Hi Everyone,

The crypto market has come a long way in the last year, continuing to develop throughout the crypto winter and now into Spring.

In fact, looking at how it’s developed it almost seems like this is an entirely different market. An extensive research paper was published by Binance over the weekend that explores the crypto environment’s evolution.

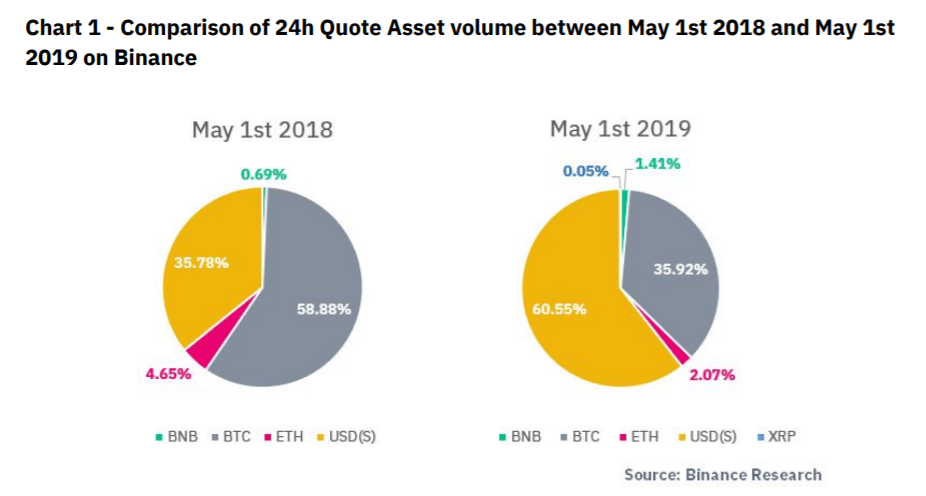

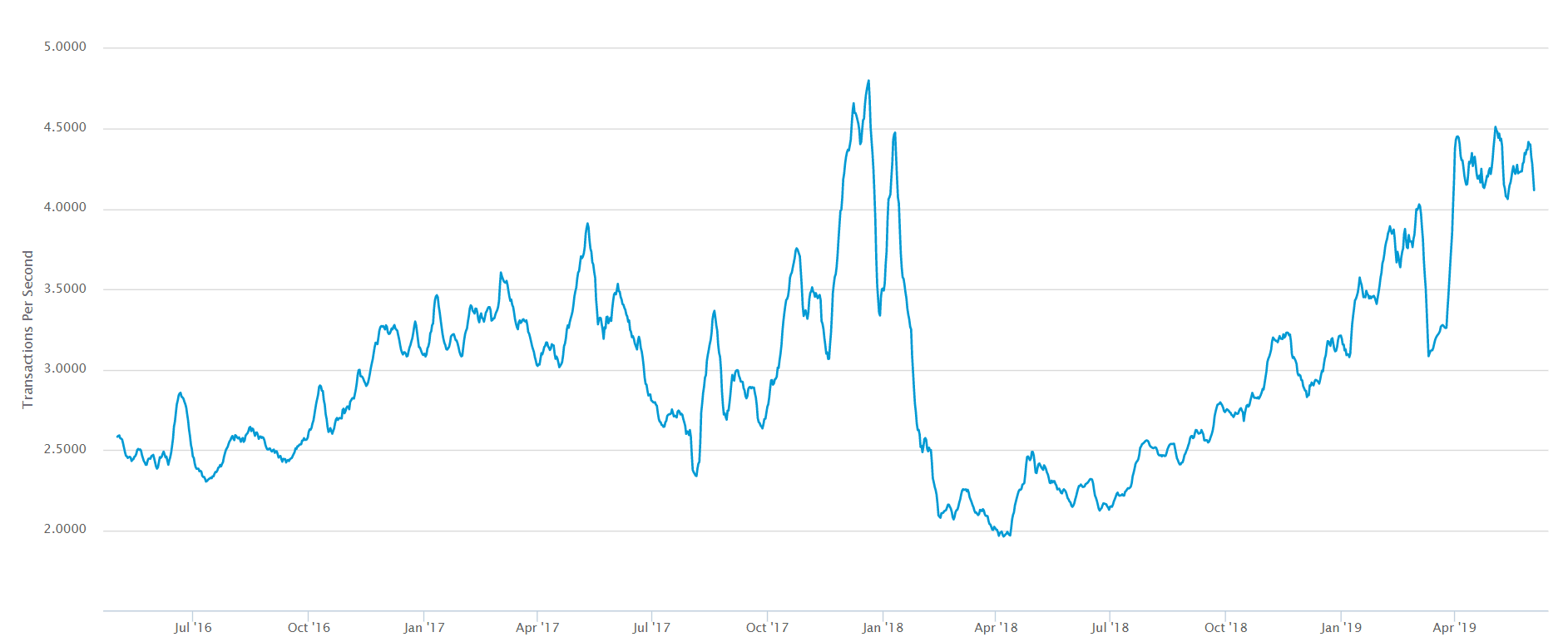

Here’s one of the key graphs highlighted in the report…

As you can see, stablecoins are basically eating the market share of crypto volumes going from about one-third to about three-fifths of total volumes in just 12 months.

This fundamental change in the market seems to be paving the way for mainstream adoption of cryptoassets by financial institutions, who according to the report only represent an estimated 7% of the crypto market at the present time but who have every reason to increase their activity going forward.

