Hi Everyone,

There’s been much debate regarding what might be the impact of Wall Street’s bitcoin futures market on the actual price of bitcoin.

Some contenders will say that the introduction of the futures contracts on the CME and the CBOE in December 2017 actually kicked off the crypto winter while others view the timing as more of a coincidence as volumes were not very high at that time. Well, today we might get a bit closer to understanding this dynamic.

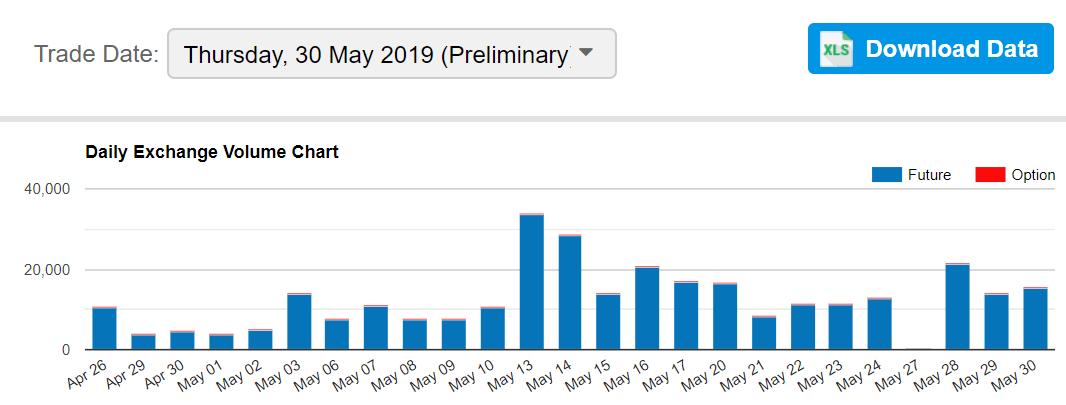

The CME bitcoin futures contract for May is set to expire at 4:00 PM in London today and, with more than $8 billion worth of volume traded so far, it’s going to be the biggest one ever.

To be clear, the contract expiration itself will not have any effect on the price whatsoever. As we’ve discussed, these contracts are cash settled. So, the way it works is that two traders bet against each other. Then at the time of expiration, the loser pays the winner the difference. So no BTC actually exchanges hands here.

What could affect the price though are hedge positions. Traders on the CME could be hedging their positions with real BTC holdings elsewhere. This tactic could especially be employed by market makers who provide bitcoin to their clients. Many of them will likely choose to roll the position over to a later contract but some might just choose to realize those positions.

Though the contracts expire today, final settlement isn’t until Monday. Whatever happens, it should be an interesting weekend.

eToro, Senior Market Analyst

Today’s Highlights

- Avocado Spike

- GDP & Rates

- Off the Chain

Please note: All data, figures & graphs are valid as of May 31st. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Yet again, President Donald Trump displayed his ability to move markets with a single tweet. This time his victim was Mexico.

So for those of you who thought, the US-Mexican negotiations were over, think again. The Mexican Peso saw a rather violent spike following the unexpected announcement.

(Remember USDMXN tracks Dollar strength. So upward movement means a weaker Peso.)

