Macroeconomic headwinds rock crypto market

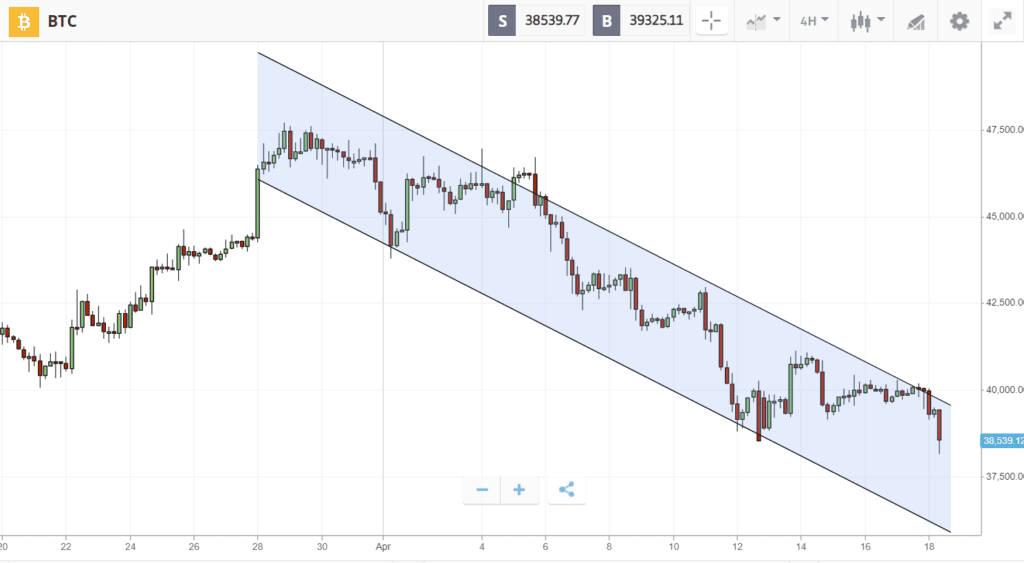

Macroeconomic concerns weighed heavily on the crypto market last week, causing Bitcoin to slide below $40K.

Prices began falling ahead of Tuesday’s consumer price index data (CPI), which failed to assuage fears of runaway inflation by coming in slightly above expectations. Making matters worse, geopolitical risk ratcheted higher on Wednesday as Putin said that peace talks with Ukraine have reached a dead end. This was matched by bad news from within the crypto ecosystem, as an Ethereum developer announced that the transition to Proof of Stake will be delayed for at least a few months.

In the altcoin market, Compound and EOS bucked the downwards trend with more than 3% weekly gains. Elsewhere, ApeCoin swung almost 30% higher before eventually finishing the week lower, and Dogecoin failed to rally — even as its biggest fan Elon Musk implicated the meme coin in his plans to buy Twitter.

This Week’s Highlights

– Ethereum sinks 6% as merge postponed

– Crypto follows stocks down on inflation concerns

Ethereum sinks 6% as merge postponed

Ethereum’s long-awaited switch to Proof of Stake, dubbed “The Merge“, has been delayed.

On Tuesday, Ethereum foundation developer Tim Beiko tweeted that the upgrade won’t happen in June as previously forecast, “but likely in the few months after.”

This is not the first time that the development has been delayed, but Beiko confirmed that it is now in its “final chapter” and strongly suggested “not investing more in mining equipment at this point.”

Crypto follows stocks down on inflation concerns

Although often thought of as digital gold, Bitcoin is trading more like a stock than ever before as the cryptoasset’s correlation with the S&P 500 nears all-time highs.

This close relationship has seen Bitcoin follow stocks down as high inflation figures spread concern about the potential for aggressive US policy tightening. The Fed has already projected a series of modest rate hikes, and there are now growing expectations of more significant action.

Despite rate hikes, eToro Chief Executive Lule Demmissie remains optimistic. She expects that while the interest rate changes may “slow things down in the interim”, both the stock and crypto markets will see a comeback of retail interests.

Week ahead

War in Ukraine, surging inflation, and possible shifts in Federal Reserve policy are the key factors likely to impact crypto markets in the week ahead.

In addition, the coming week will bring the final deadline for US federal tax-filing. This could signal relief for the market, as some commentators have blamed the recent downturn on investors taking profit to pay taxes.

Other significant events include an IMF debate on the global economy, which could see noteworthy comments from Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde.