This post was written by Joseph James Milazzo, a Popular Investor based in Australia, who has been trading on eToro since 2016. He has an MBA in Public Sector Administration and works as a Senior Consultant to the Australian Government.

This post was written by Joseph James Milazzo, a Popular Investor based in Australia, who has been trading on eToro since 2016. He has an MBA in Public Sector Administration and works as a Senior Consultant to the Australian Government.

Even the best investors make mistakes, and even experts can get it wrong when picking stocks. But the more you can learn to spot the most common investing mistakes, the less likely they will be to negatively impact your portfolio.

These are the top six investing mistakes I see people make when investing in the stock market.

Investing mistake #1: attempting to time the market

Timing the market is essentially predicting when the market will turn, and then buying or shorting accordingly, just before it does. Successfully timing the market will mean that a trader buys just when the market has reached a low, and shorts just when the market has reached a high.

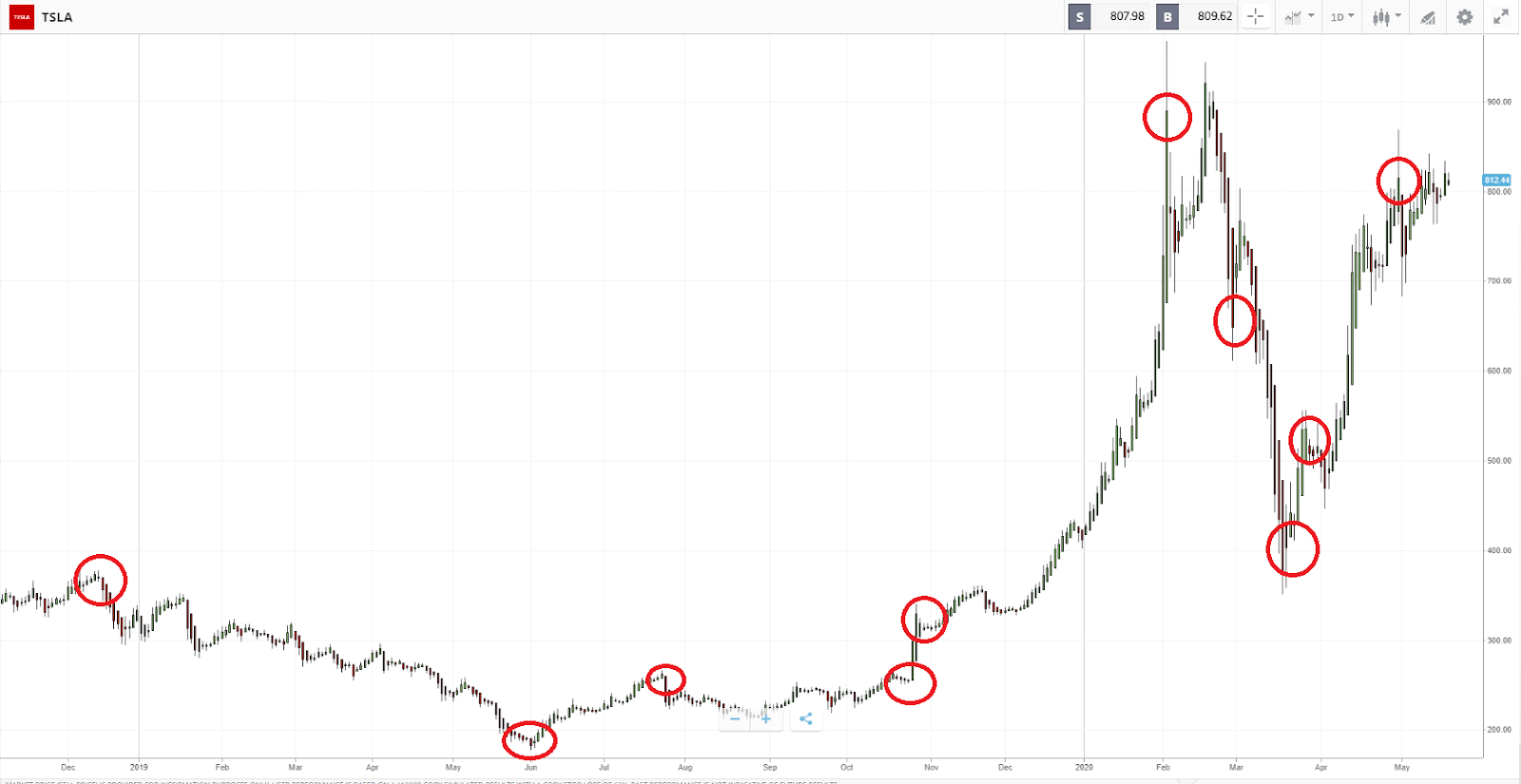

Let’s look at an example of this strategy. Below is the chart for Tesla Motors (TSLA), from 2019 until the present. We can clearly see the peaks and troughs where the price has fluctuated, usually within a short time frame.

Why is attempting to time the market a mistake? First of all, it’s very hard to do. There are simply too many unpredictable factors influencing the market to be able to have consistent success with this strategy. For example, rumours and news can send the price of a stock up or down in a matter of minutes. We have seen the power of social media, particularly from those in influential positions. One tweet from Elon Musk has the power to change Tesla’s price suddenly and dramatically.

Secondly, most traders don’t have the time or technology to devote to constantly monitoring changes around the clock, even after market hours, which is required to know each and every move affecting a stock’s price.

