Hi Everyone,

The market focus going into last week was shifting from the US-China trade war to the Fed and the monetary policy of other central banks. The central banks were acting in response to weakening global economic conditions and an inverted yield curve. This set the tone for the market to become tunnel-versioned as the hour of Fed Chair Powell’s Jackson Hole speech drew near. Even the build-up to the G7 took a backseat. However, on Friday two hours before the speech, China stunned markets with an announcement that they would levy retaliatory tariffs on US products. This led to an immediate shift in risk sentiment from a market that had been relatively static to a flight to safety and risk aversion. Market opinion became divided at this point with some focus shifting back to the Jackson Hole event and a squeeze of short positions. Fed Chair Powell’s speech created whipsaw price action, as he mainly painted a dovish picture, citing higher risks, leading to a market rally. Investors were looking for a commitment to a September rate cut but the lack of any mention of such an event built up some negative sentiment, creating market churn.

Link: CNBC Article

The Day Ahead

Key economic data releases for today include: Japan’s July services PPI, China’s July industrial profits, and Germany’s final Q2 Gross Domestic Product. In the afternoon we will get the US house price index, along with the Richmond Fed manufacturing index for August and consumer confidence figures.

Alternative view – a word of caution

Link: CNBC Article

Traditional Markets

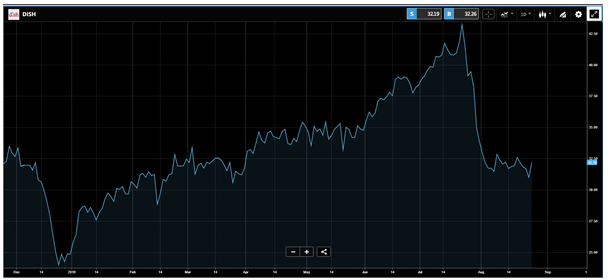

Dish Network Corporation (DISH) – Shares rose 3.9% on Monday after Raymond James upgraded the stock to “strong buy” from “market perform”. Raymond James said “it is an opportune time to buy” as Dish is poised to become a wireless carrier if the current merger agreement between Sprint and T-Mobile survives a challenge from a group of states.

Beyond Meat (BYND) – Shares of the plant-based meat company jumped 5.6% following the announcement that KFC will start testing its plant-based chicken in an Atlanta restaurant. Beyond Meat shares are up 487% since its initial public offering and stocks in Yum! Brands, valued at $35.3 billion, are up 26% this year.

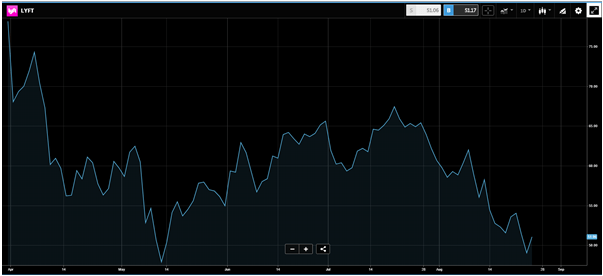

Lyft (LYFT) – Shares of in the transportation network rose more than 4% after Guggenheim upgraded the ride-hailing company to buy and set a $60 price target, citing profitability as soon as 2021. Guggenheim said Lyft has been able to raise prices more easily than expected alongside competitor Uber.

Slack Technologies (WORK) – The software company’s stock rose 3.1% after an analyst at Monness, Crespi, Hardt & Co. gave it a buy rating. The analyst said Slack has “exciting possibilities” and anticipates the service will be used at other organizations around the world.

Bristol-Myers Squibb (BMY) – Bristol-Meyers Squibb gained 3.3% on Monday after announcing that Celgene, which it has agreed to merge with, would sell psoriasis drug Otezla to Amgen. The company previously announced that it would divest Otezla as part of the regulatory process to get the merger approved. The company also said that it expects the merger to be completed by the end of the year.

