Please see this week’s market views from eToro’s global analyst team. The full 5-pager includes latest market data, the house investment view, and ‘special’ on the investment outlook for May.

Bracing for further May volatility

Markets may be set for further tests, but not to be broken, in May. By shifting US rate cut outlook and the typically weaker seasonality. April saw overdue pullback with vice of repricing rate cuts and overbought technicals. May set to see NVIDIA-driven earnings season end, Fed rate cut relief potential, and the ongoing heavy political calendar. But earnings, rate cut, and cash on sidelines bull market pillars remain. See Page 4

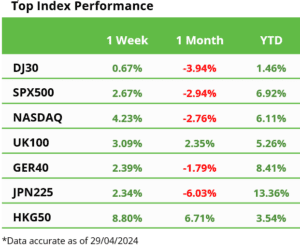

Big tech drives best week since October

Big tech’s GOOG, MSFT, TSLA results drove the best week of S&P 500 index performance since October. Offsetting disappointing META outlook, and poor US Q1 GDP and stickier PCE inflation. Saw a stronger dollar and higher bond yields. BHP bid for AAL in major mining deal. RMS.PA saw luxury sales soar. RBRK continued the IPO market recovery. See our new Q2 2024 Outlook HERE and twitter @laidler_ben. See Page 2

Where valuations matter

High US and tech valuations limit their long-term upside, whilst rest of world, and many cyclicals, have a double earnings and valuation upside and clearer rate cut and growth catalysts. See Page 2

IPO thaw a mixed blessing

Gives investors more choice but undermines the supply deficit that supported markets. The new wave is different with less profits and floats and more foreign co’s and dual classes. See Page 2

Changes to super-sized US market plumbing

US markets dominate, making next month’ trade settlement change and 24/7 trading proposals important for all, especially the largest listed stock and derivatives exchanges. See Page 2

A pricier cup of coffee is coming

The coffee price surge follows OJ and cocoa and makes ag best performing segment. Consumers set to feel as Starbucks to Nestle continue price rise strategies. @AgriWorldWide. See Page 2

Crypto moves on from the Bitcoin halving

Bitcoin resilient after four-yearly halving and in face of global markets volatility and lower ETF inflows. Focus shifts to SEC Ethereum ETF decision due next month, with expectations low. BTC and ETH ETF’s set to launch in Hong Kong. Tether to expand beyond USDT. See latest Weekly Crypto Roundup. See Page 3

Commodities firm despite macro headwinds

Commodities resilient even US dollar and bond yields rose, as demand for traditional inflation hedges built. Brent rose to $90/bbl. whilst natgas fell toward 25-yr lows. Copper in the spotlight as prices hit two-year high and BHP takeover bid for big miner Anglo American. Ag outperformed with higher OJ and coffee supply-crises. See Page 3

The week ahead: APPL, AMZN, Fed, Jobs, May

1) Q1 earnings halfway point w/ 150 S&P 500 co’s reporting this week incl. AAPL (Thu), AMZN (Tue) focus plus KO, MCD, LLY, MA. 80% beats so far. 2) US focus on high-for-longer Fed meet (Wed) and 200k jobs report (Fri). 3) Better EU Q1 GDP and 2.5% April inflation (Tue). 4) End of April (Tue) and look to May. VIK IPO. BRKb AGM. See Page 3

Our key views: Outlook for a different 2024

We see a stronger but very different 2024. Lower inflation and coming interest rate cuts as growth slows, and the earnings outlook idiosyncratically accelerates. Will drive an investor rotation from 2023 US and big tech winners to soft landing losers from Europe to cyclicals. See Page 5

,