Interestingly, it turns out that continuous investing in an index-tracking fund may actually be a better and more sustainable strategy. Research shows that simply investing continuously ($500 each month consistently, for example) yields better gains long term when compared to buying the dip with perfect timing.

Investing mistake #2: not understanding what you are investing in

Warren Buffett said: “Never invest in a business you cannot understand.” Sometimes traders buy stocks simply because they like the company name or because they heard someone else talk about it, but they themselves have not really researched why this would be a good investment. Always do your due diligence before you put down capital.

When you believe in or often use a certain product in your daily life, you probably already have an understanding of how it works. Products and services like Google, Amazon, and Apple are all around us every day. All you need to do is pay attention to the news around these investment opportunities, and you will be likely to start seeing trends.

Investing mistake #3: making investment decisions based on emotion

Whether fear or hope, when people trade with their emotions, they usually end up making mistakes. Strong emotions can possibly cloud your judgement in the moment.

Try to remove as much emotion from your decision making as possible and look at the facts instead. You can still be passionate about a company and its stock, but let it be a catalyst for really diving into the data. Then, let the numbers guide you towards a logical investment strategy.

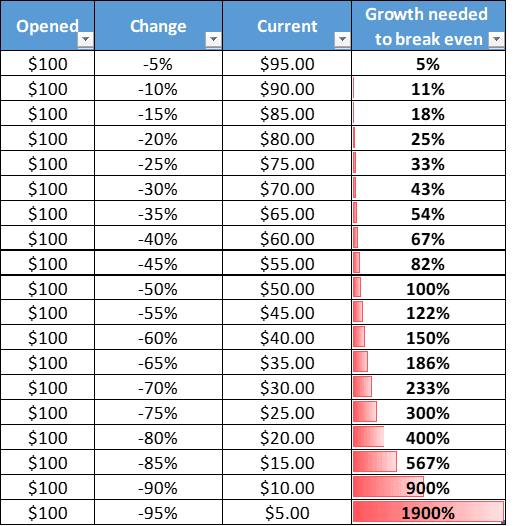

Investing mistake #4: waiting to break even

Another investing mistake is not knowing when to cut your losses. It can be difficult to accept that a position is simply not worth the investment anymore and move on, but this is often necessary in the stock market. Rather than wishful thinking, always look at the data and be realistic.

This table shows how much growth it would take to break even if an investor bought $100 worth of stock and then the price dropped. As you can see, the further the stock drops, the growth needed just to regain the investment is compounded. Of course, investors want to profit, not just break even, which requires even higher growth.

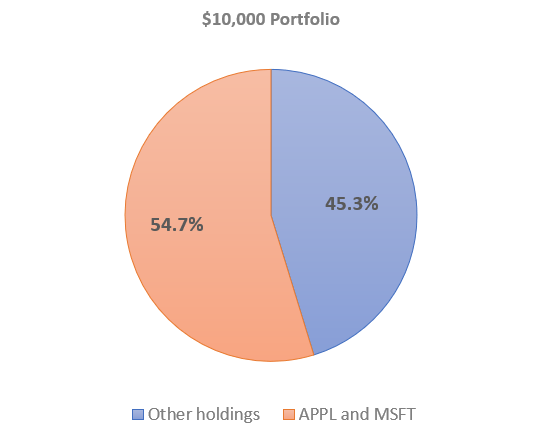

Investing mistake #5: thinking you’ve diversified, but you actually haven’t (aka diworsification)

Every investor knows that a diversified portfolio is the key to good risk management. But it is not enough to simply choose a bunch of different stocks in which to invest. Many investors make the mistake of thinking that they have diversified their trades, but if you take a closer look at their portfolio, the assets in it are very similar. This is also known as “diworsification” — investing in too many similar or correlated assets, which adds unnecessary risk to a portfolio.

For example, let’s say a $10,000 portfolio consists of the following five different holdings: NSDQ, APPL, MSFT, VOO and XLK. They each make up 20% of the portfolio. On the surface, these are different holdings, but the key here is the indices and ETFs in which they are invested. When we break down the actual holdings, there is a very strong representation of Apple and Microsoft across all of them. So, in reality, our sample portfolio is not very diverse at all:

With two stocks making up over 54% of this portfolio, we can see the potential problem here if MSFT and APPL were to take a hit in the market.

Investing mistake #6: not using Stop-Loss orders

A key mistake that investors make is not utilising the trading tools available to them. One of the most important of these tools is the stop-loss function.

A stop-loss order sets a loss limit for your trade, whereby, if the trade reaches a certain negative amount, it will automatically close. This allows you to control your risk even if you can’t monitor your trades 24/7 by setting the maximum loss in advance. For example, a trade of $100 with a stop-loss of 20% would automatically close once the value drops to $80 (20% down from $100).

Investors should be aware, however, that in certain circumstances a stop-loss order may not execute at exactly the set amount. Specifically, if you’ve set a tight stop-loss and there is a lot of movement after hours, this could impact your stop-loss. But in any case, a stop-loss order is always a good idea and better than taking chances without one.

A few final words on investing mistakes

So, there you have it — the top six investing mistakes that traders make. You’re almost guaranteed to come across these in your investing journey. Hopefully now you know how to spot them, and more importantly, how to avoid them. If you are making one or more of these mistakes, it is never too late to learn how to correct them.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilising publicly-available information.