Summary

Q2 global survey shows retail holding firm

DIY investors have been resilient to the Q2 ‘bear’ market, with near 4x more buying the correction than selling, and 72% still confident in their investments. This is an important market anchor given their greater size now. But they are turning more cautious, adding to cash, currencies, and traditional defensive sectors. Inflation remains the biggest concern, but economic growth risks are also steadily rising. New investors are disproportionately young, female, and overseas, and they often invest differently. We surveyed 10,000 investors in 14 countries.

Not too hot nor too cold for investors

A positive ‘goldilocks’ week. Slowdown fear and lower commodities cut inflation outlook. But firm China PMI and US jobs reports eased recession talk. Tech stocks led up, with energy weak. The USD surged and EUR fell to near parity. Big week ahead with US inflation and Q2 earnings. See U shaped recovery. See latest presentation, video updates, and twitter @laidler_ben.

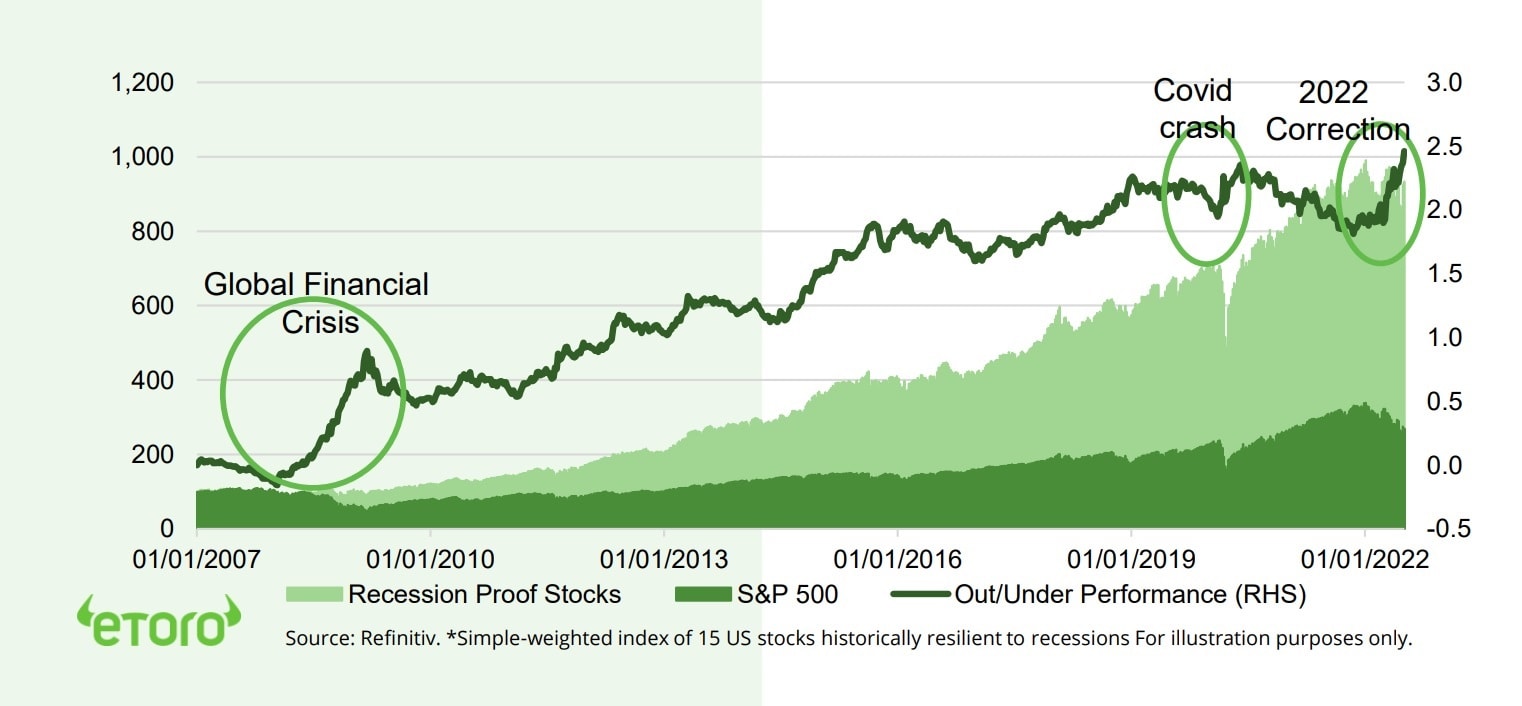

Recession winning stocks

Some stocks often benefit from recession, from discount retail (like DLTR), to home DIY (HD), auto repair (AZO), and healthcare (ABT). Our 15-stock US basket is up 10-fold since 2007.

