March 9th, San Francisco, California. The event that Apple fans, journalists and investors have all been waiting for – the announcement of the Apple Watch, the last Apple product envisioned by the late Steve Jobs.

The event was carefully planned, with cinematic drama and attention to detail. The announcement of the Apple Watch itself was, of course, saved until the end, like dessert. And sweet it was. Knowing he lacks the charisma of his mentor, Tim Cook brought the legendary supermodel Christy Turlington Burns to his aid. After a few minutes discussing the features of the Apple Watch, Tim Cook moved aside and fired up a clip of Burns running across the beautiful plains of Africa at the foot of Kilimanjaro, which culminated with Burns coming on stage in a chic dress and wearing a chic version of the Apple Watch.

The message from Apple was clear: this watch is your everyday companion. It’s cool, it’s useful for whatever you’re doing, and it can be sporty or elegant – the perfect timepiece. The presentation later continued with more detail about the features of the Apple Watch, and then the event concluded.

Crunch Time

As much as it’s fun to talk about the various features of the Apple Watch – whether it’s taking calls, opening hotel rooms, boarding flights or using it as a fitness tracker – as investors, we must drill down into the numbers and try to come up with a figure. How much is the Apple Watch worth for Apple stock?

Without further ado, here are some of the numbers investors are looking at. While it’s tempting to examine the size of the luxury watch market and carve out the potential for the Apple Watch market share from that, it would be a mistake. Why? Because if you want to use the features of the Apple Watch, you must also have – you guessed it –an iPhone, making estimates about the global watch market not that useful.

So what is? According to a survey by the investment bank Morgan Stanley, from the entire pool of iPhone owners, 9% to 10% are seriously considering buying the watch. What does that mean in earnings? According to Tavis McCourt, CEO of Raymond James, this could amount to 30 million watches. McCourt estimates that every 10 million watches sold will add 25 to 40 cents to Apple’s earnings per share.

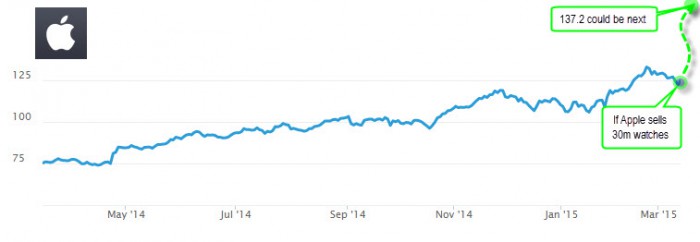

Sounds complicated? It’s not. In simple math, it means that Apple is expected to earn (going with the lower figure) 25 cents x 3 = 0.75 cents. Does that mean Apple’s stock will rise by just 0.75 cents? Not exactly – that’s what Apple stock is expected to earn from the watch per year. But Apple is probably going to make the watch for many years to come. So what do investors use? They use a multiplier called P/E. In Apple’s case, it’s 17, meaning that Apple is worth 17 times its stock’s earnings per year. So if we know how much the watch will make Apple for a year, we can multiple it by 17 and work out how much it will add to the share price: 75 cents x 17 = $12.75 in additional value.

Down to Pricing

Now to the bottom line. The stock is trading at $124.45, and adding $12.75 brings us to $137.2 – a 10% upside.

Will that be the return on Apple in the coming year? Not necessarily. The Apple Watch could disappoint – in fact, some estimate that only 3 million units will be sold. But if you’re excited about the Apple Watch and think, like some of Apple’s bulls, that it will be a hit, this gives you a rough estimate of what it means for the stock if the watch is a success – a 10% upside.

What do you think of the prospects of the Apple Watch? Let us know!