Hi Everyone,

One question that investors constantly have to deal with is how much of the value of an asset is based on hype and how much on solid fundamentals?

Not that there’s anything inherently wrong for paying more for hype. For example, I’m more than happy to pay $100+ for a pair of Nike shoes when their competitors of equal quality are usually much cheaper.

In the crypto market, a lot of the valuation for specific coins is based on hype as the more well-known networks tend to attract more participants, more usage, and more investments.

It’s always a bit funny to me when this happens in the stock markets though. For example, Tesla Motors is currently trading at a higher valuation than Ford even though Ford earns 7.5 times the amount of money.

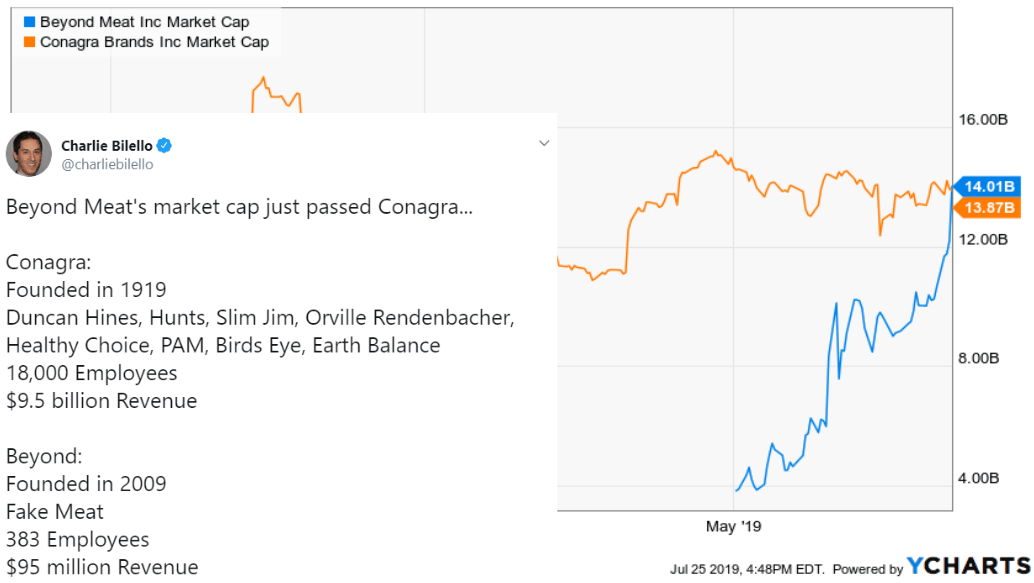

Yesterday, stock analyst Charlie Bilello pointed out that Beyond Meat’s market cap surpassed that of Conagra Brands, a company that is responsible for producing many popular food brands and outranks Beyond Meat in virtually every metric.

Certainly, there’s something to be said about impact investing and that investors these days want to support brands that they believe in but my takeaway from all this is that there is still plenty of money to be made in this market for those who know how to do their homework.

eToro, Senior Market Analyst

Today’s Highlights

- Europe Deteriorating

- Earnings and Growth

- Hype-r-crypto

Please note: All data, figures & graphs are valid as of July 26th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

You can’t always get what you want seems to be the sentiment that Mario Draghi brought to the markets at the European Central Bank’s landmark meeting yesterday. Or at least, I can’t necessarily give it to you.

Economists who were largely expecting an overly dovish Draghi were left choking on the fishbone as the ECB came out extremely non-committal about further monetary easing saying that sovereign central banks and governments should be doing more to stimulate their own economies.

German Finance Minister Olaf Scholz was quick to react to Draghi’s speech in a televised interview with Bloomberg’s Matt Miller.

It seems that Draghi’s comments were so astonishing that it even affected the outlook in the USA as investors quickly downgraded their forecast for a rate cut this coming Wednesday.

Not that they won’t cut. They will. But the perception that they might cut by 0.5% instead of 0.25% seems to have dissipated.

