Good morning everyone,

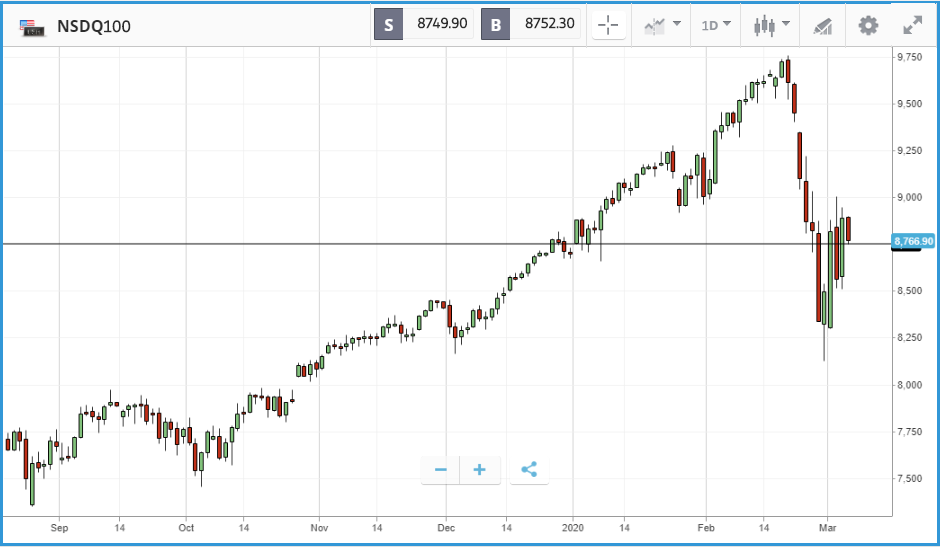

While the coronavirus epidemic was still very much front of mind on Wednesday, Joe Biden’s Super Tuesday surge in the race for the Democratic nomination drove markets higher. Previously, Bernie Sanders’ former status as the frontrunner had Wall Street worried, given his tough policy stances on taxation and promises to reform the financial sector. But Biden’s unexpected surge meant that, for the second time this week, the major US indices turned in a 4% plus day, although they still remain below their pre-sell off peak.

Healthcare stocks were the biggest winners on Wednesday, as one of Sanders’ core policies is a nationalised healthcare system. UnitedHealth, Cigna, Centene, Humana and Anthem all finished the day with double-digit gains and were the top five performers in the S&P 500. Investors were also digesting epidemic response headlines, including the US House of Representatives passing $8bn in emergency spending to combat the epidemic, and the International Monetary Fund announcing $50bn of funding for countries hit by the virus. As markets rallied and virus concerns eased off marginally, the US Treasury yield climbed back from record lows, creeping up past the 1% mark, while gold also dipped marginally to $1,637.

Asian shares also initially rebounded sharply, with the Hang Seng up 2% and the Nikkei closing up 1.1% as the wave of policy responses from central banks this week provided a boost to confidence. However, the volatility continues with these gains beginning to reverse in the futures market. European shares have now begun to give up gains and the three main US bourses look set for a 2% softer open at time of writing. Italian schools and universities are all closed, California has declared a state of emergency and increasingly company updates are coming in with coronavirus caveats, warning investors on impacts to revenues as a result.

OPEC to talk production cuts in Saudi Arabia

Saudi Arabia is expected to petition for additional production cuts in today’s meeting, hoping to get members to agree to reductions of up to 1.5m bpd for Q2 and maintain the existing 2.1m bpd cuts until year end. OPEC members will then look to seek support from the wider OPEC+ group, which includes Russia, tomorrow. Oil prices have been severely hit by reduced demand from China as a result of the coronavirus outbreak.

ITV beats estimates but shares sink

UK-listed broadcaster ITV, whose shares are currently down 9% after the firm announced that advertising revenue could drop up to 10% in April due to the coronavirus. Much of the drop is down to travel companies deferring advertising. The headline numbers were actually ahead of analysts’ estimates but this wasn’t enough to stop the selling pressure this morning. The shares had staged a miraculous recovery in the second half of 2019, rising 50% from lows, but they have now given up almost all of these gains, trading just 2p above the 2019 floor, which itself was a price last seen all the way back in 2013.

Nasdaq Composite back in positive year-to-date territory

Although it delivered the smallest daily gain of the three major stock indices, at 3.9%, the Nasdaq Composite crossed back past the positive year-to-date threshold on Wednesday. This may be short lived as the index flirts with going negative again for the year this morning and investors should expect some selling at the open.

Pharmaceutical names including Vertex Pharmaceuticals and Regeneron Pharmaceuticals were among the stocks that drove the Nasdaq higher, but chipmakers Advanced Micro Devices, Nvidia and Micron Technology also had a big day, gaining 7.2%, 7% and 6.7% respectively.

Of the three, Nvidia has had the strongest 2020 so far, gaining 13.5% over the past month and 21% year-to-date, despite the chaos. The Dow Jones Industrial average gained the most of the three indices at 4.5%, taking its year to date loss to 5.1%. All 30 stocks in the index delivered a positive day, with Boeing the only firm to deliver a sub-1% gain. In corporate news, United Airlines became the first US carrier to cut back on the number of domestic flights it is operating due to a decline in demand stemming from the ongoing epidemic. United’s share price still climbed 2% after the announcement, but this lagged the 5% and 3.8% gains posted by Delta Air Lines and American Airlines.

S&P 500: +4.2% Wednesday, -3.1% YTD

Dow Jones Industrial Average: +4.5% Wednesday, -5.1% YTD

Nasdaq Composite: +3.9% Wednesday, +0.5% YTD

Flybe goes under and TUI gets relegated from FTSE as virus takes its toll

It was a tamer day in London markets compared to the US, but the FTSE 100 still turned in a 1.5% daily gain, taking its year-to-date figure to -9.6%. The index was led by consumer goods firm Reckitt Benckiser, Vodafone and Morrisons, which all climbed by more than 4%. The FTSE 250 faced a tougher day, gaining 0.3%, with names including Restaurant Group and William Hill among the biggest fallers. However, the headlines were focused on the travel sector. TUI, the travel firm which has seen its share price tumble sharply amid the crisis, was relegated from the FTSE 100 after hours as part of the index’s quarterly reshuffle. Meanwhile, airline Flybe was forced to enter administration due to a slump in bookings caused by the epidemic, with more than 2,000 staff now facing an uncertain future. While the company is not publicly traded, its demise demonstrates the trouble that firms already struggling before the crisis may now find themselves in. The UK also reported on Wednesday that its total number of confirmed coronavirus cases has hit 87, an increase of 36 versus Tuesday.

FTSE 100: +1.5% Wednesday, -9.6% YTD

FTSE 250: +0.3% Wednesday, -9.8% YTD

Stocks to watch

Costco: Wholesale retailer Costco’s Thursday earnings are one of the highlights of the week, after a major year for its share price despite competition from online only rivals. The impact from supply chain disruption is likely to be a point probed by analysts on the company’s earnings call. During Target’s earnings yesterday, analysts quizzed company management on their contingency plans for supply issues. Subscriber growth and renewal rates are a key metric to watch for with Costco, which makes a chunk of its money through subscription. Wall Street analysts are anticipating an earnings per figure of $2.06.

Kroger: Another retailer reporting its latest quarterly earnings update on Thursday is supermarket giant Kroger, which this week was forced to limit purchases of sanitisation, cold and flu-related products due to heavy demand driven by the epidemic. Again, any virus-linked disruption is likely to be a feature of the company’s earnings call. In its Q3 update, Kroger missed earnings expectations with a $0.47 earnings per share figure, and investors will be watching closely for any underperformance this quarter given the tight margins in the grocery segment the firm operates in. Currently, nine analysts rate the stock a buy or overweight, 11 a hold and one a sell, with Warren Buffett’s Berkshire Hathaway having bought a $550m position in the firm this year.

Okta: San Francisco-based Okta provides identity verification systems that help companies manage and secure user authentication; it reports its Q4 earnings on Thursday post-market close. The $15.9bn market cap firm has gained more than 60% over the past year, even including the recent sell-off, driven by major revenue gains on the back of new customer wins. The company has posted a loss in the past four quarters, and the bar is high in terms of the numbers it will need to deliver to keep investors happy. Analysts are projecting a $0.05 per share loss for the fourth quarter.

Crypto corner:

Cryptoassets continue to remain stable amid the surge in volatility in equity markets, with the all three trading in a narrow trading range over the last 24 hours.

Bitcoin is through the $9,000 mark, up 4% this morning at $9,118, while Ethereum and XRP have also made similar gains up 4.5% and 2.9% respectively.

A very significant breakthrough for the blockchain industry came yesterday in the form of India’s supreme court overturning the ban by the country’s Central Bank on digital currencies. Crypto companies (including exchanges) can now get banking services in India. This follows a previous statement by the Reserve Bank of India giving Indian banks three months to cease dealing with any entity involved with digital currency. For such a populous country to seemingly close its doors to crypto as a whole seemed almost inconceivable, but now firms can benefit from the innovation that blockchain provides.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.