Summary

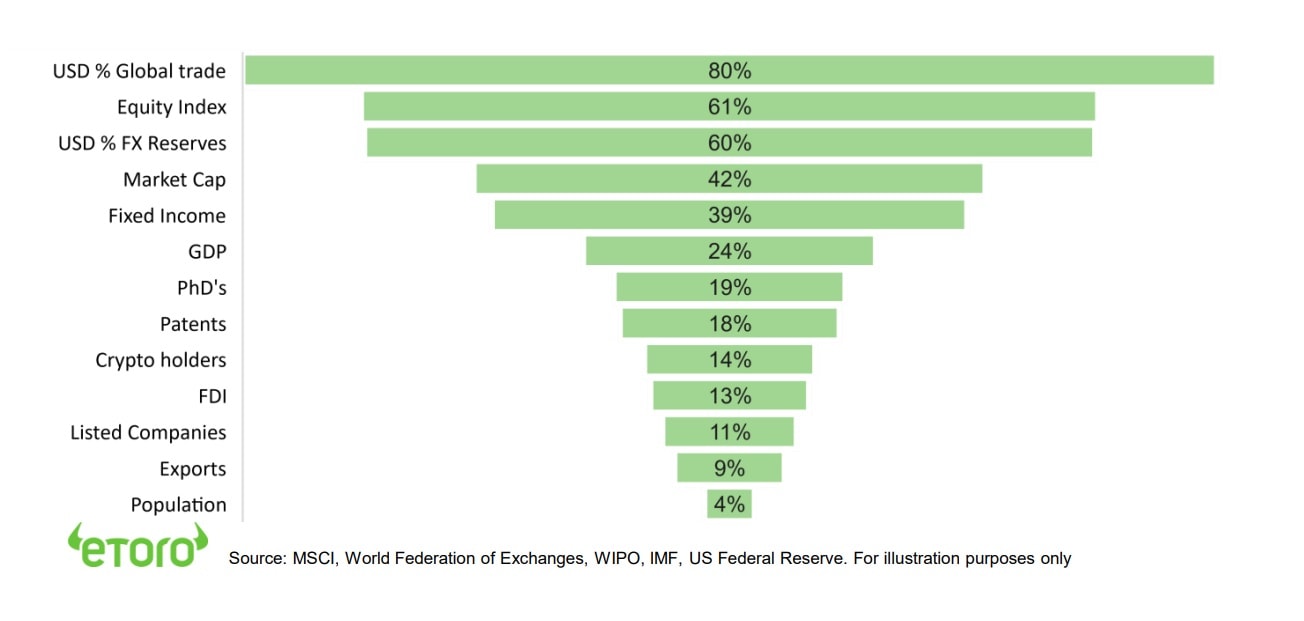

What dramatic super-sized US markets mean

The US dominance of global capital markets is extraordinary. It is 40-80% of equity, FX, bond markets but only 4% of population and 24% GDP. Crypto is the only big exception. The US has kept outperforming this year, from the US dollar to – more surprisingly – equities. But international diversification still matters, despite some of the additional FX and macro risks. The US has never been the best annual equity performer despite its dramatic run of outperformance.

Bear market rally gains legs

S&P 500 bear market rally gained steam. Better than feared Q2 earnings, like NFLX, TSLA, helped. Crypto led, whilst US dollar eased as ECB started hiking more aggressively. Saw rotation back into YTD laggards, like tech and US, and away from winners like defensives, UK, China. Inflation peak key to rally sustainability. ‘Analyst Weekly’ returns Aug. 8th after a holiday break. See latest presentation, video updates, and twitter @laidler_ben.

Dr. Copper in the hospital

Copper prices have recently plunged, a widely followed barometer of rising recession fears. But the long-term energy-transition outlook is rosier. Major producers FCX, SCCO, ANTO.L.

