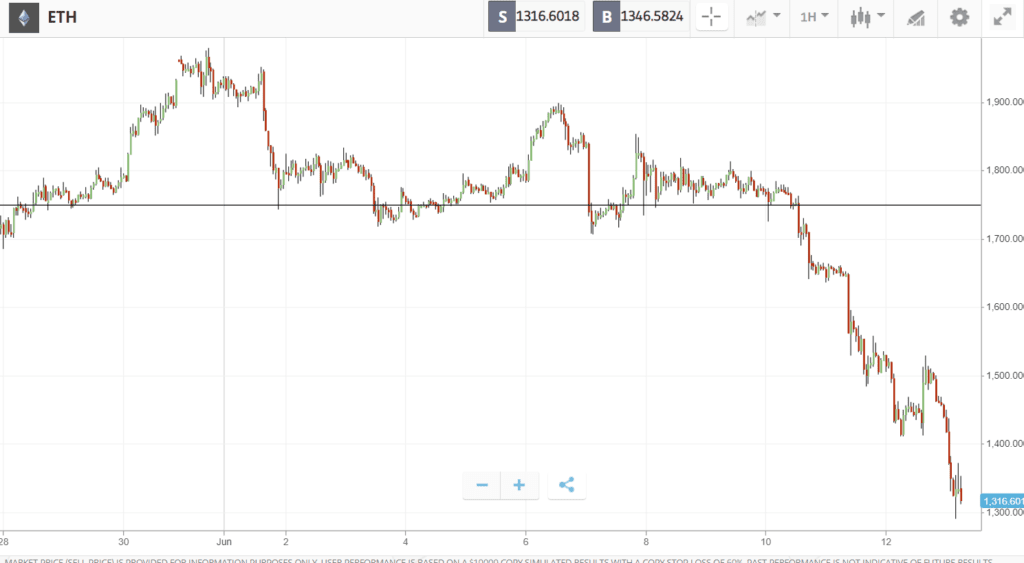

Ethereum fell below the highs of 2018 over the weekend, losing 25% as Bitcoin weathered the storm with 12% losses.

The marketwide downturn was driven by both macroeconomic and crypto-specific events. US inflation figures came in hot on Friday, triggering turmoil across global financial markets as traders priced in the possibility of more aggressive rate hikes. Meanwhile, Ethereum was dealing with its own problems as the “difficulty bomb” — a critical mechanism relating to The Merge — was delayed, raising concerns about the upcoming upgrade. Combined, these events countered the impact of more positive news, including the release of a draft bill aiming to create regulatory clarity by defining a digital asset regime for the US, and Ethereum’s oldest testnet Ropsten completing its Merge upgrade.

Almost all major altcoins fell alongside Bitcoin and Ethereum. Chainlink dropped 20% on the week after releasing a new roadmap towards staking, and ApeCoin was one of the biggest losers. The NFT community token dropped 30%, despite Snoop Dogg announcing a Bored Ape-themed dessert restaurant, and Mastercard and Salesforce moving to adopt NFTs.

This Week’s Highlights

– Ethereum completes “dress rehearsal” for The Merge

– Concerns over The Merge drag Ethereum below previous all-time high

Ethereum completes “dress rehearsal” for The Merge

Last Wednesday, the Ethereum network took a major step towards its biggest upgrade yet: The Merge.

Ropsten, Ethereum’s oldest testnet and one of the closest replicas to the real Ethereum, successfully implemented its own version of the upcoming upgrade. This set the community abuzz in anticipation of Ethereum’s transition from proof-of-work to proof-of-stake, which is set for August and promises to make the network cheaper, faster, and more environmentally friendly.

Nonetheless, the technical milestone was not reflected in the price. Ethereum continued falling to mark 10 weeks of consecutive losses.

Merge concerns drag Ethereum below previous all-time high

Despite the successful Merge on Ropsten, other events have weighed heavily on the price of Ethereum.

On Friday, Ethereum developers decided they would delay the so-called “difficulty bomb,” which is a mechanism to encourage post-merge support for the proof-of-stake chain by continually increasing the difficulty of proof-of-work mining.

Even with assurances from developers that “The Merge will not be delayed”, the news fed into growing uncertainty about Ethereum’s future. The resulting price dump was exacerbated by uncertainty around staked ETH, which slipped by 5% on Curve due to a large imbalance in the liquidity pool.

Week ahead

Much of last week’s downturn could be attributed to persistently high inflation figures, as rising living costs have created expectations that the Federal Reserve will hike rates more aggressively.

On Wednesday, we could get an idea of how realistic this expectation might be. Federal Reserve Chair Jerome Powell is set to raise rates by half a percentage point, and investors will be watching for hints of more aggressive rate hikes in future.

Elsewhere, hopes for a market rebound are being boosted by speculation that a long-awaited spot Bitcoin ETF could finally be approved by the U.S. Securities and Exchange Commission (SEC) in the next few weeks. Such an investment vehicle may inspire more hesitant traditional investors to add Bitcoin to their portfolios.