Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and a weekly ‘special’.

AI profits boom justifying the valuations

Artificial intelligence is moving from investment hope to reality, as a general-purpose technology with the fastest user adoption in history. We see three AI investment strategies: suppliers (like NVDA), enablers (like CAN), and users (like WMT). Semiconductor giant NVIDIA has led the way in the AI charge, with profits outlook surging 3x this year, cutting its valuation to ‘only’ 35x P/E. With S&P 500 valuations full the rally is all about the earnings rebound. @AI-Revolution. See Page 4

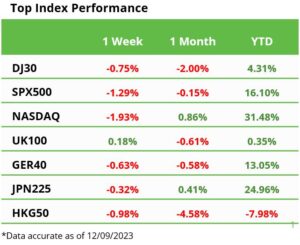

September starts with a slump

Tech stocks led markets down on headwinds of 4.3% 10-year bond yields and $90/bbl. oil, as US economy surprisingly strong and China stimulus continued. The S&P 500 fell below 50-day moving average, and BX and ABNB joined index. Poland first European country to cut interest rates. AAPL hit by China iPhone curbs. Weight-loss NVO now Europe’s largest stock. See Q3 Markets Outlook HERE and at twitter @laidler_ben. See Page 2

US growth is as good as it can get

Q3 GDP growth is tracking highs not seen in 40-yrs ex-pandemic. A inevitable ‘soft landing’ slow down should take sting out of bond yields and help long duration assets like tech. See Page 2

Why interest rates aren’t working yet

The US a global outlier with its high level of fixed interest rate and long maturity corporate and consumer debts. Only delays impact of Fed’s interest rate upcycle on economy. See Page 2

The twin threat from higher oil prices

It’s $100bn US consumer tax and raising inflation fears but will self-correct as triggers slowdown fears. US gas prices exacerbated by its low taxes, car inefficiency, and huge mileage. See Page 2

Space is booming but difficult

Objects launched soaring on flywheel of lower costs and miniaturisation. Investable universe broadening from rockets to imaging even as space ETFs serial underperformers. See Page 2

Easier for companies to own crypto

Crypto stabilises, even as trading volumes and VC funding now at multi-year lows. Better news from the US accounting standards board making easier for companies to own crypto, ARK and Van Eck filing to launch spot Ethereum ETF, and UK FCA pushing back tougher marketing rules. See latest Weekly Crypto Roundup. See Page 3

Oil hits year-to-date high over $90 per barrel

Oil rally offsets the stronger dollar and global growth fears. Brent was boosted by Russia/Saudi extending production cuts, China stimulus, and inventory falls. Ag markets disrupted by supply concern and El Nino. OJ hits high on Brazil citrus disease. Lithium consolidation builds with ALB 100% premium bid for LTR.AX. See Page 3

The week ahead: Inflation, Apple, ARM

1) US inflation (Wed) most important number in markets. 2) AAPL iPhone 15 launch (Tue) and ARM biggest IPO of year (Thu). 3) Big tech ADBE and ORCL earnings plus Zara owner ITC.MC, CPRT, LEN. 4) Friday is ‘triple-witching’ high volume futures and options expiry. See Page 3

Our key views: A positive markets breather

Market seeing breather after strong 1H, with weaker seasonality, low volatility, and coming growth slowdown. But fundamentally positive on lower inflation and coming rate cuts. Focus on defensive growth and long duration assets from healthcare to big tech. Cautious growth exposed cyclicals, commodities, and banks. See Page 5