Altcoins see lackluster week as major cryptoassets drift sideways

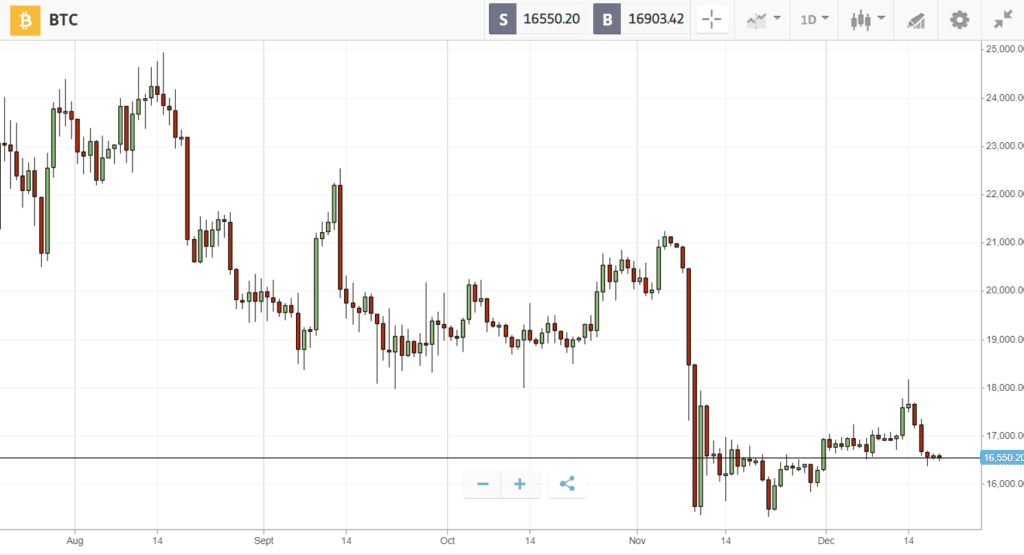

After a week of economic turbulence and exchange rumors, Bitcoin returned to its favorite perch at $17K ahead of the Christmas holidays.

November’s inflation reading came in lower than expected last Tuesday, sending Bitcoin briefly above $18K on expectations that the Federal Reserve would pause interest rate hikes in 2023. The rally couldn’t last however, with prices then falling on Wednesday as Fed chair Powell emphasized the need to continue the battle against inflation. At the same time, rumors about crypto exchanges helped curb any bullish momentum.

While Bitcoin showed resilience against these headwinds with only 2% weekly losses, many altcoins fell much further: Cardano sank 14%, Dogecoin dropped 10%, and Litecoin was one of the biggest losers at 16% down.

This Week’s Highlights

– Banks call for end to crypto winter in 2023

– Regulatory concerns cast shadow over market

Banks call for end to crypto winter in 2023

Although winter winds continue to chill the crypto market, recent comments from banks and investment managers reveal expectations of a thaw in the new year.

Analysts from JP Morgan suggest that Ethereum will be rejuvenated by the Ethereum Surge, which is expected to act “as a catalyst for development in the cryptocurrency markets” and increase blockchain use cases. This upgrade is expected in the next six to twelve months.

Other major financial institutions have identified different bullish catalysts, with Bank of America saying that “an increased urgency for regulation may enable greater institutional engagement”, and VanEcK claiming that Ethereum, Polygon, Avalanche, Polkadot and Cosmos are set to emerge as the winners of the next major wave of institutional adoption.

Regulatory concerns cast shadow over market

Regulatory uncertainty continues to plague the crypto market, as a pair of US senators push for a bill that is widely perceived as an attack on freedom and privacy,

If passed into law, the Digital Asset Anti-Money Laundering Act would bring know-your-customer rules to blockchain infrastructure providers and participants operating in the United States, including self-custodial wallet providers.

As such, the bill has been criticized for proposing unconstitutional surveillance requirements, but according to some commentators, it’s very unlikely to become law.

Week ahead

As the aftermath of the recent exchange collapse continues to play out with the arrest of key figures, Bitcoin looks set for a quiet Christmas.

Yet before crypto investors can fully relax, there is one last key economic data point due on Friday: the US PCE price index, which is the Fed’s preferred measure of inflation.

This data is expected to show that inflation rose 0.1% in November, and anything less than this could trigger a rally for both stocks and crypto.