Hi Everyone,

For the past 20 years, global financial markets have paid close attention to the Federal Reserve Bank of Kansas City’s annual symposium in Jackson Hole. They have good reason to. Jackson Hole has often been used as an opportunity by various central banks to indicate potential changes in monetary policy. With the bond yield inversion, the escalating US-China trade war and global recession fears, this week’s event has become very important. There is a growing expectation that the Fed Chairman Jerome Powell could use his opening address as an opportunity to announce the readiness of central banks to reduce interest rates further. This week’s gathering could provide the trigger for some volatility across US equities, US Dollar currency crosses and commodities such as gold, silver and crude oil.

Link: Bloomberg Article

The Day Ahead

All eyes and ears today will be focused on Fed Powell’s speech at Jackson Hole which is scheduled for 15.00 BST. As for economic data releases, Japan’s Consumer Price Index for July is forecast to come in at 0.5% from previously published 0.7%. This afternoon we have the US home sales data for July and the Baker Hughes US oil rig count.

Traditional Markets

The US yield curve inverted once again yesterday. This is the third ‘recession indicator’ in less than two weeks. During their interviews on CNBC, Kansas City Federal Reserve President Esther George and Philadelphia President Patrick Harker stated that they don’t see a need for another rate cut which is contradictory to current market expectations. US Markit Manufacturing PMI data yesterday came in at 49.9, below expectations of 50.5. This important economic data point showed that the US manufacturing sector was in contraction for the first time in nearly a decade.

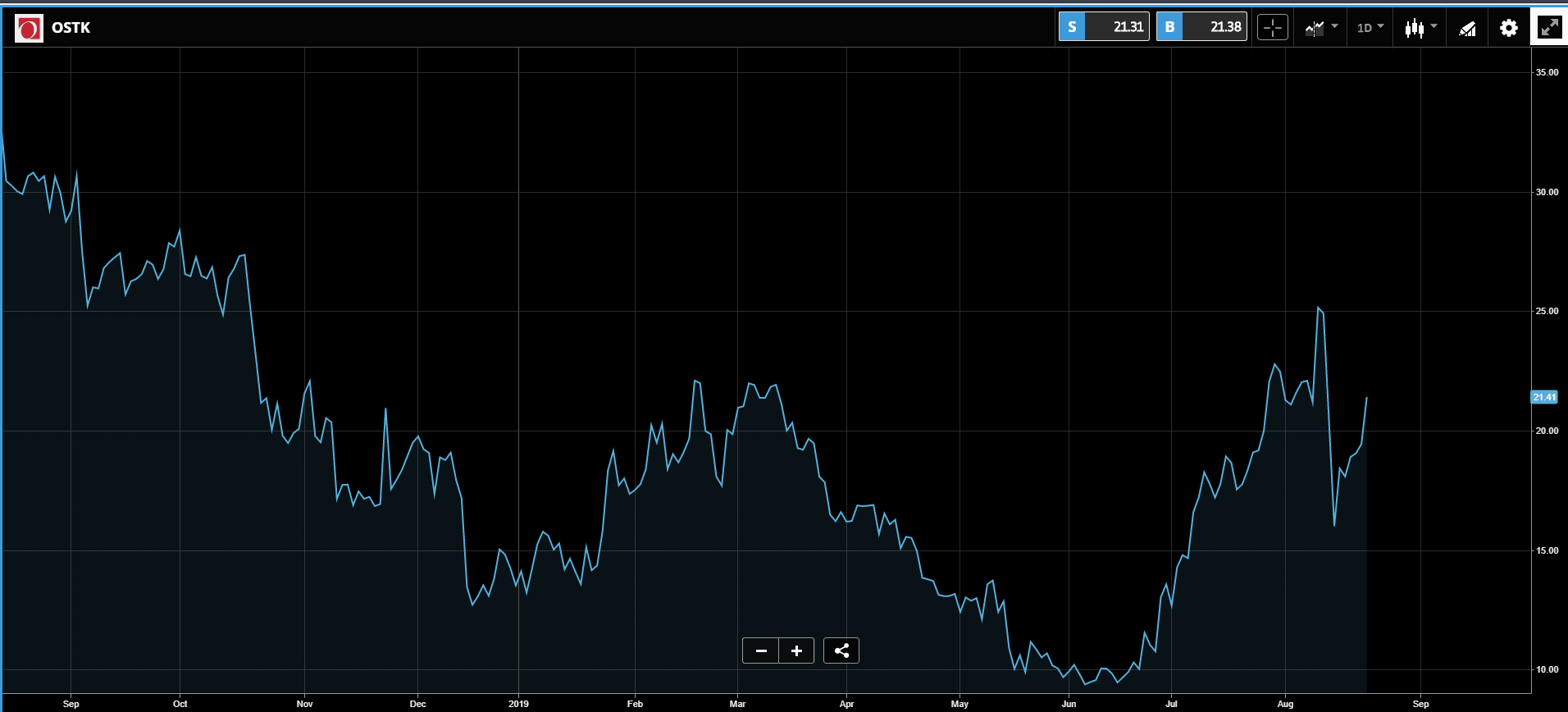

Overstock.com (OSTK) – CEO Partick Byrne resigned from the e-commerce company on Thursday with immediate effect, 10 days after his press release about his role in the ‘Deep State’. He said that he was “far too controversial” to serve as CEO. Shares rose as much as 17% after being halted for the news. Shares were up 10.20% later in the afternoon.

L Brands (LB) – The retailer reported an adjusted quarterly profit of 24 cents per share for the second quarter, 4 cents a share above estimates. However, sales came in below forecasts and L Brands issued a weaker-than-expected current-quarter earnings outlook as sales at the Victoria’s Secret chain continue to decline. L Brands maintained its full-year earnings forecast.

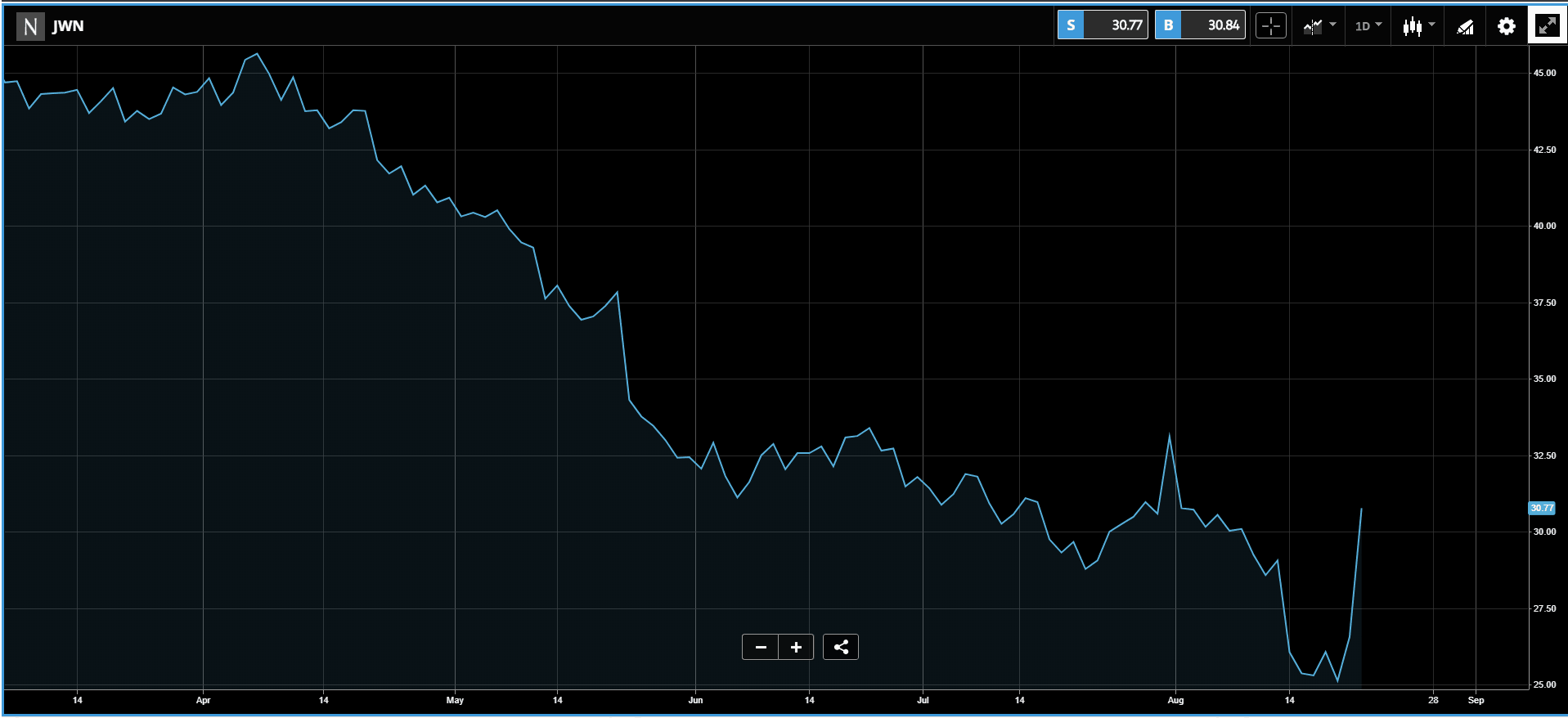

Nordstrom (JWN) – The department store company’s share price rallied 15.70% after earnings. Nordstrom beat estimates by 15 cents a share, with quarterly earnings of 90 cents per share. Revenue, however, was slightly below forecasts. Nordstrom said its bottom line received a boost from lower expenses and inventory reductions.

Dick’s Sporting Goods (DKS) – The sporting goods retailer earned $1.26 per share for the second quarter, 5 cents a share above estimates. Revenue also beat forecasts. Comparable-store sales rose 3.2%, compared to a consensus forecast of 1% from analysts surveyed by Refinitiv. Dick’s also raised its full-year forecast.

Hormel (HRL) – The food producer came in a penny a share ahead of expectations, with quarterly earnings of 37 cents per share. Revenue was essentially in line with expectations. Hormel’s results took a hit from weakness in its grocery segment.

Splunk (SPLK) – The cybersecurity company reported an adjusted quarterly profit of 30 cents per share, well above the 12 cents a share consensus estimate. Revenue also exceeded Wall Street forecasts, and Splunk raised its full-year revenue guidance. Separately, the company announced the acquisition of cloud-monitoring software maker SignalFX for $1.05 billion in cash and stock.

