Markets pulled back overnight in the US and Asia, with futures indicating more losses are likely today, after a lack of clear policy direction from the Federal Reserve triggered some profit taking combined with the fact the tone was not quite as dovish as some had hoped.

Minutes published from its latest meeting spooked markets after the notion of introducing yield caps – whereby the Fed would directly intervene to keep yields from soaring from current record lows – were quashed for now. In reaction, the S&P 500 closed down 0.4%, just off its record high, while Asian markets followed suit, with Japan’s Nikkei down 1% and Australia’s benchmark ASX 200 weaker by 1%. European shares have also opened lower with the FTSE 100 down 1.3% and Germany’s DAX down 1.5%

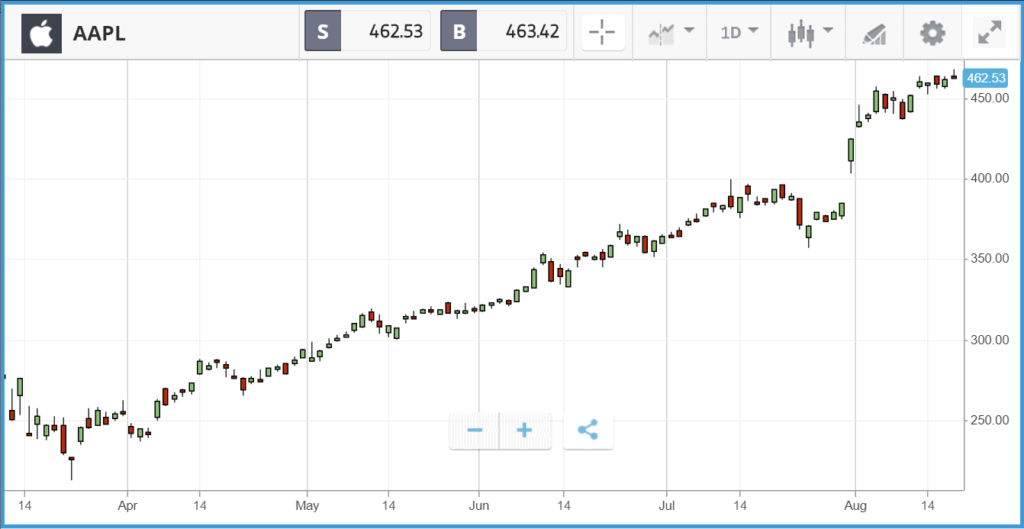

It comes after the record-breaking week for US markets saw another milestone achieved during trading hours, with Apple becoming the first company to hit a two trillion dollar market cap. Despite supply chain issues hurting the firm early in the pandemic, Apple’s earnings have proved resilient and the company has been caught up in the broader rally, boosting technology shares. Apple’s share price is up 57.6% year-to-date and 118% over the past 12 months, and it now occupies a 7% weighting in the S&P 500 index – which has a total market cap of $27trn.

Uber and Lyft made headlines on Wednesday too, as the firms said that they will likely have to shut down in California if forced to comply with a court ruling, relating to how they classify their drivers. Both firms are appealing to a higher court, but as things stand, they will be made to recognise their drivers as employees rather than self-employed contractors. Both companies have seen their share price sink over the past three months while the broader market has rallied, with Uber down 14.7% and Lyft 8.7%.

FDA drug rejections send pharma names lower

All three US stock indices fell slightly on Wednesday, with the Nasdaq Composite off the most at 0.6%. Biomarin Pharmaceutical, Gilead Sciences and Biogen were among the names that dragged the index lower. Both Gilead and BioMarin had non-Covid related drugs rejected by the US regulator on Wednesday, which triggered the sell-off. At the other end of the spectrum Target enjoyed a big day, adding 12.7% after reporting its latest set of quarterly earnings, driven by growth in its online sales.

In corporate news, Airbnb followed through with a filing for its rumored initial public offering, which is likely to be one of the year’s biggest. Earlier in the year, the pandemic appeared to have put its flotation plans on ice but now that demand for its services is rebounding, the firm appears ready to seize its moment. During the pandemic the firm raised billions in emerging funding, which valued the firm at sub $20bn, below the $30bn plus it was pegged at during 2017 fundraising.

S&P 500: -0.4% Wednesday, +4.5% YTD

Dow Jones Industrial Average: -0.3% Wednesday, -3% YTD

Nasdaq Composite: -0.6% Wednesday, +24.2% YTD

British Airways parent leads FTSE 100 higher as travel stocks rebound slightly

The FTSE 100 added 0.6% on Wednesday, with International Consolidated Airlines Group leading the way with a 7.6% gain, following a rough few days for UK travel names. The British Airways operator was flagged as a “compelling investment into the next cycle” by Bernstein analysts, which appears to have prompted the rally. The company’s stock is still down more than 5% over the past five trading days but is now back in positive territory over the past three months. At the bottom of the index were property firms Persimmon and Barratt Development, losing 2.5% and 2.2% respectively. Airlines easyJet and Wizz Air delivered positive days too, while Capita enjoyed a 15.1% rebound, following its 20% plus sell off on Tuesday. The FTSE 250 was taken lower by names from a wide array of sectors, including Hochschild Mining, GCP Student Living and Aston Martin Lagonda.

FTSE 100: +0.6% Wednesday, -18.9% YTD

FTSE 250: -0.2% Wednesday, -19.7% YTD

What to watch

Alibaba: Chinese e-commerce giant Alibaba delivers its quarterly earnings this morning before the bell. The firm, which has a New York Stock Exchange listing, has added 22.9% to its share price this year and 48.7% over the past 12 months. Given that the firm operates largely in China, where the economic reopening is more advanced than the US, investors will be watching the firm as a template for how a return to normality may play out in other economies. However, US-China tensions may weigh on the company’s outlook – a topic certain to be explored by analysts on the company’s earnings call.

Estee Lauder: Cosmetics giant Estee Lauder has managed to eke out a positive return in 2020 so far, despite store closures hurting its ability to generate revenue. Online sales will be a crucial component of the firm’s Thursday earnings report, along with cost cutting endeavors such as reducing headcount. The firm has already cut salaries and more than 100 jobs as part of a major efficiency drive.

Ross Stores: Discount retailer Ross Stores has faced a tough 2020 as its share price is still down 22% year-to-date, and the firm has missed out on the market’s rally in the past few months. This week has been a mixed bag for retailers, with Target delivering an earnings beat while TJX sank 5.4% after disappointing in its own update. The problem Ross faces is that bargain clothes have not been an essential for consumers during the pandemic, and the performance of stores that have been able to reopen fully will likely be a topic of discussion on the company’s earnings call.

Crypto corner: Bitcoin in space?

SpaceChain, a community-based space platform that uses blockchain technology to build and operate a satellite network, said it had secured a bitcoin transfer in orbit. Using multi-signature transaction hardware, the firm’s Chief Technology Officer Jeff Garzik was able to authorise a 0.0099 BTC transfer (worth about $92 at the time) on June 26, the company reportedly said this week.

Data can only reach the ISS via the craft’s encrypted ground station links. SpaceChain says this adds security and resilience to transaction authorizations. The value of bitcoin is yet to shoot off into orbit however, with the price held below $12,000 once more in early trading today.

All data, figures & charts are valid as of 20/08/2020. All trading carries risk. Only risk capital you can afford to lose