Please feel free to sign up to watch this month’s recorded webcast here.

From the global trade wars to Brexit to the crypto bear market, it’s a very exciting time to be trading. Many analysts are now saying that the end of the economic cycle may be near. With volatility comes opportunity and in this webcast, we’re going to sum up what’s been driving the markets in 2018 and give a forecast of what to expect in the New Year.

What we will cover today:

- What did happen in 2018

- What is driving the markets in 2019

- Why is the market more volatile

- Stocks

- Crypto

2:02min | BREAKING NEWS – ETC Hacked

4:02min | Bear market and how it affected ETC

7:58min | Platinum member webcast on a monthly basis

9:21min | eToro Club Benefits

- The Platinum+ Club, start by raising your equity to $50,000

- Access unlimited articles on FT.com

- Email Alerts with breaking news from the Financial Times

- Daily Emails with the top news stories from the Financial Times

- Regular trading updates from our Senior Market Analyst and Webinars

- Free access to Trading Central Platform – which you can learn more about here.

12:35min | Trading Central is a leading provider of Technical Analysis

As part of the service, you will receive:

Newsletter: Sent twice a day just before European and US markets open with updated technical analysis on

BITCOIN, GOLD, DAX, DOW JONES, EUR/USD, USD/JPY, USD/CHF, GBP/USD

Online Portal: A complete portal with technical analysis on 25 FX / Bitcoin / 3 commodities / 6 Indices + 400 STOCKS + 20 ETFs

The following cryptos are included: Litecoin, Dash, Ripple and Ethereum.

15:23min | Question – Quick Review of Netflix during a survey

18:24min | What is moving the markets – Central Banks

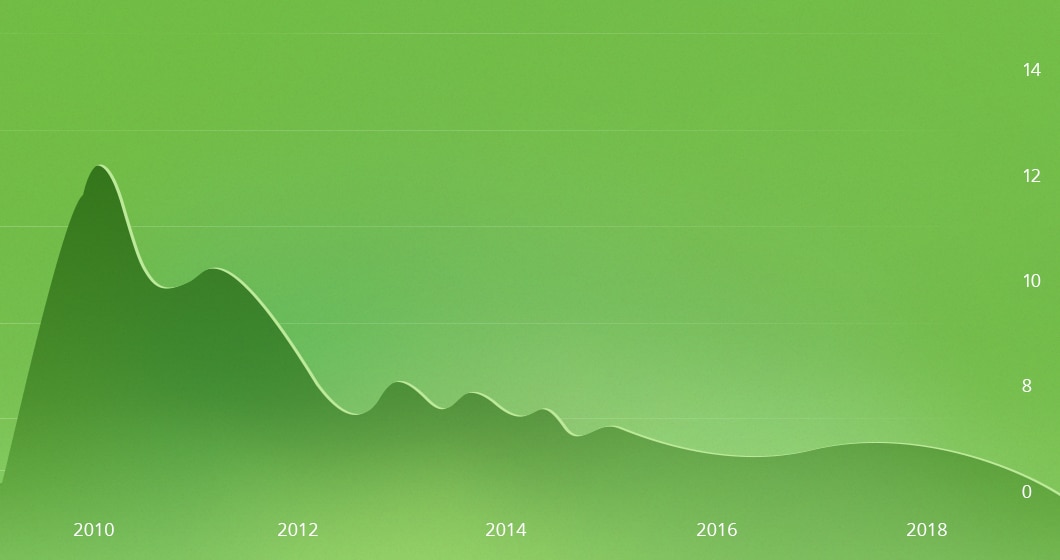

19:57min | USD Interest rates

US Interest Rates

22:14min | Quantitative easing and tightening explained and how it is bringing volatility