Macro

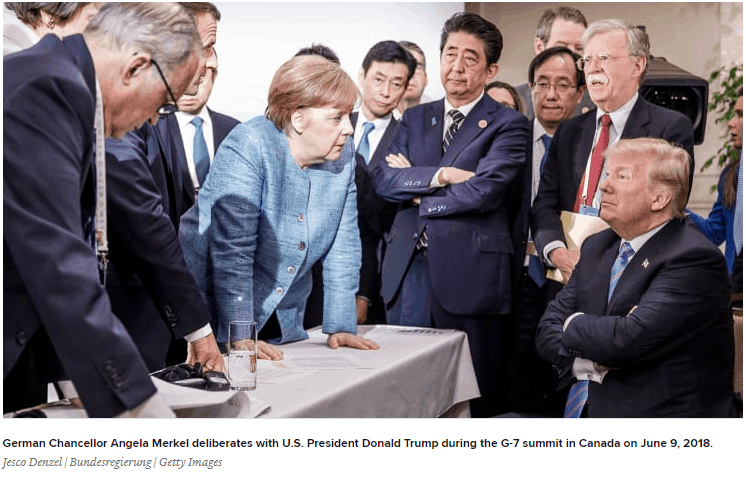

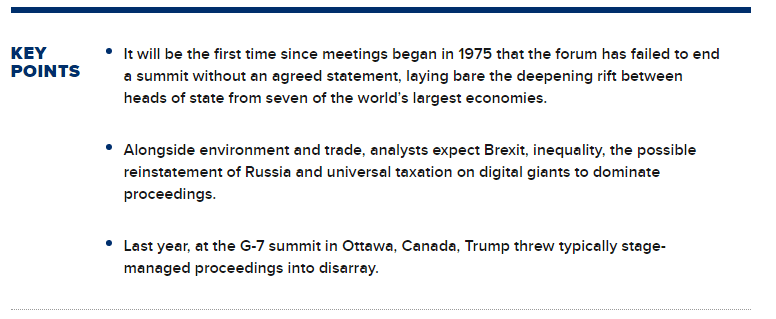

The annual G-7 summit begins tomorrow in Biarritz and will bring together the leaders of Britain, Canada, France, Germany, Italy, Japan and the United States. This time the format has been adjusted to include the leaders of the African Union, IMF, OECD, UN and World Bank. Key topics for discussion include: foreign policy and security affairs, trade, Africa, inequality and women’s empowerment, climate change and the oceans, as well as digital transformation.

Link: CNBC Article

Crypto

The Security Service of Ukraine (SBU) has arrested power plant operators for mining cryptoassets in the Yuzhnoukrainsk nuclear power plant facility. English-language Ukrainian news site UNIAN reported the details of the arrest on Wednesday. According to the news site, the crypto miners compromised the nuclear facility’s security with their mining setup’s internet connection which reportedly resulted in the leak of classified information on the plant’s physical protection system.

Link: Cointelegraph.com Article

Blockchain Capital’s Bogart told Bloomberg that bitcoin will become a safe haven long term in an interview you can watch here.

Bogart believes that bitcoin will be worth a lot more in two to five years, however, he doesn’t believe bitcoin will perform well from a price perspective in the event of a severe economic crisis. He added the important caveat that he was not convinced that we have a full economic crisis on the horizon.

On Libra, he believes that lots of the Libra partners and other large financial institutions and tech companies had been taking a “wait and see” approach to crypto as a whole and Bitcoin in particular. That said he thinks that Libra has really “kick-started” things and companies now realise they need to start being proactive because if they are not, someone else will be. He believes lots of large financial institutions and tech companies are working on crypto initiatives behind the scenes.

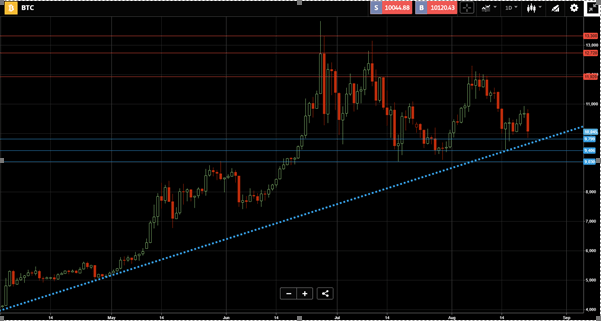

Bitcoin is still trading close to the psychologically important 10,000 level, up 140 points or 1.40% on the day. Big winners in crypto markets yesterday were Cardano (ADA) up 6.70% and Tron (TRX) up 6.10% by the close of trading.

—

Kind regards,

Adam Vettese

UK Market Analyst

E: adamve@etoro.com Twitter: adamvettese

Your Social Investment Network

www.eToro.com

All data, figures & charts are valid as of August 23rd. All trading carries risk. Only risk capital you can afford to lose.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.