In the film, “King of War,” the protagonist says:

“The world’s largest arms salesman is the President of the United States. He sells more arms in a day than I sell in a year.”

The general consensus was that the decades-long conflict between the United States and Iran would end in 2019, but as 2020 approached, the world was shocked by another event.

On January 3, US forces killed Iran’s Revolutionary Guards “Sacred City Brigade” Commander, Qasem Suleimani. A few days later, Iran, grief-stricken, launched two waves of missile attacks on two US military bases in Iraq, sparking speculations that the United States and Iran are about to go to war.

Speaking at the White House, President Trump announced, “The American people should be extremely grateful and happy. No Americans were harmed in last night’s attack by the Iranian regime. We suffered no casualties.”

The US President took the opportunity to boast about the country’s military power. “US armed forces are stronger than ever before.”

“Our missiles are big, powerful, accurate, lethal and fast.”

“Under construction are many hypersonic missiles.”

“The fact that we have this great military and equipment, however, does not mean we have to use it. We do not want to use it. American strength, both military and economic, is the best deterrent.”

But, apparently, Iran does not want to appear “weak,” and Foreign Minister Zarif said that Iran does not want to go to war, but it will defend itself against American aggression.

Given recent events, both sides have strengthened their defence security and US arms dealers have greatly benefitted from this escalation.

In 2020, political, economic and territorial disputes in various countries are expected to continue to rise. Thus, all countries need to procure armaments and strengthen their defence capacities. At this sensitive time, a number of researchers have concluded that the following defence companies might be able to benefit from this evolving situation.

Lockheed Martin (LMT)

The world’s largest arms manufacturer is Lockheed Martin(LMT) . It is the world’s largest defence industry contractor, primarily for the US Department of Defence, other US federal agencies, and foreign military forces.

On January 1 this year, the company profited from the US-Iran conflict. According to Wind Data Display, LMT secured a US$1.93 billion contract with the US Navy. LMT is also the largest arms seller to the United States Air Force.

According to research data by Huasheng Securities, LMT’s aviation, missile, R&M, and space businesses enjoyed a noticeable year-on-year increase in the third quarter of 2019. Q3 financial data for 2019 also shows that LMT’s total profit in the first nine months was $4.934 billion, a sharp increase year-on-year . The aviation business responsible for the R & D and production of fighter aircraft still accounts for the majority of the profit.

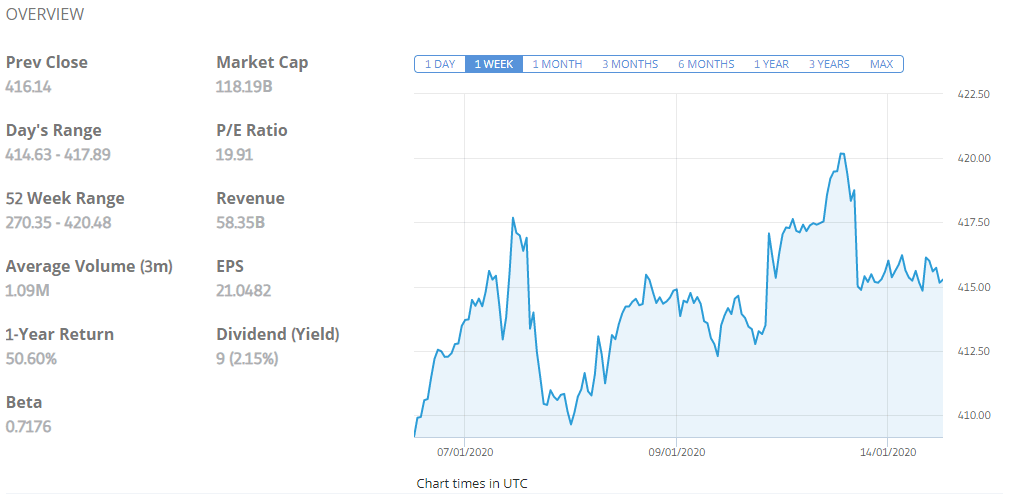

In 2019, Lockheed Martin’s stock price also outperformed the market, with a cumulative increase of 50.86%. For nearly ten years, LMT has remained a proper big bull stock.

The recent crisis shows that drones might be the most cost-effective military weapon in the future. Stimulated by the incidents, drone-related stocks have experienced a strong position in the market. Since last Friday, Northrop Grumman and Lockheed Martin have all risen against the market trend.

According to a report in Jane’s Intelligence Review, from 2016 to 2026, drone stocks are expected to rise from $6.4 billion at an annual rate of 5.5%. If events such as the recent ones in the Middle East continue, drone-related stocks may increase at a much faster rate.