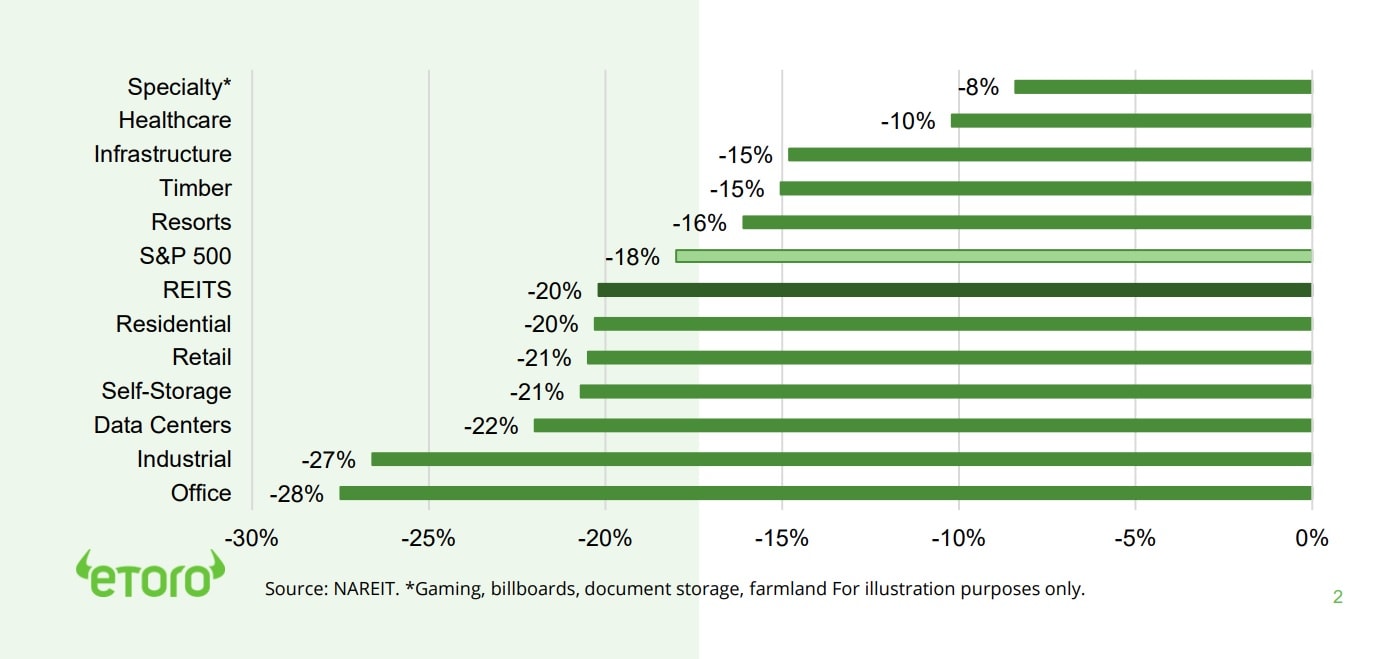

Getting ready for REITS

Real estate investment trusts (REITS) done poorly as S&P 500’s most indebted sector seen surging interest rates. But traditional rate sensitives, like REITS, should do better as focus shifts to coming rate cuts. See @RealEstateTrusts.

US midterm election bounce could be bigger

Midterm elections are on November 8th, and a Republican clean sweep is possible, and may further gridlock US politics. But may also see market relief, just as inflation falls.

The world’s biggest currency surprise

Russian ruble (RUB) best performing FX this year, but clouds are now gathering.

Crypto relief rally despite TSLA bitcoin sale

Crypto assets rebound from the June -70% lows continued, taking market capitalisation back over $1 trillion. Bitcoin (BTC) was resilient to Tesla (TSLA) announced sale of 75% its holdings. Ether (ETH) led the price recovery on firming plans for September ‘merge’ to Beacon chain.

Commodities relief from weaker US dollar

Commodity markets recovered some of recent 20% fall with US dollar easing as global markets rallied and ECB hiked interest rates. EU natgas stabilised as Nord stream supplies restarted, for now. Many futures prices, from oil to cotton, remain heavily ‘backwardated’ (lower in future) incentivizing current production.

The week ahead: Fed hike and tech earnings

1) Busiest Q2 earnings week, with big tech MSFT, GOOG, AAPL, AMZN, META. 2) Fed set to hike US interest rates at least 0.75%. 3) US Q2 GDP report could see another fall and ‘technical’ recession. 4) Europe stays in spotlight, with Q2 GDP slowdown and a new 9.3% inflation record.

Our key views: Inflation versus recession race

Recession and earnings risk driving markets, with valuations slumped and bond yields peaked. Recession not inevitable, on resilient corporates and consumer, and easing price pressure. But recovery only U-shaped. Focus defensives, in ‘new’ world and to manage risks. Healthcare and high dividend yield, to UK and China.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.95% | 1.27% | -12.22% |

| SPX500 | 2.55% | 1.28% | -16.88% |

| NASDAQ | 3.33% | 1.95% | -24.36% |

| UK100 | 1.64% | 0.94% | -1.46% |

| GER30 | 3.02% | 1.03% | -16.56% |

| JPN225 | 4.20% | 5.37% | 3.05% |

| HKG50 | 1.53% | -5.11% | -11.92% |

*Data accurate as of 25/07/2022

Market Views

Bear rally gains legs

- The S&P 500 bear market rebound gained steam, up 8% from the mid June lows and crossing the 50-day moving average. Helped by Q2 earnings coming better than feared. Crypto assets led the rebound, whilst US dollar eased as ECB started hiking more aggressively. Saw rotation into YTD laggards, tech to US, and away from winners like defensives, UK, and China. Page 6 for Resource reports, presentations, videos, and twitter.