These findings seem to support our recent assumption that it is mostly people who are already familiar with the crypto industry who are responsible for the recent price recovery. We haven’t seen much increase in newcomers or institutions as of yet, only speculation that they will come soon. With all this new infrastructure, they just might.

eToro, Senior Market Analyst

Today’s Highlights

- Worst May Ever

- Who is Driving Cars?

- Best May Ever

Please note: All data, figures & graphs are valid as of June 3rd. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

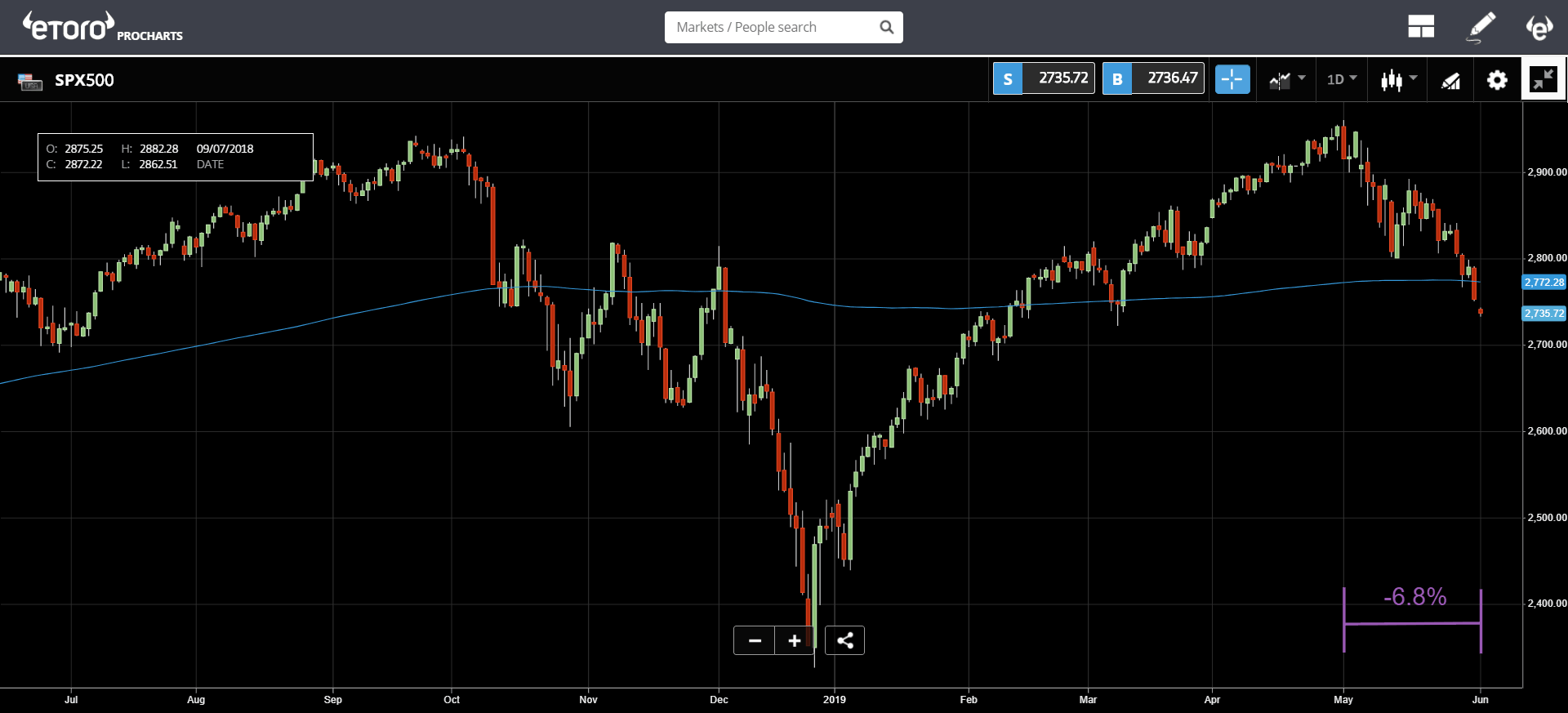

The stock markets are just coming off the worst month of May in seven years. Yet another indication that it pays to diversify.