Revenge of the supply chain

Our Global supply chain ‘pain’ index is -22% from highs, easing inflation fear. But disruption is still high. Been helping freight (@GlobalLogistics), but hurting semi stocks (@Chip-Tech).

Shorts in the toolkit

Shorting became a lost art in big rally of recent years. But now S&P 500 seen similar proportion – 2% days as GFC, its short interest ratio up off lows, and largest ‘inverse’ ETF +70%.

The Prime Day consumer test

This week’ Amazon ‘Prime Day’ is the next US retail health-check, and 3rd largest spending event of the year. @ShoppingCart. See Page 2

Bitcoin (BTC) rises over $20,000, helped by equity strength. Long-suffering miners, from MARA to RIOT, benefitted from rising crypto prices and easing mining difficulty. Etoro global ‘beat’ survey shows nearly four times as many DIY investors bought the Q2 sell off as sold it.

Lower oil eases inflation fears

Bloomberg commodity index -18% from high, on slowdown risk and strong US dollar. Been cutting global inflation fears. But Brent oil still $100/bbl.+ for only 3rd time ever, with China’s reopening and supply tight. And EU natgas prices doubled in a month. Depressed copper also helped by China composite PMI rebounding to 55.

The week ahead: inflation and earnings

1) June US inflation (Wed) key test for recent fall in price rise worries. 2) Global Q2 earnings start with JPM. S&P 500 consensus for +5% growth. 3) AMZN Prime Day, 3rd biggest US spending day, and the latest consumer test. 4) China Q2 GDP to be bad, but June data is rebounding.

Our key views: Inflation versus recession race

Recession and earnings risk driving markets, with valuations slumped and bond yields peaked. Recession not inevitable, on resilient corporates and consumer, and easing price pressure. But recovery only U-shaped. Focus defensives, in ‘new’ world and to manage risks. Healthcare and high dividend yield, to UK and China.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 0.77% | -0.17% | -13.76% |

| SPX500 | 1.94% | -0.04% | -18.19% |

| NASDAQ | 4.56% | 2.60% | -25.63% |

| UK100 | 0.38% | -1.66% | -2.55% |

| GER30 | 1.58% | -5.43% | -18.07% |

| JPN225 | 2.24% | -4.70% | -7.90% |

| HKG50 | -0.61% | -0.37% | -7.15% |

*Data accurate as of 11/07/2022

Market Views

Not too hot nor too cold for investors

- A positive ‘goldilocks’ week. Economic slowdown fear and lower commodity prices cut the inflation outlook. Whilst robust China PMI and US jobs report eased imminent recession talk. Tech led sectors up, with energy weaker. USD surged and EUR fell to near parity. TWTR deal pulled. A big week ahead with US inflation and Q2 earnings start. We see a U-shaped recovery. Page 6 for Resource reports, presentations, videos, twitter.

Recession winning stocks

- With recession risk soaring we look at 2008 and 2020 recessions for stocks that were defensive but also made money. From discount retail (DLTR, ROST) and home DIY (HD, LOWE) to auto repair (AZO, ORLY) and healthcare (ABT, AMGN).

- They are doing well again now, and have a strong record, with our 15-stock US basket up ten fold since the beginning of the global financial crisis. But parallels exist in all markets, with our UK basket outperforming by 120%.

Revenge of the supply chain

- Our Global supply chain ‘pain’ index is -22% from its April highs, with falls in DRAM computer chip prices (-31% from peak), container freight (-17%), and bulk freight (-62%) rates. This is consistent with Fed’s global supply chain pressure index, and easing supplier delivery times in the US ISM.

- This is being driven by time to adjust, easing end demand, and China’s covid reopening. This is helping ease global inflation pressures.

- But disruptions are still 1.5 to 3 times normal, and hurting many. Freight stocks (@GlobalLogistics) are helped, but Semis (@Chip-Tech) hurt. Fears of an inventory destocking ‘bullwhip’ are high, as recession risks build, but absent so far.

Shorts in the toolkit

Using short positions to manage risk and take directional views on a stock or market is a lost art after the rally in recent years. No more. The S&P 500 is -20% this year. The number of -2% days is 4x average, second only to global financial crisis. Short interest as % of S&P 500 market cap is off its 1.5% 2021 lows, but still only half of 2008 crisis levels.

▪ But shorting has unique and higher risks that need to be well understood. See the SQQQ and SH 3x levered ‘inverse’ ETFs illustrations.

The ‘Prime Day’ consumer test

- Consumers are a key bulwark to rising recession risks with labour markets and their balance sheets strong. Consumers are running down savings to maintain spending. This works for now, but is not inexhaustible. It also masks a shift back to physical sales from online, and to services from physical goods. Plus, however resilient US, trends in China are dwarfing them in scale and online penetration.

- This week’ Amazon ‘Prime Day’ is the next US retail resilience health-check, and 3rd largest spending event of the year, at $8 billion. But may not be enough to help suffering online stocks. See @ShoppingCart, @FashionPortfolio.

Crypto finding its feet

- Bitcoin (BTC) gained above $20,000, helped by firmer markets. This was enough to give some relief to hard-pressed miners, from Marathon Digital (MARA) to RIOT blockchain (RIOT). They have seen dramatic falls this year, driven by the combination of lower crypto prices and rising mining ‘difficulty’. Bitcoin’s is up 20% this year.

- Crypto lender Voyager filed for bankruptcy, following the earlier demise of the 3AC crypto hedge fund to which it was heavily exposed.

- 39% of crypto investors added to positions in Q2, near four times the 12% proportion who sold, according to the latest eToro global retail investor beat survey. 50% made no changes.

Lower oil easing inflation fears

- Price slump ongoing with Bloomberg commodity index now -18% from June highs on rising recession fears and surging US dollar. Brent oil briefly fell below $100/bbl. This is provides some welcome inflation relief but is still a level only seen twice before in history, and part offset by volatile and high natgas prices. These have more than doubled the last month in UK and Europe.

- Copper is -30% from 2022 highs. Its known as ‘Dr. Copper’ for its economics PhD. and wide ranging industrial uses. It saw some support amongst recession fears as macro data from largest user, China, was stronger than expected. The latest services PMI rebounded to an expansionary 55.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 4.83% | -4.38% | -26.20% |

| Healthcare | 1.40% | 1.21% | -9.49% |

| C Cyclicals | 3.96% | -4.74% | -28.71% |

| Small Caps | 2.41% | -6.43% | -21.20% |

| Value | -0.10% | -6.62% | -12.51% |

| Bitcoin | 12.71% | -27.75% | -54.08% |

| Ethereum | 16.37% | -30.87% | -66.91% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: inflation and earnings

- June’s US inflation (Wed) the focus, plunge in forward looking indicators, from inflation break evens to oil price. Consensus looking for stable 8.6% price rise, but with risk on upside.

- Global Q2 earnings start with JP Morgan (JPM). Consensus S&P 500 revenues +10% and EPS +5%. Crucial test with 2022 earnings growth still at +10% despite soaring recession risks. Also, GOOG 20:1 stock split goes effective (Fri).

- Amazon (AMZN) Prime Day (Tue-Wed) the 3rd largest retail event of the year and a key test for resilience of consumer spending. Walmart (WMT) and Target (TGT) also have events on.

- Q2 China GDP (Fri) to show a sharp fall in the world’s no.2 economy as was under Covid lockdown, but June retail sales and industrial production set for a welcome rebound.

Our key views: Recession fears in driving seat

- Saw biggest sell-off since the 2020 covid crash. Recession and earnings risk drive markets, with valuations slumped and bond yield peaked. See the fundamentals stressed but secure, with recession not inevitable, on resilient corporates and consumer. But recovery U, not V, shaped.

- Focus on cheap and defensive assets. To be invested in this ‘new’ world, but to manage still very high risks. See Value sectors, like healthcare, defensive styles like high dividend yield, and related markets from UK to China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -1.04% | -14.41% | 16.88% |

| Brent Oil | -3.88% | -12.12% | 37.48% |

| Gold Spot | -3.97% | -7.16% | -4.89% |

| DXY USD | 1.67% | 2.64% | 11.39% |

| EUR/USD | -2.28% | -3.14% | -10.42% |

| US 10Yr Yld | 19.00% | -7.90% | 157.04% |

| VIX Vol. | -7.72% | -11.21% | 43.09% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Retail investor diamonds hands

DIY investors resilient to the ‘bear’ market, and near 4x more buying dip than selling

The message from the Q2 eToro retail investor beat survey is that DIY investors are holding firm, and many taking advantage of the market pullback this year. 28% bought the correction in Q2, with only 8% selling. This is good for markets, with DIY investors more important than ever. US households for example have 40% of investments in equities, and quarter of investors are new to markets the past few years. And will likely also be good for investors, with bull markets built on bear markets, and four times larger and longer.

