Apple recently announced it would end its relationship with chip designer Imagination Technologies. Shares in the UK firm promptly fell off a cliff, from 165p to 103p in a single day, reducing the company value from around £765m to £250m. It was a harsh and timely reminder that the big boys of tech – Apple, Amazon, Google and the rest – hold enormous influence over the fortunes of other businesses, and stock, in the sector.

But while these tier 1 companies, all of which feature in our BigTech CopyFund, dominate the headlines, there are many exciting businesses beavering away in their wake that may present excellent opportunities for traders and investors. Here we take a look at five tech stocks currently living in the shadow of the big boys that are well worth keeping an eye on.

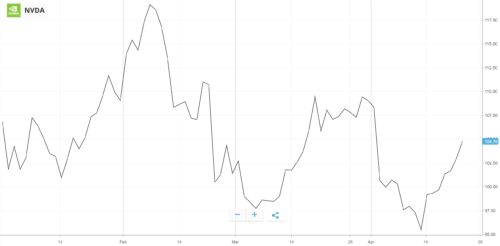

Nvidia (NVDA)

The GPU (graphic processing unit) manufacturer has become a starlet of machine-learning technology. Nvidia stock has rocketed this year with many companies now using its products, including Google’s parent company Alphabet, and Facebook, who have publicly declared that in “leveraging Nvidia’s Tesla-Accelerated Computing Platform, Big Sur is twice as fast as our previous generation.” Has it hit its peak, or is there room for another prolonged surge?

LAM Research (LRCX)

Another firm closely associated with the chip-making industry, LAM has built up an impressive customer list, including Samsung, Amazon and Spotify, Their flash memory products are also used in iPhones, Macbooks, fitness trackers and Tesla cars.

LAM stock has had periods of big price increases this year and some believe it can be volatile due to the cyclical nature of big-brand product releases, making it potentially attractive to short-term traders with a lot of tech industry knowledge.

Palo Alto (PANW)

Cybersecurity is another fast-growth area since the big boys of tech have increasing budgets for the best software and systems that will help protect their products and ultimately their customers. Palo Alto Networks produce next-generation firewalls and demand is strong with the company expecting to see revenue increase by 31% in the next fiscal year. Much like LAM and its relationship with product releases, cybersecurity budgets can also go through cycles which may add an element of volatility to the Palo Alto stock price.

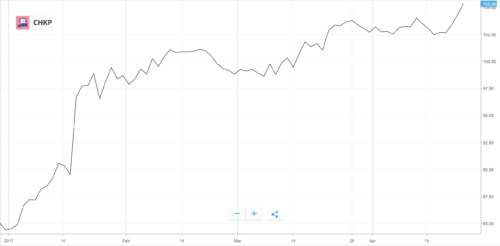

Check Point Software (CHKP)

Elsewhere in cybersecurity, a quieter cousin to the much-fancied Palo Alto is Check Point Software Technologies. Founded in Israel in the pre-dotcom-boom 1990s, Check Point has enjoyed steady, robust growth for a number of years. Some pundits see it as a well-priced, mid-sized business with good potential for further growth.

MercadoLibre (MELI)

Sometimes cited as ’the eBay of Latin America’, MercadoLibre has delivered consistent growth in recent times. The company operates in a region that eMarketer believes could double in terms of e-commerce sales over the next few years, from $40 billion in 2015 to $80 billion in 2019, so there may be much more to come.

*This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation.

*Past performance is not an indication of future results. All trading involves risk. Only risk capital you’re prepared to lose.