ApeCoin DAO’s token up double figures as Zcash and Curve make double-digit gains

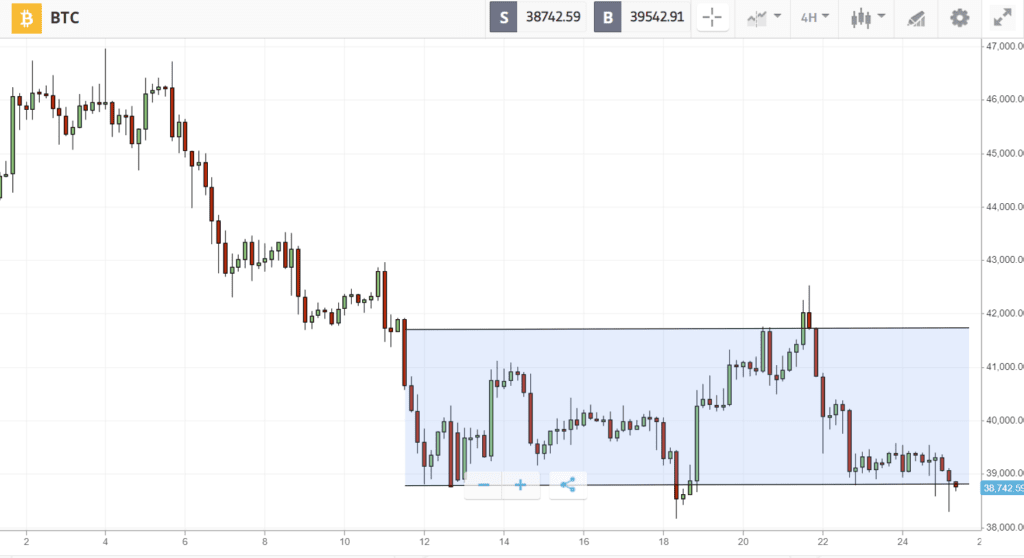

Altcoins have seen another action-packed week as Bitcoin continues to cling to $40K.

The largest cryptoasset briefly moved higher last Thursday, hitting almost $43K before falling as Federal Reserve Chair Jerome Powell said that aggressive interest rate hikes will be “on the table” for the next big Fed meeting in May. So far, rising interest rates have weighed heavily on crypto, which has traded in tandem with traditional risk assets such as tech stocks. Nevertheless, Bitcoin’s unique appeal continues to grow. Just a few days ago, the Central African Republic introduced new laws to adopt crypto as currency.

As Bitcoin drifts sideways, most of the action has been in the altcoin market. ApeCoin has swung 40% higher to approach all-time highs on metaverse speculation, followed by a 20% rally from DeFi protocol Curve. Close behind, privacy coin Zcash is up 14%, and TRON has added 5% on the announcement of a new algorithmic stablecoin.

This Week’s Highlights

– ApeCoin adds 40% on metaverse speculation

– TRON trends 5% higher on algorithmic stablecoin announcement

ApeCoin adds 40% on metaverse speculation

ApeCoin was one of the biggest market movers last week, swinging 40% higher to approach all-time highs.

The rally was driven by speculation that Yuga Labs, the creators of the Bored Ape Yacht Club NFT collection, will be using the token to sell virtual land in its metaverse project known as Otherside.

Excitement about this pushed ApeCoin’s market cap above other leading metaverse cryptoassets, including The Sandbox’s SAND, which is flat on the week, and Decentraland’s MANA, which fell 6%.

TRON trends 5% higher on algorithmic stablecoin announcement

TRON is the among top-performing altcoins, adding 5% after founder Justin Sun announced the launch of algorithmic stablecoin USDD (USD Decentralized).

TRON’s native token TRX, along with $10 billion of other cryptoassets, will be used as collateral to ensure that the new stablecoin stays pegged to the dollar.

USDD will be deployed on May 5th, and will be accompanied by a borrowing and lending protocol that will drive demand by offering 30% annual percentage yield (APY).

Week ahead

Bitcoin’s correlation with tech stocks could come into play in the coming days, as earnings are released for some of the world’s biggest companies including Microsoft and Google.

Markets might also react to the release of new inflation data, with another critical metric — the personal consumer expenditures index — set for release on Friday.

Meanwhile, ApeCoin fans will be watching to see if the token can make new all-time highs, or if the Bored Ape metaverse launch on April 30 will be a “sell the news” event.