Dr. Copper in the hospital

- Copper has plunged by a third from March high, twice the broad commodity fall, under weight of surging recession fear, struggling China recovery, and the dollar rally. Copper’s ubiquitous uses from construction to the green transition makes it the ‘canary-in-the-coalmine’ for global growth.

- But long-term outlook is rosy, and entry points more attractive the closer prices get to marginal cost of production around 2.50/lb, with copper stocks overshooting on the downside. Major producers from FCX, SCCO, ANTO.L.

Getting ready for REITS

- Real estate investment trusts (REITS) have not performed as well as hoped. The negative impact of Fed’s dramatic interest rate pivot on S&P 500’s most indebted sector has offset their defensive inflation-linked revenues and dividend yields.

- But we are getting closer to a positive catalyst of interest rate cuts in 2023 as inflation emergency eases. This has traditionally helped the sector.

- But this is a double-edged sword, as we get closer to the positive catalyst of a potential Christmas rate peak and interest rate cuts in 2023 as the inflation emergency eases. The REIT sector traditionally performs well as the market anticipates lower interest rates. See @RealEstateTrusts.

US mid term election bounce could be bigger

- Midterm elections are on November 8th. Polls show Republicans winning back the House of Representatives and maybe Senate in a Congress clean sweep. They benefit from usual anti incumbent party sentiment, Biden’s low approval, and inflation concern. Down ballot initiatives will be important for many. Congress gridlock seems likely.

- We see a traditional post mid-term market bounce potentially accelerated this year by lower inflation, a peaked Fed, and year end seasonality.

The world’s biggest currency surprise

- Russian ruble (RUB) is the best performing FX this year against soaring US dollar, up 30%. This is a seven-year high and double its post-Ukraine invasion lows. Brazilian Real (BRL) only other FX up. A combination of capital controls, high interest rates, and high oil prices have driven this currency surprise, despite the impact of the Ukraine war.

- But with the ruble now among the world’s most expensive currencies, controlled weakness is likely ahead. The authorities are easing interest rates and capital controls, whilst oil prices have seen their highs. Watch out below.

US Real Estate Investment Trusts performance 1H 2022 (%)

Crypto relief rally despite Tesla sale

- Crypto assets have rebounded over 25% from June lows, after the 70%+ price falls from the November 2021 peak. This has been driven by its high beta performance relative to recovering equities, and has taken the overall asset class market capitalisation back over $1 trillion.

- Bitcoin (BTC) shrugged off news Tesla (TSLA) had sold 75% of its holdings, valued at $936 million, during the second quarter. The company had announced a $1.5bn investment in Feb. 2021.

- The Ether (ETH) price surged by around a third on seemingly firming plans for the long-delayed merge from PoW to PoS with the Beacon chain seen happening as early as September 18th.

Commodities relief from the easing US dollar

- Commodity markets stabilised after recent near 20% weakness. Relief was driven by the easing of the US dollar. The ECB raised interest rates more than expected and rallying equities eased the usual safer-haven demand for the US dollar.

- EU natural gas prices to the rebound as the critical Nord stream pipeline reopened, with reduced volumes, after recent maintenance. Fears had been Russia would further ‘weaponize’ Europe gas reliance by cutting off all supplies.

- Many futures curves are highly ‘backwardated’, led by oil and cotton, incentivizing current production and historically bullish for prices.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 2.52% | 6.26% | -25.47% |

| Healthcare | -0.24% | 4.93% | -10.31% |

| C Cyclicals | 6.29% | 11.05% | -24.68% |

| Small Caps | 3.58% | 6.90% | -19.53% |

| Value | 1.56% | 3.13% | -11.63% |

| Bitcoin | 8.59% | 14.18% | -51.73% |

| Ethereum | 23.49% | 45.60% | -58.33% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Fed hike and busiest earnings

- It’s the busiest week for US Q2 earnings, with big tech’s MSFT, GOOG, AAPL, AMZN, META. Plus others like V, KO, XOM. 75% of stocks beaten forecasts so far, a relief to markets.

- The US Fed (Wed) set to hike interest rates by at least 0.75% to 2.25% to contain inflation that risen to 9.4%. Markets assume further 0.75% hike at following Sept. 21st meeting as well.

- US Q2 GDP (Thu) is expected to rise 0.8% QoQ annualised vs the Q1 -1.6% fall. But the Atlanta Fed Nowcast is signalling a GDP fall that would confirm a ‘technical’ US economic recession.

- The spotlight will remain on Europe after last week ECB rate hike, Nord stream gas restart, and continued Italian political turmoil. Q2 GDP growth (Fri) to slow to 2.8% YoY and 0% QoQ, with July inflation rising to a new record 9.3%.

