September is here. It’s time to go over your portfolio and check if you need to make some adjustments to your copy strategy.

Let’s begin with the first part – reviewing your portfolio:

1. Check your stats. See if you’ve achieved positive gain since you started copying. Compare the Popular Investors to find out who has gained you the most, and on the other hand, consider changing the ones who have diminished your capital.

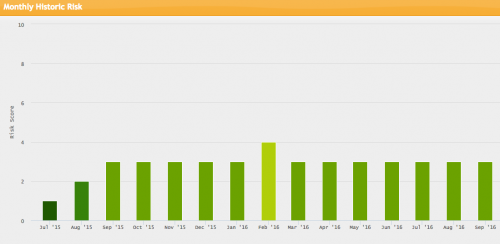

2. Check your risk score and ask yourself if it fits your risk appetite. It not, find a Popular Investor that better suit your risk preference.

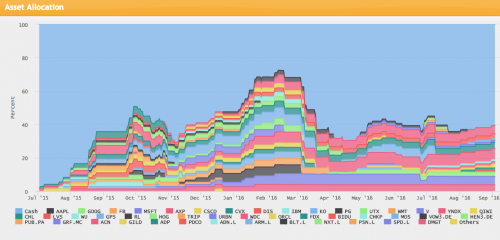

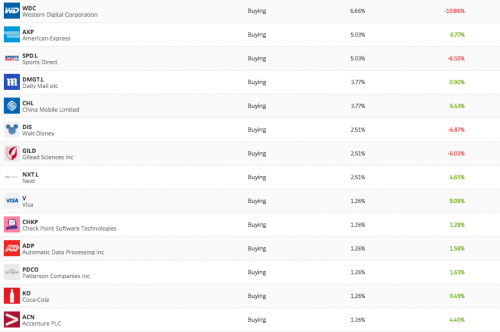

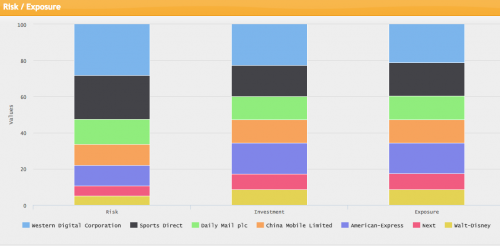

3. Go over each user who you are copying and compare the strategies and assets that they are using. If your portfolio is not diversified enough, consider a change to your copy allocation.

Now, after you have finished analysing your smart portfolio, I’m happy to share with you an excellent example of what it means being a Popular Investor.

Meet Claudio Lugini, from Italy – AKA @EquitiesFund, who has joined eToro around Jul 2015 and started investing in stocks.

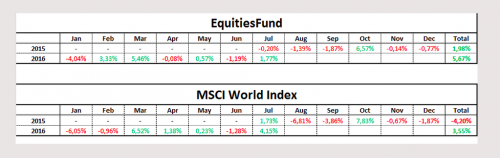

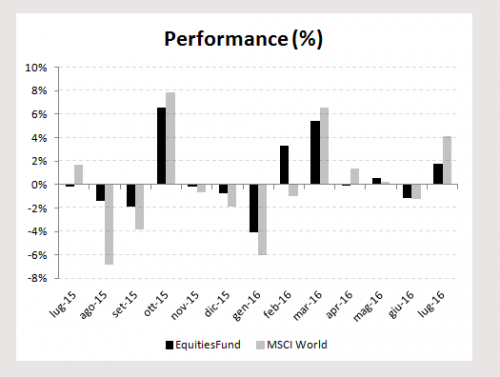

He has a great asset allocation of stocks with low risk and positive gain since he joined our platform.

Have a look at his website and what he wrote on his eToro wall: