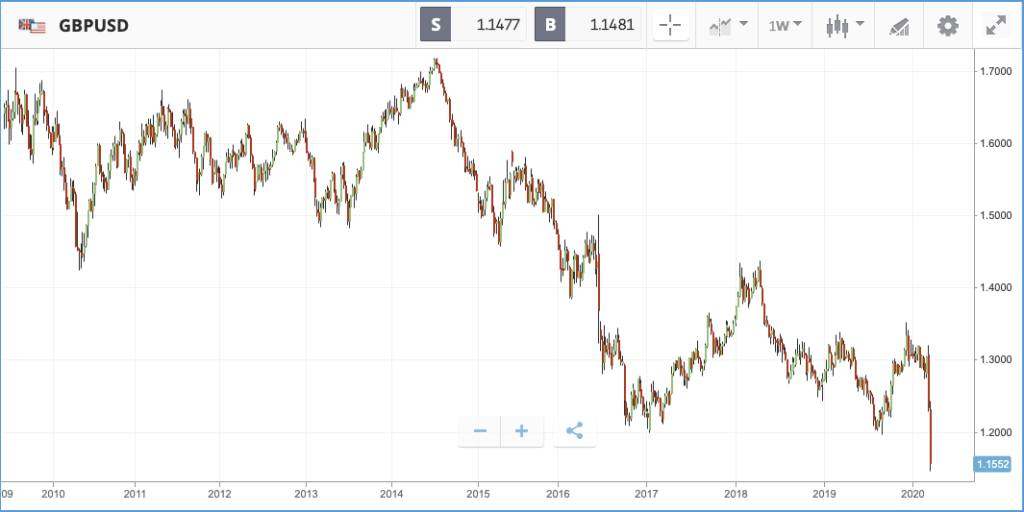

The global market sell off continues as investors shun everything except USD, moving into cash positions. The greenback gained against all other currencies, with Sterling at a 30+ year low against its US counterpart. Stimulus continues to be poured in as governments scramble to throw everything they have at reducing the impact of the coronavirus outbreak.

In Europe, the ECB announced a €750bn emergency coronavirus package to buy government and company debt across the Eurozone. Dubbed the “Pandemic Emergency Purchase Programme” bank boss Christine Lagarde said there were no limits to what the European Central Bank would do to defend the euro, but it remains to be seen if it will further quell wider turmoil.

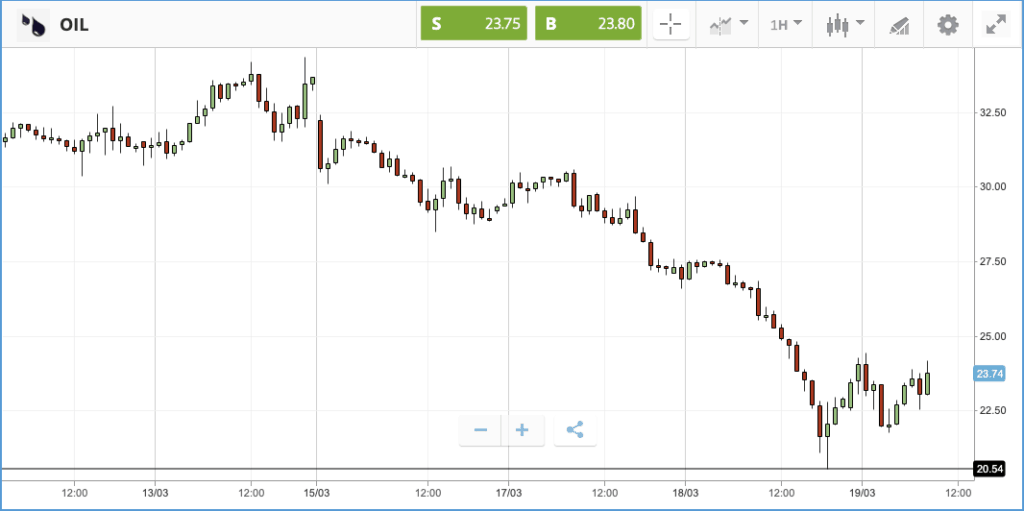

Oil bounced back 13% this morning, although yesterday saw it fall to almost $20 a barrel to hit its lowest price in almost two decades as stocks and bonds sold off in tandem. Investors even fled traditional safe havens such as US Treasuries and gold, with the latter falling below $1,500 an ounce, down from more than $1,600 a week ago. This marks a new phase of the bear market, as so far heavy stock sell-offs have been accompanied by investors piling into Treasuries, sending yields tumbling.

Fresh oil price pain sent energy firms reeling; in the US Chevron sank 22%, while in the UK both BP and Royal Dutch Shell fell double digits. One Wall Street analyst, Paul Sankey of Mizuho Securities, claimed that oil could go much lower from here — even below $0 a barrel. His thesis is that oil comes with storage costs, and if the economic impact of the current pandemic crushes oil demand, producers could theoretically pay customers to take it off their hands. Sankey’s viewpoint is an extreme one, but he is not the only analyst warning that, with tumbling demand and OPEC’s product limit deal with Russia in tatters, surplus oil could become a major issue. In other pandemic news, General Motors, Ford and Fiat Chrysler all announced they will close their factories, with GM and Ford reportedly in talks to utilise the empty production lines to make ventilators. Meanwhile, Starbucks set out to reassure investors, with CEO Kevin Johnson telling shareholders in a meeting that the protocols it used to combat the virus in China will work elsewhere.

Boeing ‘on the brink’

In the US, the Dow Jones Industrial Average was the hardest hit of the three major indices on Wednesday, closing 6.3% lower, with Chevron, Boeing and Travelers the biggest losers. Boeing fell another 17.9% despite rumblings of a government bailout for airlines and aerospace firms, taking its one month loss close to 70%. High profile hedge fund manager Bill Ackman described Boeing as being “on the brink” in a CNBC interview yesterday and said that it will not survive without a bailout. The aerospace firm was already swimming in troubled waters thanks to its grounded 737 Max airliner. If the firm were to go under, the impact would be enormous — the company employs around 150,000 people, with many of those in high skill, high salary roles. Investors are now waiting anxiously to see the details of the stimulus package currently being assembled by the Trump administration and congressional leaders. Daily life in major US cities has been grinding to a halt, with more locations beginning to enact ‘shelter-in-place orders’, and businesses beginning to feel significant pain. Outside of virus news, payment technology company Square had its application to start a bank in Utah approved, allowing it to offer loans to the merchants who use its equipment to process their payments.

S&P 500: -5.2% Wednesday, -25.8% YTD

Dow Jones Industrial Average: -6.3% Wednesday, -30.3% YTD

Nasdaq Composite: -4.7% Wednesday, -22.1% YTD

UK mid caps continue to plummet

On Wednesday, smaller UK companies continued to plummet faster than their large cap counterparts. The FTSE 250 closed 6.6% lower, taking its year-to-date loss past 40%. The FTSE 100 has lost 32.6% in 2020 so far. Sterling played a role, as it sank below $1.15, putting the currency at multi-decade lows. This helped cushion the sell-off blow for the FTSE 100, the constituents of which make most of their money overseas.

Gambling firm William Hill was one of the biggest fallers in the FTSE 250 after another brutal day. Its share price sank 24.3%, taking its monthly loss past 80%, as investors weigh up the prospects for the stock now that sporting events have been cancelled en masse. In the FTSE 100, cruise firm Carnival was the biggest loser, falling 34.2% on fears that cruise firms may be left out of the White House’s bailout plans (Carnival is dual listed in New York and London). A large number of other FTSE 100 firms posted double digit losses on Wednesday, but one to pick out is Rolls Royce, which fell 10.8% and is now down close to 50% over the past month. The firm, which makes jet engines, is heavily exposed to the fortunes of the aerospace and airline sectors.

It was also reported on Wednesday that the UK government is considering a partial lockdown of London to halt the spread of the disease, as there are concerns residents are not listening to advice to remain at home.

FTSE 100: -4.1% Wednesday, -32.6% YTD

FTSE 250: -6.6% Wednesday, -40.6% YTD

What to watch

Initial jobless claims: One data point to watch today will be the weekly initial jobless claims figure put out by the US Department of Labor. With restaurants, bars and other businesses in many major cities all having shut down, the number will give some insight into whether employers facing disruption have reached the point of laying off workers, and an inkling of the scope of the economic disruption to come. There is the potential for a major spike.

UK retail sales: Retail sales figures for February will also be published on Thursday. Similar to the US, any coronavirus impact feeding through into the numbers is likely to be minimal given when the data will have been collected, but there may still be early signs of an impending slowdown which will be watched closely.

Accenture: Consulting giant Accenture will report its latest quarterly earnings on Thursday morning New York time. The company has been moving broadly in line with the market, given that it’s consulting work extends into a huge range of sectors; it counts three quarters of Fortune 500 companies as its clients. Accenture stock had a big 2019, climbing more than 50%, and currently 20 Wall Street analysts rate it as a buy or overweight, six as a hold and one as an underweight. Aside from the spotlight that analysts will undoubtedly shine on how the pandemic is affecting its business, the firm’s intelligent platform services business will likely be a feature of the call. The service combines cloud, machine learning and other services from firms such as Microsoft and Salesforce. It accounts for 40% of revenue, and grew double digits last year.

Crypto corner:

The world’s three major cryptoassets outperformed wider markets on Wednesday, falling initially but recovery later in the day.

Bitcoin traded down to near $5,005 in the midmorning before ending strongly up. It is trading around $5,450 early this morning. Meanwhile, Ethereum experienced similar movements reaching a low of $109.03 at lunchtime before climbing back. It is moving around £118.46 early today. Finally, XRP bottomed at $0.1384 before rebounding to trade at $0.1468 early on Thursday.

As we have seen the wider market flock to buy dollars, it stands to reason USD backed stablecoins are holding their own in the midst of the general sell off. Stablecoins have their value pegged to a fiat currency and allow crypto traders to temporarily offset risk without having to liquidate back into fiat which takes time.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.