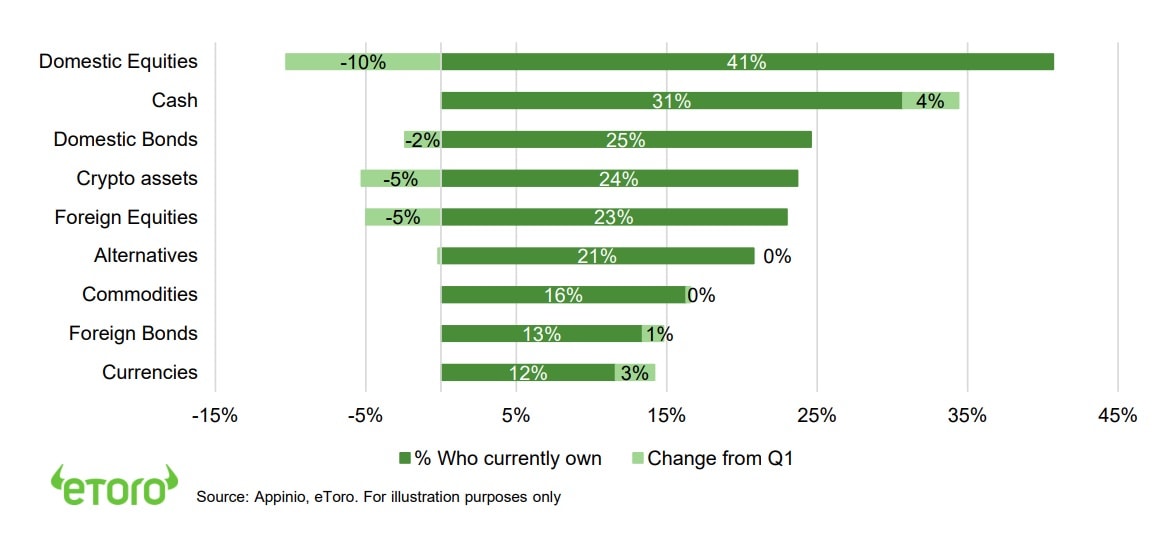

But turning more cautious, adding to cash, currencies, and traditional defensive sectors

We saw a clear shift to more defensive assets. Increased allocations to cash, which is now yielding something with interest rates higher in much of the world, and to currencies, with the US dollar, the only major asset up in Q2. Allocations to higher risk assets like equities and crypto slipped back. Similarly for sectors, with more allocations to traditional defensives, from healthcare to utilities, at expense of tech.

Inflation remains the biggest concern, but economic growth risks are also steadily rising

Inflation is seen as the biggest macro risk, by 47% of investors. This is unsurprising as inflation rates have continued to rise globally to 8-9% levels across US and Europe. Meanwhile domestic economic growth risks have also risen, along with the rise in interest rates and surge seen in recession fears. Despite this most DIY investors remain confident in their personal financial situation, investments, and job security.

The future is young and female and international, and they are investing differently

The survey shows the growth in younger investors. 49% of 18–34-year-olds started in the past three years. They tend to be more tech-savvy, risk-tolerant, and ESG and thematic focused. Similarly, 29% of female investors are new. They have a longer-term investment view, less turnover, and lower risk appetite. Studies show them often generating better long-term returns. Also new investor growth been led outside the US.

Filling the knowledge gap of retail investor thinking

The eToro retail investor beat is a quarterly global survey of 10,000 self-directed investors in 14 countries, from US to Australia, and across Europe, and seeks to fill the knowledge gap of retail investor attitudes.

What am I currently invested in (% of respondents)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks alongside the Fed hiking cycle is boosting uncertainty and weakening markets. We see this as slowly fading, the global growth outlook secure, and valuations more compelling. Focus on cheap cyclical and defensive assets within equities, like Value, plus commodities, crypto. Relative caution on fixed income and the USD. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing strong c4% GDP growth and resilient earnings growth outlook. Valuations have now fallen back to average levels, and are supported by peaked bond yields and high company profitability. Fed interest rate risks are now well-priced. See cyclicals and value catch-up, after lagging for a decade, whilst big-tech supported by structural growth outlook. See overseas markets leading in global ‘U-shaped’ rebound. |

| Europe & UK | Favour defensive and cheap UK equities (‘Economies are not stock-markets’) over high risk/high return continental Europe. Recession risks rising with Russia and energy crisis, threatening to overwhelm ‘buffers’ of rising fiscal spending (defence and refugees), low interest rates (slow to raise ECB), and weak Euro (50%+ sales from overseas). Equities cushioned by greater weight of cheap cyclical sectors, lack of tech, and 25% cheaper valuations versus US. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. More cautious rest of EM on rising rates and strong USD. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Core positions as macro risks rise and bond yields are better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | Cyclical sectors, like consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, are cheap and attractive in a ‘slowdown not recession’ scenario. Are sensitive to re-opening economies, resilient GDP growth, and higher bond yields, with depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Benefits from higher bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and room for large dividend and buyback yields. But is being outweighed by rising recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversifieds (like Berkshire Hathaway) least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In ‘sweet spot’ of robust GDP growth, ‘green’ industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Volatility very high, and correlation with weak equity prices risen. Asset class seeing 16th -50% pullback of last decade. Upside from 1) continued Institutionalization of cryptoassets, from allocations, to investment products, and regulation. Also, 2) the steady broadening of the use cases and market development, from Ethereum PoS, to DeFi to payments |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.