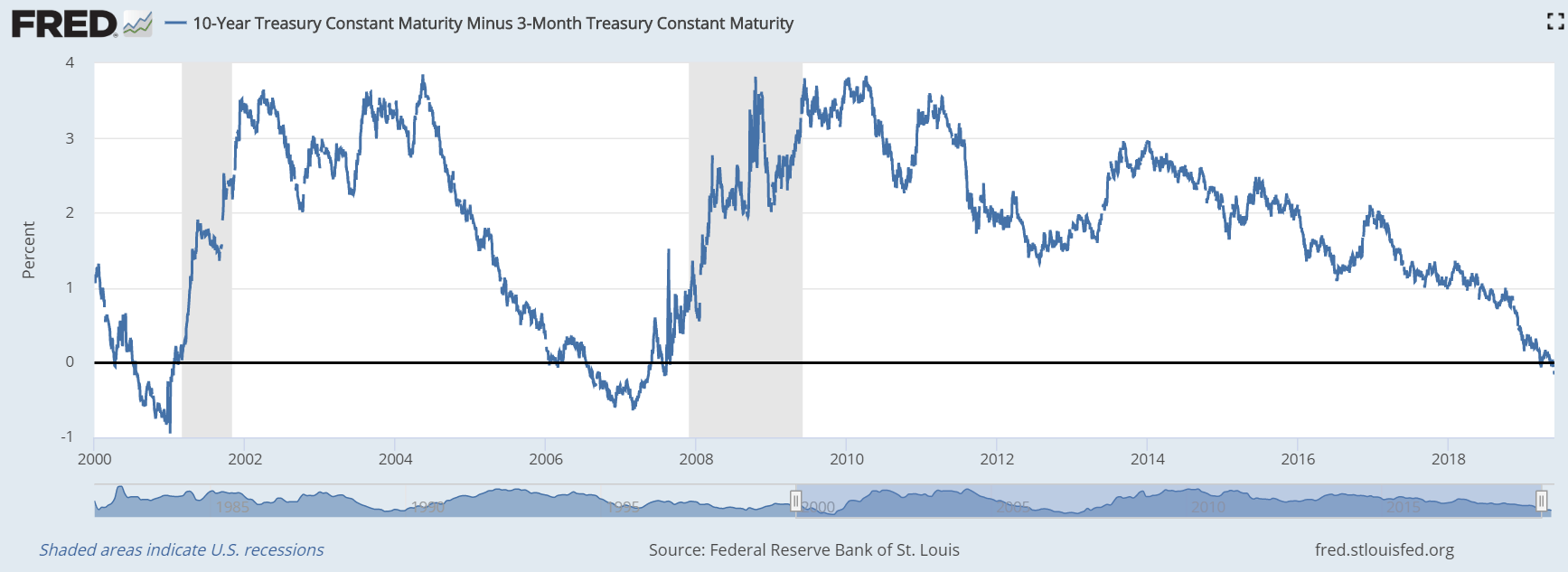

Global investors right now have their eyes firmly on the bonds market. Recently an inversion of the yield curve has put many on edge as the difference between the US 3 month treasuries and the 10 year treasuries has gone negative for the first time since 2007.

This is a very strong indication that a recession could be coming.

What’s Driving Automotive prices?

The feeling is that the biggest fears emanating from the market at the present time are around possible geopolitical risks.

For example, Trump’s proposed tariff’s on Mexico that he sprang on the markets last week seems to be affecting more than just avocados today.

President Trump will be in Europe throughout this entire week, starting out with a state visit to London and brunch with the Queen, and ending up with his good friend Emanuel Macron on Friday.

In addition to the political tensions, we also have a full economic calendar this week. Chinese PMI numbers managed to dodge scrutiny this morning and the US will have their own PMI’s out after the bell. We also have central banks talking at us. The Fed’s Jerome Powell will speak tomorrow, the Australian RBA tonight, and an ECB meeting on Thursday.