With everything going on, it’s quite fascinating to see the Euro/Dollar rate so stable. Check out this picture-perfect tight trading channel.

Growth and Profits

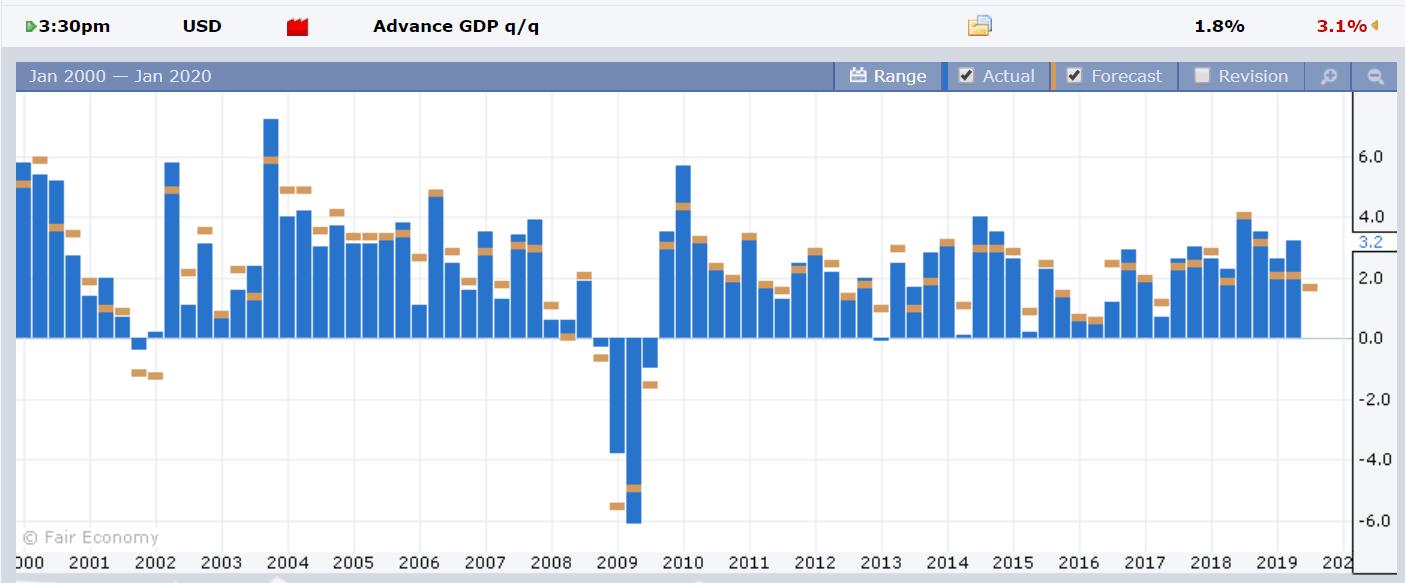

In a few moments from the time of this email, the United States will be delivering their print for Advanced GDP in the 2nd quarter. As you can see from the gold bar on the right, analysts are expecting the weakest number since April 2017.

Also worth noting the earnings reactions for the gargantuan companies.

Google’s stock is expected to open 9% higher at the opening bell after smashing their earnings per share estimates and Amazon is expected to open about 2.5% lower because revenues for their AWS service only grew by 37%.

Hype-r-crypto

With volumes and volatility still low in the crypto market we can probably expect a fairly uneventful weekend. However, a low liquidity environment like we’re seeing now often leaves the market vulnerable as any large orders, buy or sell, can have a larger impact on prices.

For your entertainment this weekend, I am proud to share a particularly amusing Blockchain on Booze panel that I had the pleasure of participating in yesterday where we discussed specifically the hype currently going around the crypto markets among other things.

Watch it now: https://blocktv.com/watch/2019-07-26/5d3a9c2477d86-the-panel-where-crypto-and-blockchain-meet-booze

Feel free to always add to the conversation by sending me your thoughts and questions at the social media links below.

Have a fantastic weekend.

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/matigreenspan

LinkedIn: https://www.linkedin.com/in/matisyahu/

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.