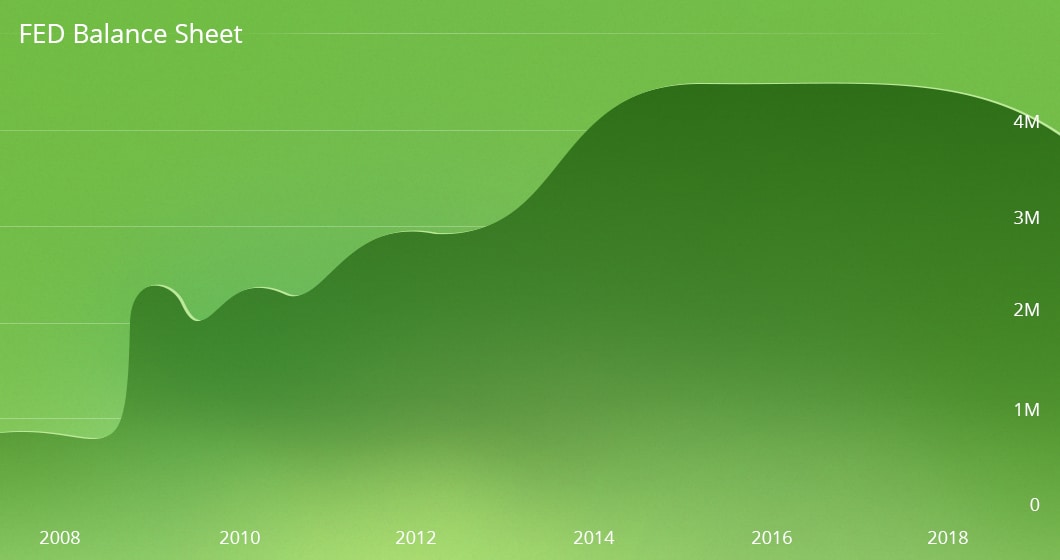

FED Balance Sheet

26:53min | What about Crypto in a Stock bear market?

28:03min | Review of VXX Volatility index

30:00min | Question: Could crypto surpass gold

31:00min | Question on: What is DApp Development – decentralised application development site discussed: https://www.stateofthedapps.com/stats

34:30min | US Government shutdown and China trade war

35:52min | Data coming out of China – https://tradingeconomics.com/china/gdp-growth-annual

36:57min | Emerging markets and August economic tightening. Review of the Turkish Lira

38:06min | Review of EEM – Emerging markets ETF

39:35min | Bear trend risk and Matis Portfolio: http://etoro.tw/Mati

40:46min | Review of the DJ30 and NSDQ100 and the exposure to risk

45:32min | Question about Oil, now that the Jamal Khashoggi case is nearly over after Saudi Arabia commenced prosecutions, do we expect OIL WTI to go back to the $60s? Answered with a technical review of Oil.

50:12min | Brexit and big events reviewed

53:40min | The Yellow Jackets and their impact – Can this be an indicator for 2019?

56:18min | Copying GainersQtr vs. the market – This Smart Portfolio has performed in a resilient way over the past 3 months, especially when taking into account that the market suffered its worst December since 1931.

57:56min | Review of different Popular Investors and a sneak peek at a new Smart Portfolio MobilePayments.The newest addition, MobilePayments, focusing on stocks from the online payments space, is now open for investment. Read more about it here.

zsyuan – This Popular Investor from China trades mostly currencies, diversifying with some assets from other classes. He has been on eToro since early 2017 and claims to have 7 years of experience. He holds trades open for 1.5 weeks on average and refreshes his portfolio more than 9 times per week.

Harshsmith – This Popular Investor says he is a full-time investor, who adapts to markets by changing strategies. He trades mostly stocks, and uses technical analysis for day trading and fundamental analysis for long-term trades. He recommends copying him with at least $1,000, and not to copy open trades.

18610274070 -This Chinese Popular Investor says he started trading 12 years ago, when he was still in high school. While only trading on eToro since mid-2018, he has managed to gather a following of copiers. He recommends copying him with at least $500, for at least 6 months, and to copy open trades.

60:00min | ETH Fork discussed, Constantinople will be implemented as a hard fork on Ethereum. If you’re not 100% sure how forks work, please review this short explanation now.

Ethereum Classic Hacked! – Not to be confused with Ethereum, Ethereum Classic is a legitimate fork of Ethereum. A disagreement among the community back in 2016 led to a chain split. Since then, Ethereum Classic (ETC) has not done too well, especially when compared to her sister Ethereum (ETH).

Last night Coinbase put out the following alert on Ethereum Classic.

63:55min | XRP

69:27min Questions about the Platinum club. You are able to upgrade to the Platinum Account by reaching 25,000USD in equity, the benefits of a Platinum Account are as follows:

- Personal Account Manager

- No withdrawal fees

- Faster customer service

- Regular trading videos and Webinars

- Regular trading updates from our Senior Market Analyst and Webinars

Please see the full list of benefits here.

69:53min | Tokenisation – The ability to create a digital token that represents a financial asset is just around the corner. This is only the beginning. Over the next decade, we could very well see the tokenisation of the entire financial market. Essentially, anything that has value and can be traded, can be represented as a digital token and traded on a blockchain.

70:49min | Question on XRP What’s your view on Ripple releasing xrapid and their future adoption? How bullish are you on XRP? And have you read Ripple’s future forecast report around adoption?

We hope you enjoyed the webcast. If you have any feedback or comments, please feel free to connect with Mati Greenspan on all social media channels: eToro, ,Twitter, LinkedIn, Telegram.

eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptocurrencies can fluctuate widely in price and are, therefore, not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework. Past performance is not an indication of future results. This is not investment advice. Your capital is at risk

Data presented during the webcast is accurate as of January 8th, 2019.