Link: CNBC Article

Macro

US President Trump responded to the Chinese tariff announcement. He tweeted that “Our great American companies are hereby ordered to immediately start looking for an alternative to China, including bring your companies home and making your products in the USA. I will be responding to China’s tariffs this afternoon.”. This announcement sent risk sentiment off a cliff, with assets crashing lower in seconds. The S&P 500 Index fell from 2,922.00 to 2,872.00 before ending the day around 2,833.00 close to where it currently trades. Gold rallied from 1,500.00 to hit a high of 1,555.00 while USDJPY fell from around 106.60 to 104.45 at its low, but is now trading around 106.20 as risk sentiment has recovered somewhat. WTI crude oil was also under pressure, trading below $53.00 per barrel at one point.

Link: CNBC Article

Crypto

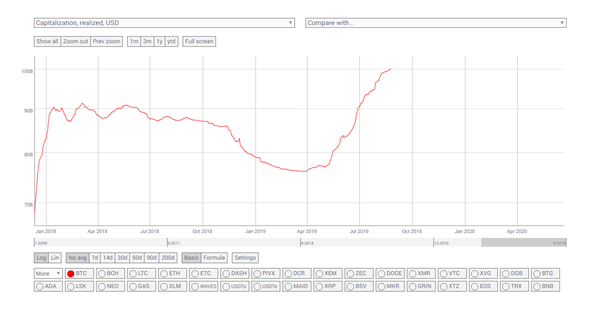

Bitcoin realized market cap hits $100 billion for the first time

According to data aggregator Coinmetrics.io on August 25, the so-called realized market cap has become the latest bullish indicator for Bitcoin.

Realized market cap, an alternative calculation of Bitcoin’s market capitalization, is now at record highs. Calculated from multiplying the price each bitcoin last traded at by the size of each trade, the figure for Bitcoin passed $100 billion on Sunday. The achievement is just one more in a string of near-constant records for Bitcoin, which recently posted all-time highs in areas such as hash rate and daily trading volumes.

Link: cointelegraph.com article

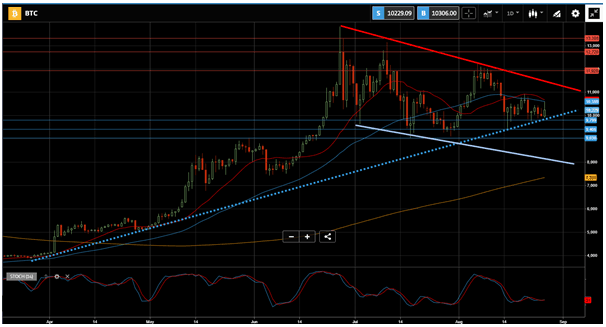

Bitcoin outlook and key trading levels

BTC is uptrending in the daily and 4 hourly time frames capped by the 20 and 50 day moving averages and supported by the 200 day moving average.The price appears to be in a consolidation range, creating lower highs and lower lows. Intraday price action is bearish, supported by the 10,000 level. The upside is capped by initial resistance at 11,000. A confirmed breakout above 11,000 appears bullish targeting resistances at the psychologically important 12,000 followed by 12,780 and 13,300. Alternatively, a confirmed loss of 10,000 would support a bearish outlook targeting additional downside supports at 9,960 initially and 9,400 followed by 9,030 and 8,745 levels.

Craig Wright ordered to give away half of his Bitcoin holdings by US district court

A US Magistrate Judge ruled on Monday that Craig Wright must turn over 50% of his Bitcoin and intellectual property (held prior to 2014) to the estate of David Kleiman. The case began in 2018 when Wright was sued for $10 billion by the Kleiman estate who alleged that Wright was trying to seize Dave Kleiman’s share of the Bitcoin they mined prior to Kleiman’s death. Judge Reidhart’s order will now have to be adopted by District Judge Beth Bloom before becoming final.

All data, figures & charts are valid as of August 27th. All trading carries risk. Only risk capital you can afford to lose.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.