Our key views: Recession fears in driving seat

- Saw biggest sell-off since the 2020 covid crash. Recession and earnings risk drive markets, with valuations slumped and bond yield peaked. See the fundamentals stressed but secure, with recession not inevitable, on resilient corporates and consumer. But recovery U, not V, shaped.

- Focus on cheap and defensive assets. To be invested in this ‘new’ world, for the coming recovery, but to manage still high risks. Value sectors, like healthcare, defensive styles like div. yield, and related markets from UK to China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 2.69% | -3.95% | 17.50% |

| Brent Oil | -2.35% | -9.40% | 26.70% |

| Gold Spot | 1.10% | -5.62% | -5.75% |

| DXY USD | -1.40% | 2.27% | 11.02% |

| EUR/USD | 1.27% | -3.24% | -10.17% |

| US 10Yr Yld | -16.03% | -37.71% | 124.50% |

| VIX Vol. | -4.95% | -15.42% | 33.74% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Impact of the super-sized US

The dominance of the US in global capital markets is extraordinary. Crypto is the exception

US equities are over 60% of global markets (see chart), with the other 50 biggest markets totalling only 40%. The US dollar similarly dominates commodity markets, international trade, and FX trading. US fixed income is 39% of all the world’s debt securities. This dramatically lopsided investment world compares to the US as only a quarter of global GDP, under a tenth of listed companies, or under 5% of population. The only asset class where the US does not dominate is crypto, where an estimated 14% of global crypto holders are US based. This dominance puts a huge focus on tracking US fundamentals and events, but also opens diversification opportunities in the under-represented rest of the world.

The US has continued to outperform this year, from the US dollar to – more surprisingly – equities

US leadership has continued this year. The US dollar has outperformed near all global currencies, as the Fed has hiked interest rates and investors have sought refuge from volatile global markets. More surprising has been US equity outperformance. Despite its very high valuations coming into the year and huge tech-sector, US equities have clawed their way ahead of international peers in recent weeks. This has been helped by signs of a coming US inflation and interest rate peak and relief that second quarter earnings have not been weaker. This is a continuance of over a decade of US outperformance. Despite this, there has not been a single year in that period when US has been the top performing developed market.

Pros of international diversification include lower valuation and correlations

Overseas markets do offer a broader investment opportunity set, lower valuations, and diversification – with a low correlation of returns versus the US. Some ‘international’ diversification is possible by owning US companies with large overseas businesses. However only 30% US company revenues come from overseas, one of world’s lowest proportions (UK is twice as high, for example). International also offers more sector diversification, with ‘tech’ 40% of US markets, double rest of world. Our current preferences are for the UK (ISF.L), with its low valuations and defensive index composition. Similarly, Japan (EWJ), with many of Europe’s attractive aspects of low valuations, globalised and cyclical corporates, but without soaring inflation and a war. And China (MCHI), seeing a growth recovery and with room to cut interest rates more.

…but also Cons – macro economic risks, currency, government intervention, and capital controls

International investing also involves some extra risks, even if they can be reduced by diversification and research. These include 1) Currency, seen this year with most currencies slumping against the dollar. 2) Economic stability. From emerging market stresses like Sri Lanka, to broader recession concerns across Europe. 3) Corporate governance and intervention risks are often higher globally than in the US.

The weight of the US in the world (% total)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks alongside the Fed hiking cycle is boosting uncertainty and weakening markets. We see this as slowly fading, the global growth outlook secure, and valuations more compelling. Focus on cheap cyclical and defensive assets within equities, like Value, plus commodities, crypto. Relative caution on fixed income and the USD. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing strong c4% GDP growth and resilient earnings growth outlook. Valuations have now fallen back to average levels, and are supported by peaked bond yields and high company profitability. Fed interest rate risks are now well-priced. See cyclicals and value catch-up, after lagging for a decade, whilst big-tech supported by structural growth outlook. See overseas markets leading in global ‘U-shaped’ rebound. |

| Europe & UK | Favour defensive and cheap UK equities (‘Economies are not stock-markets’) over high risk/high return continental Europe. Recession risks rising with Russia and energy crisis, threatening to overwhelm ‘buffers’ of rising fiscal spending (defence and refugees), low interest rates (slow to raise ECB), and weak Euro (50%+ sales from overseas). Equities cushioned by greater weight of cheap cyclical sectors, lack of tech, and 25% cheaper valuations versus US. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. More cautious rest of EM on rising rates and strong USD. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | Core positions as macro risks rise and bond yields are better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | Cyclical sectors, like consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, are cheap and attractive in a ‘slowdown not recession’ scenario. Are sensitive to re-opening economies, resilient GDP growth, and higher bond yields, with depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Benefits from higher bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and room for large dividend and buyback yields. But is being outweighed by rising recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversifieds (like Berkshire Hathaway) least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In ‘sweet spot’ of robust GDP growth, ‘green’ industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 16th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.