Good morning everyone,

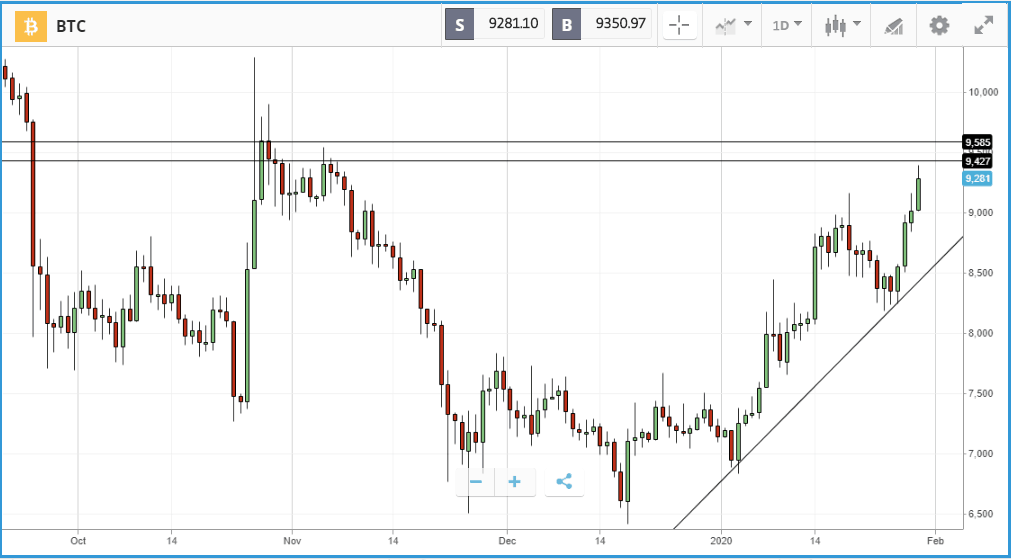

Bitcoin and the other largest cryptoassets are surging this week, moving within touching distance of three-month highs this morning as investors look to alternatives to equities.

Having rallied over 12% in 3 days, it hit a peak of $9,389 overnight, its highest level since early November when it nudged over $9,400. This could prove to be the next significant hurdle of resistance, although if we do see a pullback, seeing the price make another higher low and maintain the 2020 uptrend will be encouraging for bulls.

Ethereum and XRP are also closing in on three month peaks. Ethereum is up at $176, less than 10% off its previous high above $190, although XRP has some way to go. It is trading at $0.236 today after rising sharply throughout January, but is still some 30% off its previous peak of $0.308.

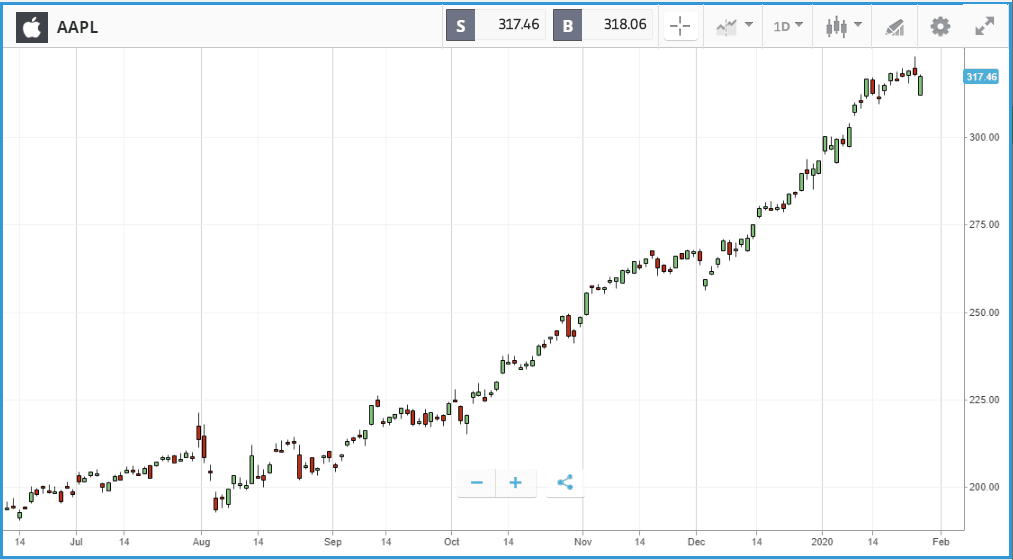

In stock markets, Apple, the world’s largest listed company, climbed 2.8% yesterday running up to its post market-close earnings announcement, and climbed further in after-hours trading thanks to an expectation beating quarterly earnings update. The company’s wearables, home and accessories category, which includes the Apple Watch and AirPods, passed $10bn in quarterly revenue for the first time. Apple beat its own guidance by posting overall revenue of $91.8bn for the last quarter of 2019, with iPhone revenue up 8% to $56bn. The earnings per share figure of $4.99 was 9.9% higher than analysts had predicted, and the only revenue miss was in the company’s services division. CEO Tim Cook highlighted that the company has alternatives to its suppliers in Wuhan, the region at the center of the coronavirus epidemic, but offered up a wider guidance range than normal for next quarter due to the uncertain impact of the virus on sales in China.

