Hi Everyone,

Sometime between the time that I’m writing to you and the time that you received this message, the European Central Bank (ECB) will deliver its monetary policy outlook.

Now, I could try and guess what they’re going to say at this meeting but frankly, I don’t have a clue, which is a shame because the actions they take today will affect millions of people.

Today’s Highlights

- Mexico’s Loss

- Russia’s Gain

- Crypto Junction

Please note: All data, figures & graphs are valid as of June 6th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Despite Mexico’s best efforts, a deal has yet to be reached to stave off tariffs on their US-bound exports. Talks continue, and Trump is aware that Mexico wants to make a deal, but at the moment he’s overseas.

Meanwhile, President Xi Jinping is over in Russia visiting his “best friend” Vladimir Putin. If there’s a clear winner in the US-China trade war, it’s definitely Russia. Talks between the two reportedly include efforts to promote trade settlements in Yuan and Ruble rather than US Dollars.

We’ve been discussing the de-dollarization trend in our emails a lot over the last few months and this is the biggest official step towards this agenda by far.

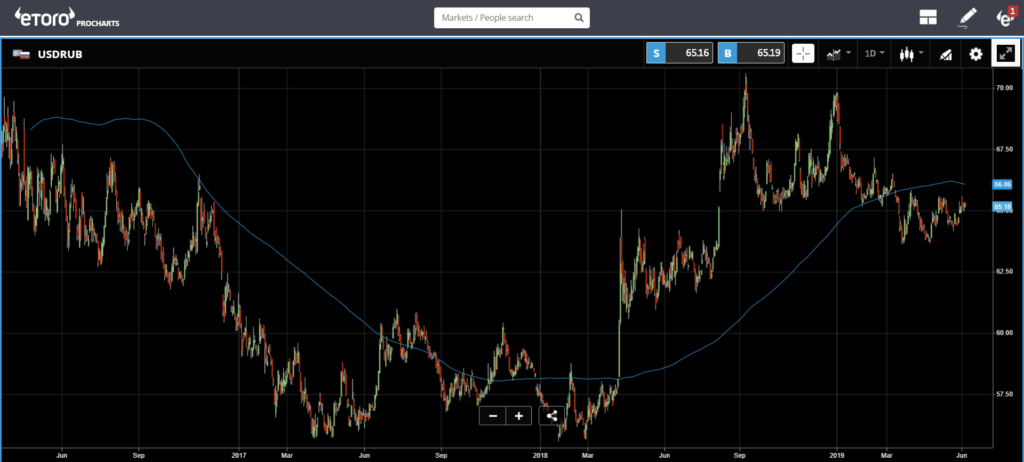

Normally, this would be a very Ruble positive update. Selling the US Dollar against the Ruble is an interesting play because it carries a positive rollover.

But, looking at the USDRUB chart it’s clear that we’re well off the highs.

Crypto Juncture

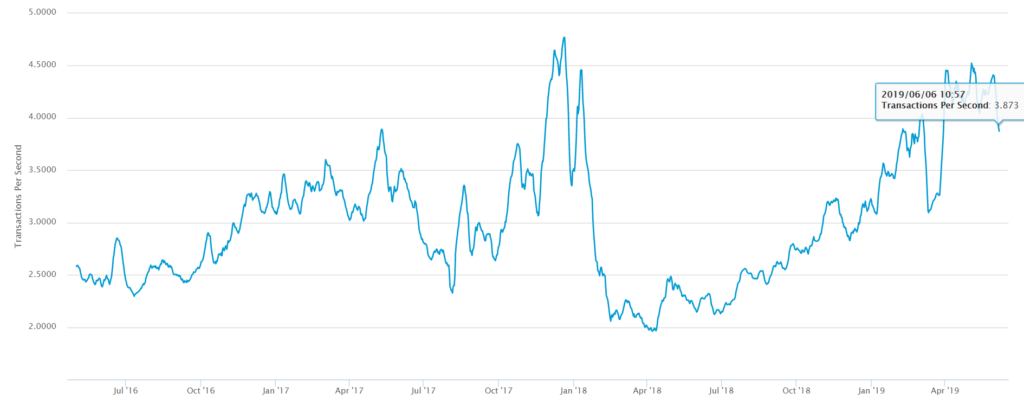

The crypto market seems to be at a critical juncture this morning. At this point, volumes are less than half of what they were during the mid-May surge but still more than double what they were before the April 2nd spike.

The bitcoin blockchain has cooled down as well and is now back below 4 transactions per second.

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.