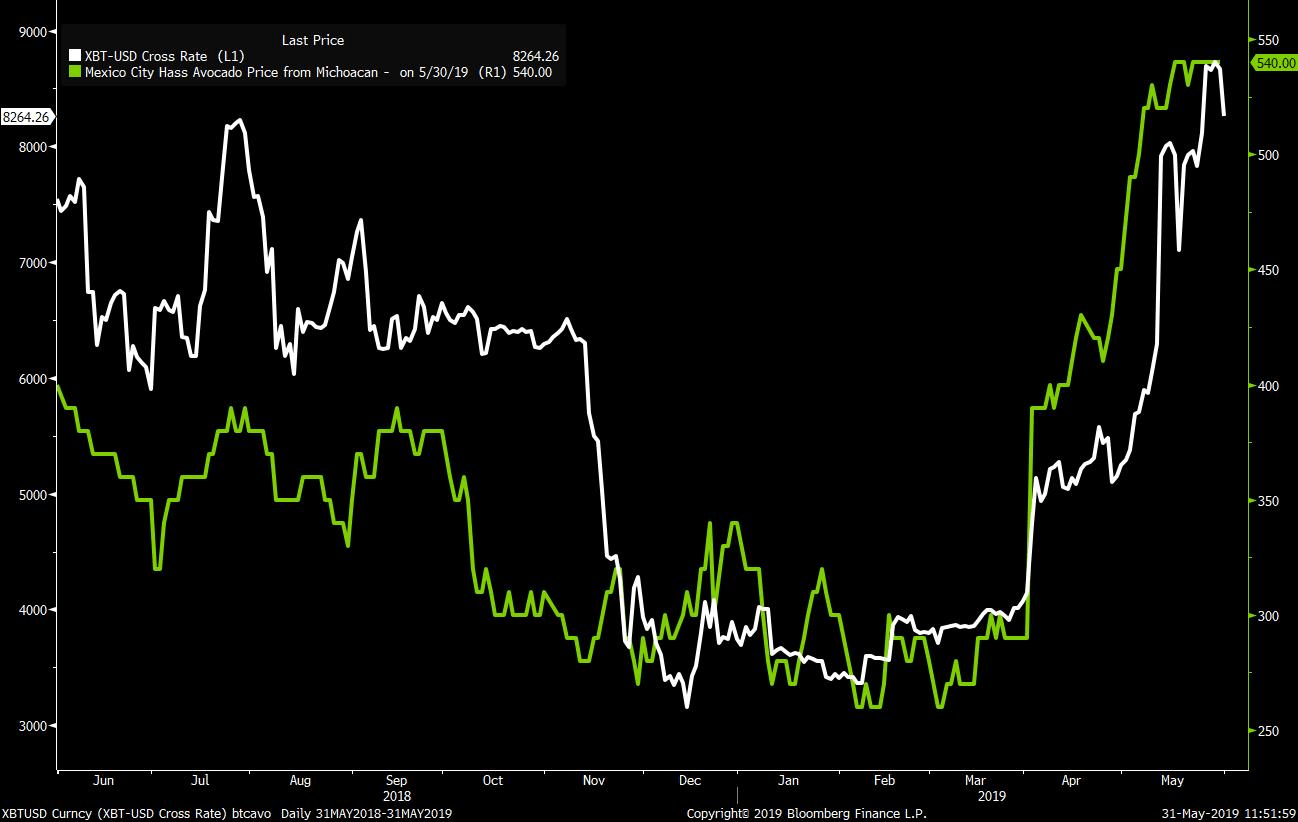

Also, the price of avocados in the US has been surging. The correlation between the green fruit and bitcoin is simply striking.

State of the Economy

The US GDP figures came out slightly better than expected. Yet another sign that the American economy is quite strong at the moment.

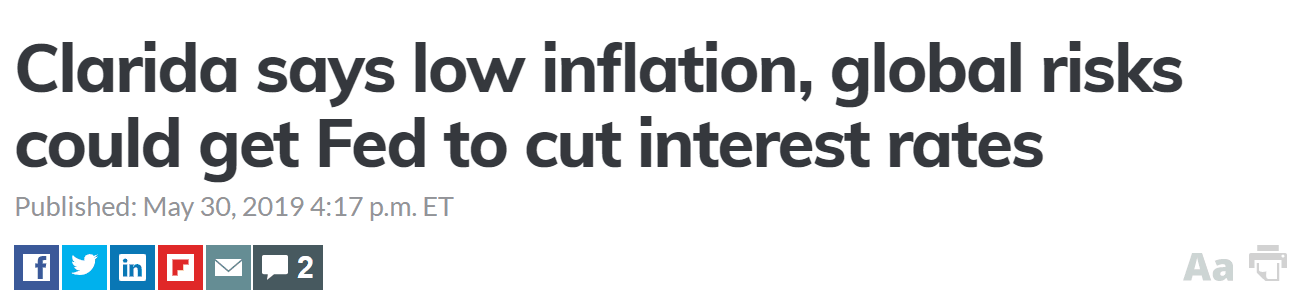

Still, the Fed seems to be preparing for a rate cut, which is weird because usually they try to raise rates when the economy is doing well. Speaking to the Economic Club of New York, New York, New York, Fed Vice Chair Richard Clarida outlined the case for a cut.

Seems like the central banks are bending over backward to show the markets that during these times of strife. This is likely the reason that things have been so incredibly stable lately.

Off the Chain

For a few brief and glorious moments yesterday, bitcoin breached $9,000 a coin. As we know, the bear market is now over and the crypto season is now spring.

Here’s an interview I did with BlockTV, where I explained why Spring is the best season, among other crypto related topics, including how I came to the conclusion to include IOTA in my portfolio.

Looking at the chart, we can see that the post 9k pullback was indeed significant and did serve as a bull trap for some. The aggressive upward trendline (yellow) that we’ve been tracking is now broken.

Of course, every analyst draws their lines a bit differently. Technically, we could redraw the yellow line to include yesterday’s price action but I don’t feel that would be completely fair.

In any case, we’re currently (as of this writing) holding at the key psychological support of $8,000 per coin. If that does break to the downside the next major resistance is at $6,400.

For this weekend’s entertainment, I really brought something special for you. I’ve always admired the leadership skills of our CEO but in his recent podcast with crypto legend Anthony Pomplioano, I was able to get some excellent insight into Yoni’s history and how he sees the future.

Enjoy —> Off the Chain with Yoni Assia & Anthony Pompliano

Bang bang! Have a great weekend!

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/matigreenspan

LinkedIn: https://www.linkedin.com/in/matisyahu/

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.