MakerDAO adds 30% on demise of Terra Luna

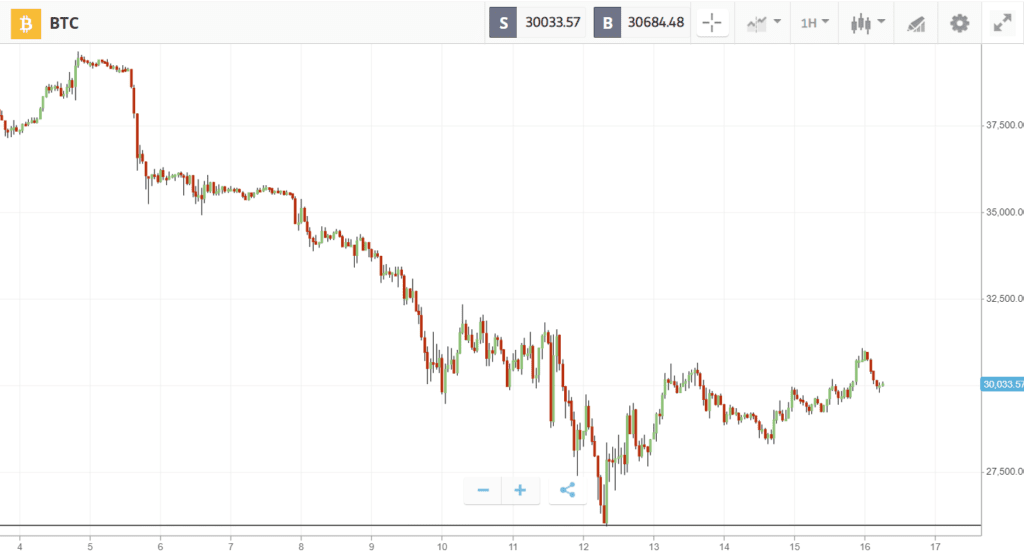

Bitcoin has climbed back above $30K after growing recession fears and the collapse of the third-largest stablecoin drove prices down to $25K.

The drop was triggered by the release of hot inflation data on Wednesday, and deepened by the crisis on the Terra blockchain, which saw the destruction of more than $40 billion in value from stablecoin TerraUSD and associated token LUNA. Combined, these headwinds pushed the crypto Fear and Greed Index to one of its lowest points on the traditionally terrifying day of Friday the 13th.

Luna’s death-defying descent dominated the altcoin action, wiping 99.9% off the coin’s value before the release of a recovery plan helped catalyze a rebound. Most other altcoins were flashing double-digit losses amidst the panic, with the exception of Terra Luna competitor MakerDAO, which added 30% over the week.

This Week’s Highlights

– MakerDAO moves 30% higher on Luna meltdown

– Crypto sinks with stocks as inflation stays close to 40-year high

MakerDAO moves 30% higher on Luna meltdown

In the biggest collapse in crypto history, so-called stablecoin TerraUSD fell far from its dollar peg last week, causing a near-total crash for ecosystem token LUNA.

The meltdown, which is thought to be the result of a Soros-style attack on the Terra ecosystem, wiped out more than $40 billion in a matter of hours. It also caught the attention of US Treasury Secretary Janet Yellen who took the opportunity to urgently call for stablecoin regulation.

Yet as Luna was plummeting to earth, the token of another decentralized stablecoin was mooning: MakerDAO, Terra’s main competitor, jumped 30% on the week.

Crypto sinks with stocks as inflation stays close to 40-year high

Wednesday’s consumer price index data revealed that US inflation was at 8.3% in April; less than March’s 8.5%, but still more than the 8.1% estimate and close to the highest level in more than 40 years.

The data was received badly by both stocks and crypto. Such a small dip was not convincing enough to suggest inflation had peaked, and thus caused widespread concern that the Federal Reserve will need to act more aggressively in tightening monetary policy.

These tightening measures are widely anticipated to have knock-on effects that could potentially tip the world’s largest economies into recession.

Week ahead

The collapse of Terra represents a systemic shock, and some analysts are expecting further volatility as the ripple effects are felt across the crypto market.

Yet after an unprecedented seven weeks of consecutive losses, Bitcoin investors are also looking for signs of a bottom. This would provide relief from the relentless selling that has dominated both stocks and crypto since late March.

In the week ahead, hopes for a crypto rebound could be bolstered by the stock market, which made a convincing resurgence late last week.