US stocks post partial bounceback, Pfizer struggles after reporting earnings miss

All three major US indices bounced back on Tuesday but did not make up all the ground lost on Monday when global stocks sank due to the escalation of the coronavirus epidemic. The Nasdaq Composite led the way with a 1.4% gain, driven higher by share price pops from names such as Apple, Nvidia and American Airlines. Of the major firms that reported earnings on Tuesday, Pfizer suffered a particularly poor day. The drug company came in well under earnings expectations, sending its share price down 5%. Pfizer is a firm in transition, attempting to find its way as a more streamlined company after announcing a spin-off of its off-patent drugs business last year. At the top of the S&P 500, which climbed 1%, were homebuilder PulteGroup, home appliances firm Whirlpool and miner The Mosaic, which gained 5.7%, 5.7% and 4.3% respectively.

S&P 500: +1% Tuesday, +1.4% YTD

Dow Jones Industrial Average: +0.7% Tuesday, +0.7% YTD

Nasdaq Composite: +1.4% Tuesday, +3.3% YTD

IHG a bellwether for coronavirus fears

The bounceback in UK shares, which fell further than their US counterparts on Monday, was more muted, with both the FTSE 100 and FTSE 250 still in negative territory for the year so far. InterContinental Hotels Group (IHG), which fell by more than 5% on Monday, led the FTSE 100 with a 3.1% gain. The firm operates more than 280 hotels in China and lost a significant chunk of its revenue in 2003 when the SARS virus hit the country. Wealth management firm St. James’s Place and broker Hargreaves Lansdown rounded out the top three in the FTSE 100, gaining around 3% each. In the FTSE 250, Irn-Bru manufacturer A.G. Barr led the way with a huge 15.9% share price jump, after reporting that its 2019 profit will come in ahead of expectations. The company’s share price has been in the doldrums for months, after delivering a profit warning in July last year that initially sunk its stock by 30%.

FTSE 100: +0.9% Tuesday, -0.8% YTD

FTSE 250: +0.6% Tuesday, -2.1% YTD

Stocks to watch

Microsoft: In a week packed with big tech names reporting earnings, Microsoft is one of the standouts. While it has not doubled in value like Apple in the past 12 months, the firm’s share price has been on a steady upward trajectory for the past five years, gaining more than 300% in the process. The company’s Azure cloud business – and how it is stacking up against rival services from Amazon and Google – will be a big focus on its post-market close earnings call today. Out of 34 analysts covering Microsoft stock, 28 rate it as a buy, with none rating it as a sell. The average 12-month price target is $176.43, to its $165.46 Tuesday close.

Facebook: Despite its regular home at the centre of various scandals, whether it be privacy concerns or content policies, Facebook stock has still gained more than 50% over the past year. One question on its post-market close Wednesday earnings call will likely be about how it plans to generate revenue from messaging service Whatsapp. According to Canaccord Genuity analyst Maria Ripps this is a key issue, the business having decided not to go down the advertising route. Again, analysts are heavily in favour of the stock overall, with 46 rating it a buy or overweight, four as a hold and two as a sell. Average 12-month price targets vary hugely, from $342 to $120, versus its current $216.

Boeing: Front and center of Boeing’s earnings call today will be the ongoing 737 Max airliner saga. Investors will be looking for an update on how much the ongoing grounding of the 737 Max fleet is costing the firm, and any financial impact from it suspending production. With the grounding looking to persist into the peak summer travel season, that impact could be substantial. This week, the firm moved to sure up its liquidity by securing $12bn in new loan commitments. Boeing stock is now down 13.3% over the past 12 months, and 9.3% in the past three months.

Tesla: The big question for Tesla on its today’s earnings call will be whether it is sustaining the momentum that has driven its share price up 91% over the past year. A significant part of that has been its expansion in China, so again, any impact from coronavirus is likely to be addressed. Tesla remains one of the most divisive stocks among Wall Street analysts, who are almost evenly split between buy, hold and sell ratings, with 12-month price targets ranging from $200 to $734, versus its current $567. Any update on sales targets, vehicle deliveries, and when already announced new models will hit the market, will be closely watched.

Other large US names reporting today: AT&T, Mastercard, Novartis, McDonald’s, PayPal, General Electric, Mondelez International

Large UK names reporting tomorrow: Diageo, Unilever, BT Group

Crypto corner

While cryptoassets are attracting the headlines today, the outlook this year is very mixed. Many commentators are split on Bitcoin and its peers. Below are three views from experts on what could happen to Bitcoin in 2020.

$16,000: Bitcoin could double in value by the end of the year, Luno Asia head of business Vijay Ayyar told CNBC. Ayyar’s view is that a sustained price run would snowball as the masses poured into the market. He said the target for this price run would be up to around $16,000 by the end of 2020– an increase of over 100% since the beginning of the year.

$50,000: Nexo co-founder Antoni Trenchev has stated that Bitcoin’s price could reach $50,000 by the end of 2020, labelling Bitcoin the “new gold”, he is clearly a firm believer in the value of bitcoin as a safe haven.

$0: Nouriel “Dr Doom” Roubini professor of economics at NYU’s Stern School of Business and the CEO of an economic consultancy firm is a stern detractor of Bitcoin. He has said on multiple occasions that it has no inherent value and that its crash to $0 is inevitable. Roubini believes that Bitcoin has an inherent lack of scalability and is not nearly as decentralised as it claims.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.