Hi Everyone,

The crypto market has been anticipating the participation of large financial players ever since the peak of the last massive rally in 2017. While this dream has not yet been actualized, there are clear signs that it’s getting closer.

Mark Zuckerberg first announced his blockchain intentions in a post dated January 4th, 2018. So to have come out with a full white paper now is definitely progress.

Similarly, the Bakkt platform was first announced on August 3rd, 2018 and had an initial launch date scheduled for last November. After some wrangling with local regulators, they are now confident that they’ll be able to open testing by July 22nd.

On Tuesday, it seems that one firm in the USA made some incredible headway with the local regulators.

Today’s Highlights

- G20 Upcoming

- Bitcoin Downtime

- Technical Analysis

Traditional Markets

The meeting is set. At 11:30 AM on Saturday morning in Osaka Japan President’s Trump and Xi will have a landmark meeting. What we can expect is anyone’s guess.

Trump has already vowed that if it does not go well, he’ll be putting billions and billions more tariffs on China. So, no pressure.

Pundit vary in their opinions about the outcome of the meeting, from ‘no deal whatsoever’ to ‘a groundbreaking deal will be struck’ so it’s a bit difficult to gauge where this will go. All we know is that if you do want to have a position on the market, you’ll need to get it in tomorrow.

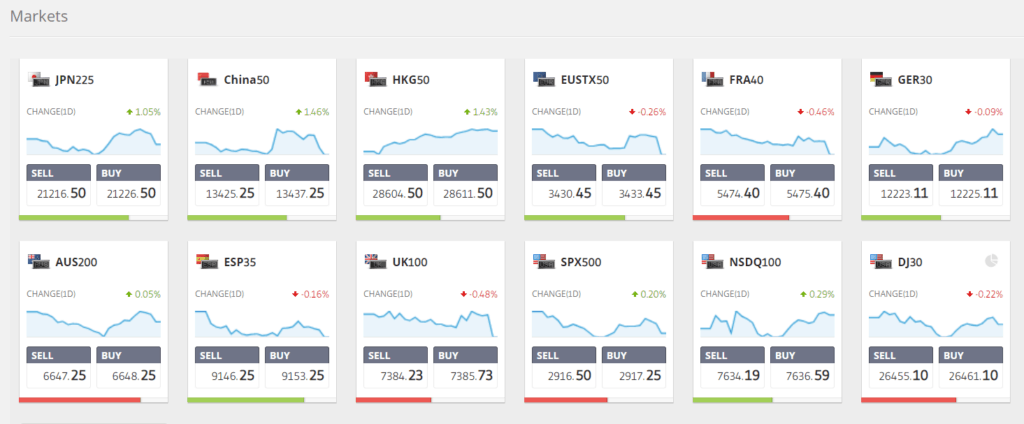

Stocks are doing pretty well today overall. The Asian session was fantastic but it seems the opening in Europe was a bit soft. US futures are holding.

Bitcoin DownTime

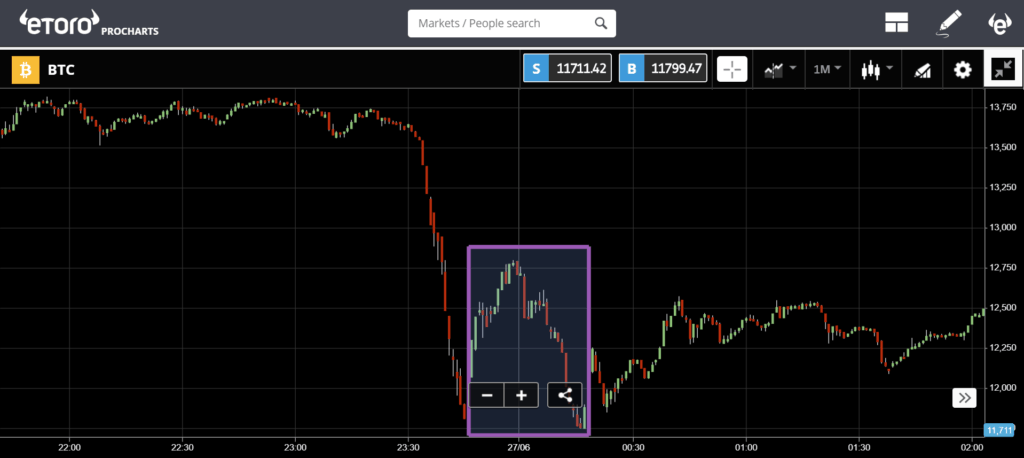

It seems the crypto market got a bit too hot yesterday and is now cooling down. What an incredible market where the price can crash about 15% in less than an hour and bring us back to the highs of the previous trading day.

The price crash coincidentally coincided with the downtime of the popular exchange Coinbase. Here we can see the approximate time of the outage in purple.

So in fact, it was not Coinbase that caused the crash but rather the opposite. The running theory is that its website buckled under the weight of traffic caused by the sudden price drop.

Trading app Robinhood also reportedly halted bitcoin trading around the same time.

Welcome to summer!!

It’s also worth noting that Bitfinex was down as well during this time for scheduled maintenance, which could have contributed to the fall. The platform handles a lot of orders so no doubt the market was missing the liquidity.

Record Volumes

In any case, we’re now seeing record high trading volumes across the board. This morning, I spotted Messari’s ‘real 10’ bitcoin volume at $5.5 billion, which is the highest I’ve ever seen it.

OTC desks are also reporting record high volumes. Some of them are even eclipsing anything they’d seen previously.

Of course, with this pullback in place, it pays to look at the chart. The most aggressive possible trendline (white) has been broken now.

The nature of the climb as such prevents us really from getting a solid support footing. However, the yellow line here represents my best attempt at drawing the trend. It certainly wouldn’t surprise me to even see it below this line again.

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.