Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and ‘special’ focus on opportunities outside the US.

Looking outside the super-sized US and tech

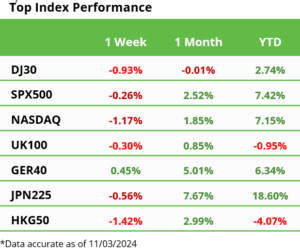

US markets are super-sized and super-expensive and have outperformed overseas markets for 14-years. This US exceptionalism is unusual but not unprecedented. But it’s a clear concentration risk. We see an economic soft landing and lower interest rates driving rotation to cheaper, more cyclical, and unloved overseas markets. Europe’s Stoxx50 has already joined Japan’s Nikkei 225 in outperforming the S&P 500 this year. See Page 4

Tech takes a performance back seat

Friday’s strong US jobs report drove profit-taking, even as Fed and ECB kept door open to rate cuts. China fiscal stimulus disappointed. Small cap and Value outperformed. Bond yields fell and dollar had worst week in 3-mths. BTC hit new high, and gold soared. AAPL hurt by China sales slowdown. NVO weight-loss boom made bigger than TSLA. SMCI surge saw join S&P 500. See 2024 Outlook HERE and twitter @laidler_ben. See Page 2

All-time-highs lead to more highs

With earnings recovery and rate cut pillars and 1-year average returns of 15% and 90% positive hit rate after new high. Average S&P 500 bull market historically five years and 150%. See Page 2

Stepping up to the AGM

Annual general meeting key for shareholders to have voices heard. The important retail investor is in the spotlight with only 30% voting but it now becoming increasingly easy to do so. See Page 2

Women gaining in markets and business

International Women’s Day reminds on rise of female CEOs. Now 10% of US Fortune 500 CEOs. And women investor numbers up 30% past 2-yrs and performance outpacing men. See Page 2

The cotton ‘fabric of our lives’ rally

Cotton prices up as Texas fires hit world’s biggest exporter and rising oil makes more attractive versus oil-based substitutes. A concern for fast fashion retail, from ITX.MC to LEVI. See Page 2

New Bitcoin high drives broader rally

BTC hit first new all-time-high since 2021 as rally broadens. SHIBxM price more than doubled in a week. Whilst largest stablecoin Tether reached $100bn of assets. Focus ETH’s Dencun upgrade, due on Wednesday, to cut gas fees and boost scalability. NYCB bank plunge and $1bn help. See latest Weekly Crypto Roundup. See Page 3

Commodities coming in from cold

Boosted by lower bond yields and weaker US dollar. Precious metals, from silver to platinum led, with gold new all-time-high. Cocoa surged to unprecedented $7,000/t on deepening supply shortfall. Natgas rebounds from 25-year low and Brent holds above $80/bbl. Uranium pulls back as sanctions not extended to Russia. See Page 3

The week ahead: Inflation, Triple-witch, ADBE

1) US inflation (Tue) the most important number in markets. Feb. est. flat at 3.1%. 2) Also, US retail sales (Fri) est. +0.8% and UK GDP est. -0.1%. 3) Europe earnings focus, with Stoxx 600 profits a less bad -6%. See ITX.MC, ADS.DE, VOW.DE plus US’s ADBE, ORCL, LEN. 4) Big volume Friday w/ triple-witching. And Russia election. See Page 3

Our key views: Outlook for a different 2024

We see a stronger but very different 2024. Lower inflation and coming interest rate cuts as growth slows, and the earnings outlook idiosyncratically accelerates. Will drive an investor rotation from 2023 US and big tech winners to rate sensitive losers from Europe to real estate. See Page 5