Please feel free to sign up to watch this month’s recorded webcast here.

As expected, geopolitics has played a huge role in the financial markets lately. Even the central banks, the largest players in the market, have stood by watching. Now that we’re moving closer to a resolution of some of the main themes, let’s take a look at the markets from the unique perspective of our senior market analyst, Mati Greenspan, who will review with you the latest trends of stocks, commodities, currencies and crypto.

What was covered:

- Trade Wars Update

- Central Banks Looser

- Turkish Lira

- Wash Trading

- AltSeason is upon us

- CopyTrader Battle

- Renewable Energy

1:06min Walk-through of your trading portfolio

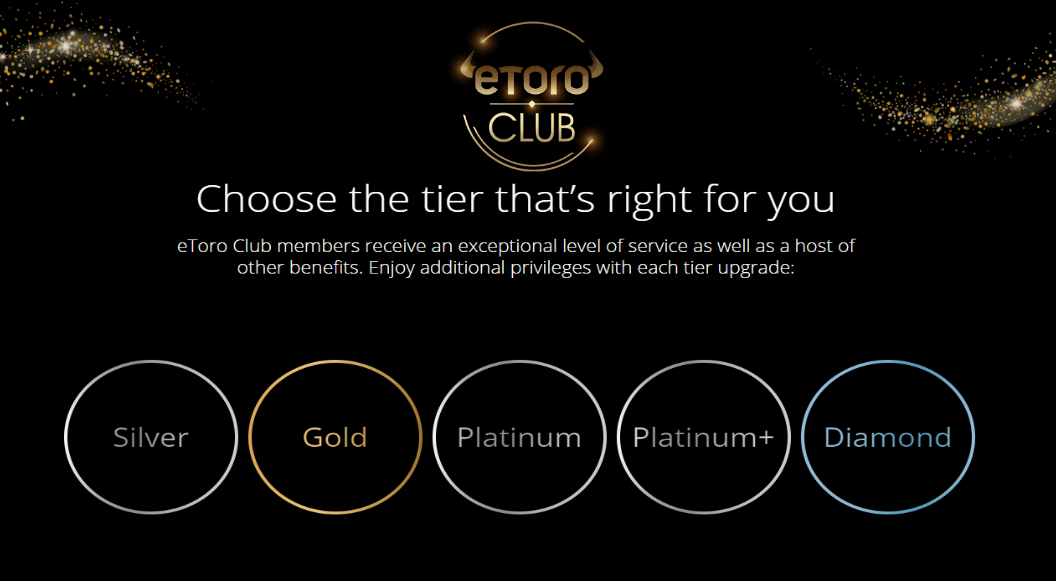

2:11min eToro Club Benefits discussed, refer to here for more information

Some of the benefits discussed are as follows:

- Personal Account Manager

- No withdrawal fees

- Faster customer service

- Regular trading videos and Webinars

- Regular trading updates from our Senior Market Analyst and Webinars

- Access to unlimited articles on FT.com

- Email alerts with breaking news from the Financial Times

- Daily emails with the top news stories from the Financial Times

- Regular trading updates from our Senior Market Analyst and Webinars

- Free access to Trading Central Platform – which you can learn more about here.

For more information please speak to your account manager.

Trading Central is a leading provider of Technical Analysis. As part of the service we can offer:

- Newsletter: Sent twice a day just before European and US markets open with updated technical analysis on: BITCOIN, GOLD, DAX, DOW JONES, EUR/USD, USD/JPY, USD/CHF, GBP/USD.

- Online Portal: A complete portal with technical analysis on 25 FX / Bitcoin / 3 commodities / 6 Indices + 400 STOCKS + 20 ETFs

- The following cryptos are included: Litecoin, Dash, Ripple and Ethereum.

4:30min Trade Wars and what markets they will affect

6:30min Brexit

8:49min Question: A new trader at eToro wants to know when is the right time to collect the profit? is it ideal to claim it every week?

10:26min How to take partial profits from a trade

12:37min GBPUSD reviewed for different Brexit outcomes

15:52min Central banks and how they affect markets. You can see a more in-depth explanation of crypto markets here

16:54min What does Hawkish and Dovish mean

17:51min How did the central banks affect Oil prices

18:36min USDTRY chart reviewed

21min Stock questions and reviews

21:30min Question – Review the Monc.MI stock and Boeing

Question: With respect to the number of plane accidents that Boeing has been experiencing lately, when do think is the right time to buy?

22:40min Boeing chart reviewed

24:19min Question – When is the time to buy on the possible trade agreement as China’s Technology Market is growing bigger and bigger.

24:39 Answer – Buy the rumour, sell the news – China50 chart review and comparison to DJ30, GER30, JPN225 and the NSDQ100

26:30min Question: How big are the chances of global slowdown and stock price correction (downwards)?

Answer: The slowdown has already happened – In depth review

Crypto Review

30:31min Wash Trading

Article referenced – Reported Bitcoin Trading Volume Is Fake

Bitwise was trading report – Presentation to the US Securities and Exchange Commission

37:54min AltSeason and in-depth BTC chart reviewed

47:11min Take on the near future of crypto – Bloomberg Interview discussed.

50:58min How eToro is moving forward with cryptos – eToroX BETA and our new wallet services discussed

52:20min XRP discussed

Battle of the Popular Investors

53min Analisisciclico – This Spanish Popular Investor has been on eToro since late 2017. He is a serial entrepreneur, who says he wants to create value for as many people as possible. According to his bio, he aims to keep a very low risk score, and recommends copying him with at least $1,000 and for at least 3 months.

Kela-leo – According to this Chinese Popular Investor, he works as a senior quantitative investment consultant. He focuses mainly on currency trading and holds trades open for one week on average. He recommends copying him with at least $500.

64min CannabisCare and the Cannabis industry discussed

66:45min Renewable Energy – This portfolio is composed of 22 global companies (11 countries) that represent a variety of renewable energy sectors and most are considered “pure players” (companies whose main line of business is renewable energy).

The time to market is highly relevant, as today the world acknowledges not only the importance of clean energy production but also the technological capability to actually produce mass amounts of gigawatts and connect them to major gridlines.

Please review further information in our Overview, Video. and our Blog Post.

69:57min Question on GBPJPY – Chart reviewed

We hope you enjoyed the webcast. If you have any feedback or comments, please feel free to connect with Mati Greenspan on all social media channels: eToro, Twitter, LinkedIn, Telegram.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk

Data presented during the webcast is accurate as of April 2nd, 2019.