To top it all off is the US Non-farm payroll announcement this Friday. Fun times.

Crypto Section

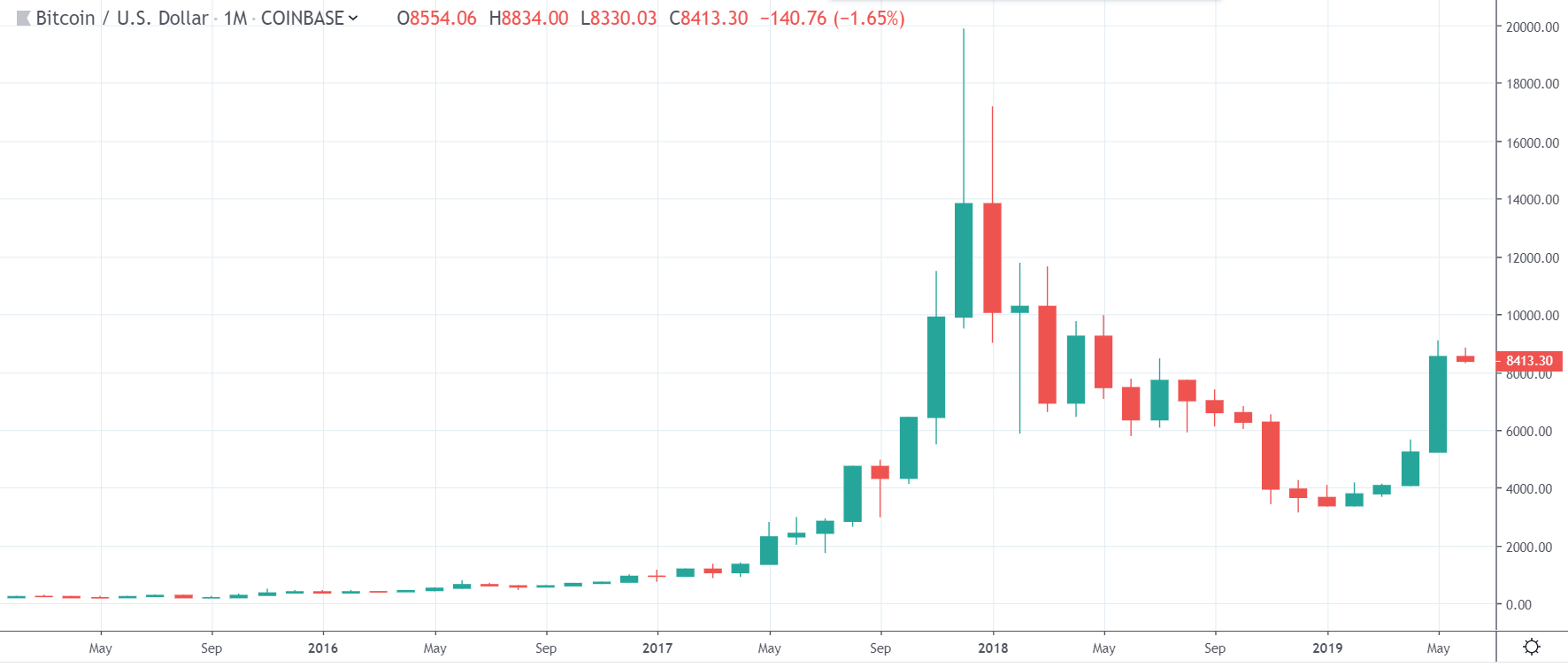

All things considered, the crypto market looks pretty stable at the moment. Cryptoasset prices have outperformed everything in the first half of the year, with many coins seeing more than 100% gains.

Just like the stock market has had it’s worst May in 7 years, bitcoin has had its best May ever.

It will be quite a task to continue this momentum but in the crypto market, this not only seems possible but it does look like many are even counting on it.

At this point, some of the momentum that we saw before is tapering off. Volumes across the industry are still elevated but seem to have dissipated over the last week or two. Transactions on the bitcoin blockchain are telling a similar story.

Even the ADX indicator that we highlighted last week has dipped as low as 49 today, which still indicates a strong trend, just not as strong as before.

Don’t get me wrong. Even a bit of excitement at this point has the potential to snowball into an upward breakout as this is a market on edge. But do please be prepared for the possibility of a pullback after such a strong surge as we saw in May.

Have a fantastic week ahead!

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/matigreenspan

LinkedIn: https://www.linkedin.com/in/matisyahu/

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.