Double-digit altcoin rally pushes total market cap above $2 trillion

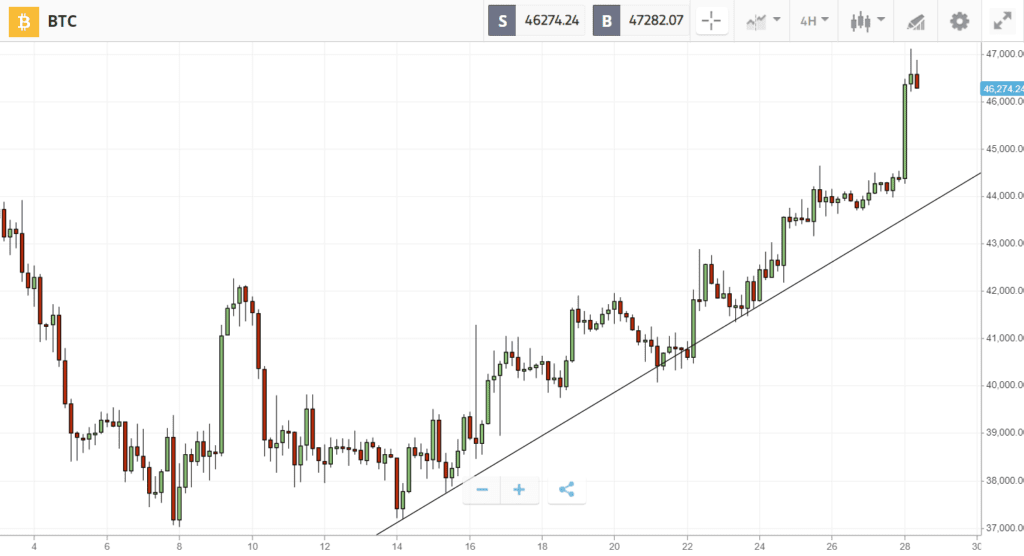

Bitcoin has surged around 15% over the last week to hit $47K, lifting the total crypto market value back above $2 trillion.

The gains come as Bitcoin continues to embed itself in the global financial system. Since last Monday, Wall Street giants Goldman Sachs and BlackRock have both made big moves towards crypto, Russia has weighed accepting Bitcoin for oil, and Exxon is reported to be running a Bitcoin mining pilot program. The market was also boosted by DeFi developer Do Kwon, with a multi-billion purchase of Bitcoin, creating an optimistic atmosphere that led to double-digit gains for almost all major altcoins.

Leading the altcoin troop higher, ApeCoin made more than 50% gains. Ethereum, which has been outperforming Bitcoin recently, added 15% to crack the $3K barrier., although it was still beaten by the 30% gains of little brother Ethereum Classic. Other top performers include Loopring, which is up almost 30% on a partnership with GameStop, Cardano which climbed 35% on new ecosystem data, and Axie Infinity, which rose 35% on excitement about upcoming game Axie Infinity: Origin.

This Week’s Highlights

– Institutional investors turn bullish

– Russia weighs accepting Bitcoin for oil

Institutional investors turn bullish

The trickle of institutional adoption is turning into a steady flow as the biggest names in global finance rush to get involved in crypto.

Bridgewater Associates is reportedly going to invest in a crypto fund, Cowen, a prominent investment bank, has created a digital assets division, and BlackRock’s Larry Fink said that the war in Ukraine could accelerate crypto adoption.

Meanwhile, Goldman Sachs is pushing on multiple fronts. Last week it became the first major US bank to do a crypto OTC transaction, and also released a survey showing that 60% of surveyed clients expect to increase crypto holdings. The bank has even redesigned its website to reflect the growth of digital assets and the metaverse.

Russia weighs accepting Bitcoin for oil

In a move that reflects how Bitcoin has become a widely accepted part of the global financial system, Russia is considering accepting the cryptoasset for oil.

During a news conference on Thursday, the country’s Congressional Energy Committee Chairman Pavel Zavalny suggested that Bitcoin could be accepted as payment for the nation’s natural resource exports.

Though some analysts took the words as throwaway comments, the price of Bitcoin reacted positively, spiking above $44K.

Week ahead

The widespread rally in the altcoin market suggests investors’ appetite for cryptoassets has returned.

This optimism might be challenged by US economic data due this week, including March unemployment rates which are set to be released on Friday 1st April — and could give the market an April Fool’s surprise.

On the chart, Bitcoin is now approaching its 2022 yearly opening figure, of around $47,700. A clear reclaim of this level would inspire confidence that the crypto market is ready to rise to new heights, and leave the doldrums of the first quarter firmly in the past.