Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and ‘special’ focus on our retail investor survey results.

Retail investors more important than ever

They are holding onto US stocks, tech and crypto 2023, but nibbling at last year’s laggards, in line with our call for a big performance rotation. Many still worry about the impact of inflation, with younger investors surprisingly focused on cash. Retail investor numbers keep growing fast, don’t think a bull market has started yet, and are adding to portfolios. While the proportion open to AI stocks outweighs those already invested, showing further growth potential. See Page 4

A new year comeback and all-time-high

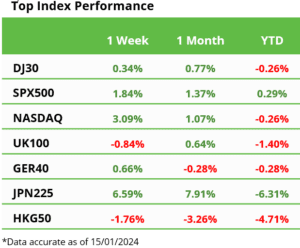

A stronger week, with S&P 500 touching its first new all-time high in two years, and MSFT briefly unseating APPL as world’s largest stock. Banks weak Q4 earnings season start, and US inflation came in warm. SEC approved long-awaited BTC ETF. BA was hit by accident, and ‘short reports’ hurt GRFS to GDCO. Whilst AI optimism returned with HPE $14bn JNPR deal. See our 2024 Outlook HERE and twitter @laidler_ben. See Page 2

Start of the election roller-coaster

Markets braced for first big 2024 election tests, with semis superpower Taiwan continued status quo, whilst the US’s Iowa primary starts an unprecedented presidential race with Trump having an early but narrow lead. See Page 2

Look through the inflation head-fake

US inflation remains most important number in markets, with focus on the further easing of underlying inflation pressure keeping door open to big interest rate cuts this year. See Page 2

AI comes into your living room

AI is dominating Las Vegas CES, as moves from hype to computer, TV, appliance reality, helping profits recovery and tech sector. See Page 2

Decision time for crypto

Long-awaited SEC approval of BTC ETF is first of many catalysts this year to youngest, smallest, most retail dominated asset class. See Page 2

Bitcoin rises after historic ETF approval

The US SEC approved launch of 11 spot ETFs in the world’s largest capital market, with very low fees and big $4.6bn in first day volumes. Focus now on next catalysts from an Ethereum spot ETF to the BTC halving. Elsewhere Circle Internet, the USDC manager, filed for an IPO. See the latest Weekly Crypto Roundup. See Page 3

Oil rises on geopolitical tensions

Brent rose toward $80/bbl. as Mid East tensions rose further, and freight rates rose. US Natgas prices soared, pulling up heating oil, as the US east coast saw big winter storms. The US shale consolidation continued as CHK pays $7.4bn for SWN. Whilst the IEA forecasts 2.5x growth in renewables capacity by 2030. See Page 3

The week ahead: Politics, earnings, Davos

1) Monday focus on the US MLK holiday and Iowa primary presidential race start. 2) 2nd earnings season week led by banks GS, MS plus BIRK, SLB, PLD. 3) Macro data focus on China’s Q4 GDP firming, resilient US Christmas retail sales, and UK inflation ease. 4) WEF meets in Davos hearing from major CEO’s and policymakers. See Page 3

Our key views: Outlook for a different 2024

See a stronger but very different 2024. Lower inflation and coming interest rate cuts as growth slows, and the earnings outlook idiosyncratically accelerates. Will drive a investor rotation from 2023 US and big tech winners to rate sensitive losers from Europe to real estate. See Page 5