Institutions move in as Goldman Sachs hunts discount crypto companies

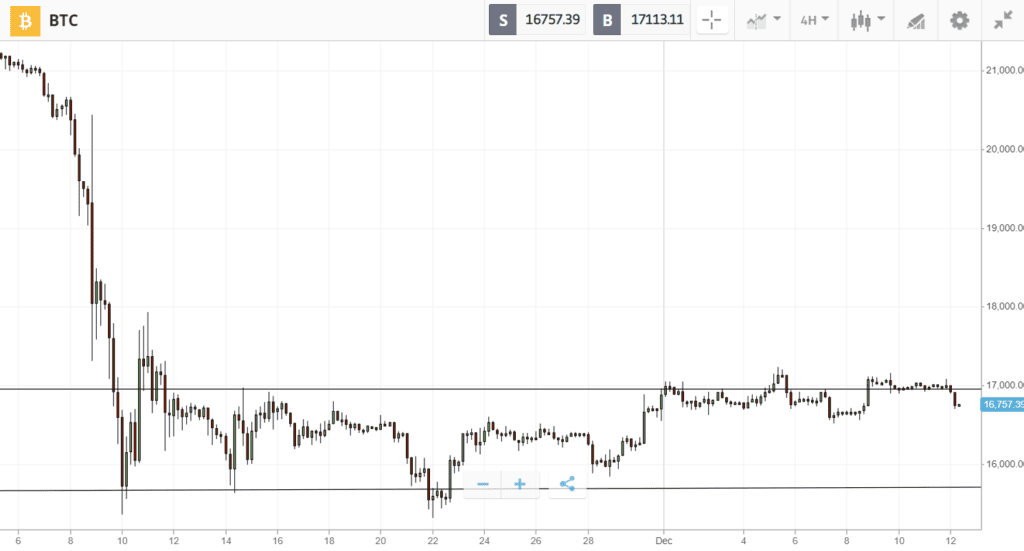

As Bitcoin continues to crawl sideways at $17K, altcoins are responding to their own news catalysts.

The lack of momentum among major cryptoassets could be attributed to ongoing uncertainty. Although individuals continue to buy Bitcoin and institutions including Goldman Sachs remain interested, the recent collapse of a large exchange continues to cause ripple effects across the market. In the last week, this manifested as solvency concerns about the world’s biggest crypto fund (Grayscale’s Bitcoin Trust), and intensifying regulatory pressure as both the Financial Crimes Enforcement Network (FinCEN) and the U.S. Securities and Exchange Commission (SEC) called for greater oversight.

Meanwhile, metaverse tokens are flavor of the week in the altcoin market. Axie Infinity has rallied 16% on the announcement of a decentralization plan, and ApeCoin is up 8% on the successful launch of staking. Chainlink, on the other hand, has fallen 10% after its own staking program opened up on December 6th.

This Week’s Highlights

– Axie Infinity adds 16% to lead metaverse rally

– Institutions see opportunity in downturn

Axie Infinity adds 16% to lead metaverse rally

Axie Infinity posted 16% gains over the past week as several metaverse tokens gathered momentum.

The governance token of the play-to-earn gaming platform appeared to be driven higher by the announcement of plans for progressive decentralization, which will eventually give the community the opportunity to shape the future of the platform.

Elsewhere, the token associated with the Otherside metaverse, ApeCoin, added 8%, while other major metaverse platforms The Sandbox and Decentraland were showing losses.

Institutions see opportunity in downturn

Despite the recent collapse of one of the largest crypto exchanges, interest in crypto is unwavering among some institutional market participants.

Last week, Goldman Sachs revealed plans to scoop up discounted crypto companies, while a Mastercard spokesperson said at a conference that “utility NFTs and metaverse-based use cases will continue to be a big area for investors and institutional involvement.”

This interest was confirmed by a recent survey from Eurex, which found that despite falling prices and the failure of certain crypto businesses, “institutions have not abandoned their interest in digital assets.”

Week ahead

Investors will be looking for an end to sideways price action on Wednesday, when the Federal Reserve is projected to raise interest rates by half a percentage point at its final meeting of the year.

Prior to this, the latest consumer price index (CPI) rate will be released on Tuesday, adding more inflation data for the Fed to take into consideration.

Combined, these two events could determine whether crypto prices continue to fall and drift sideways, or if Santa Claus will bring a rally before the end of the year.