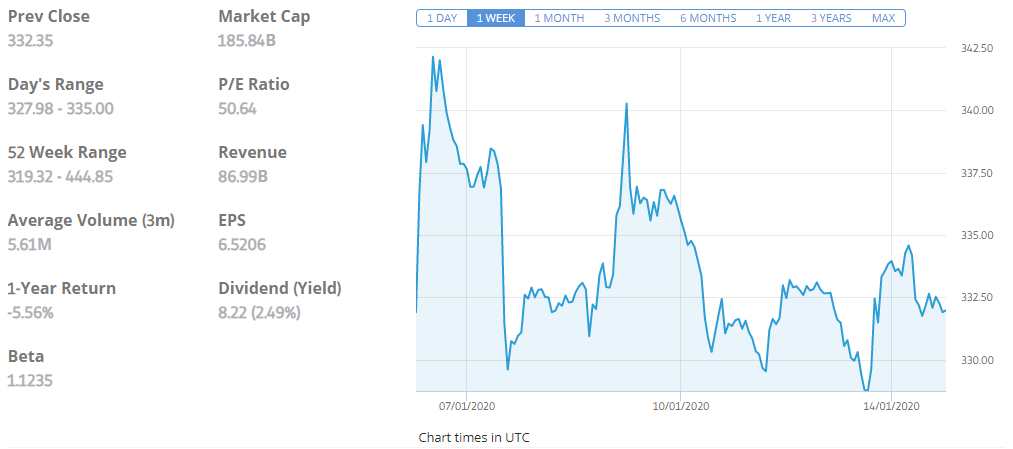

Image data from:eToro

LMT outperformed the S&P 500 in share price performance. Lockheed Martin’s main products include all US Navy submarine-launched ballistic missiles, theatre high-altitude air defence systems, communications satellite systems, and the latest F35 stealth fighter.

“If this war breaks out, it is very likely that the US military will repeat the Iraqi Air Force clearance operation in Iran with F35’s,” according to a report in The New York Times. In addition, drone manufacturer AeroVironment (AVAV) is also gaining popularity as it is developing a larger folding-wing drone.

Huntington Ingalls Industries(HII)

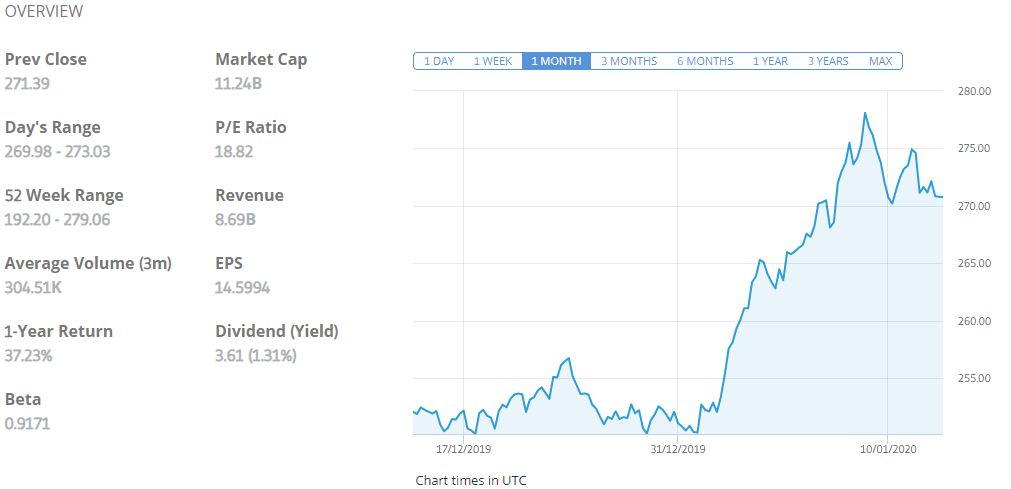

data from the picture:eToro

According to data which analysed the correlation between market returns and major crises in the Middle East since the Gulf War in 1990, defence stocks returned as much as twice the S&P 500 index within six months of those crises. Among them, HII performed very well each time. According to eToro, HII has shown an increase of 9% over the past month.

Ingles Shipbuilding and Newport News Shipbuilding is owned by Huntington Ingles Industries. Ingles Shipbuilding is a supplier and builder of amphibious assault and expedition vessels. Newport News Shipbuilding is an industrial designer and builder of nuclear-powered aircraft carriers. The company also finds itself in a very comfortable position where both Democrats and Republicans are vying for its support in the US presidential election this year.

Earlier this year, well-known Citigroup analyst, Jonathan Raviv emphasised that even if the defence budget does not increase again, defence stocks may still rise. “As usual, defence stocks often benefit from increased awareness of the risks and the potential geopolitical conflicts.”

Goldman Sachs’ October research heralded this year’s rise in the defence sector. Its research indicated that the defence sector is the perfect choice for investing in the current environment. The first stock they recommended to investors was Huntington Ingles Industries.

American Outdoor Brands (AOBC)

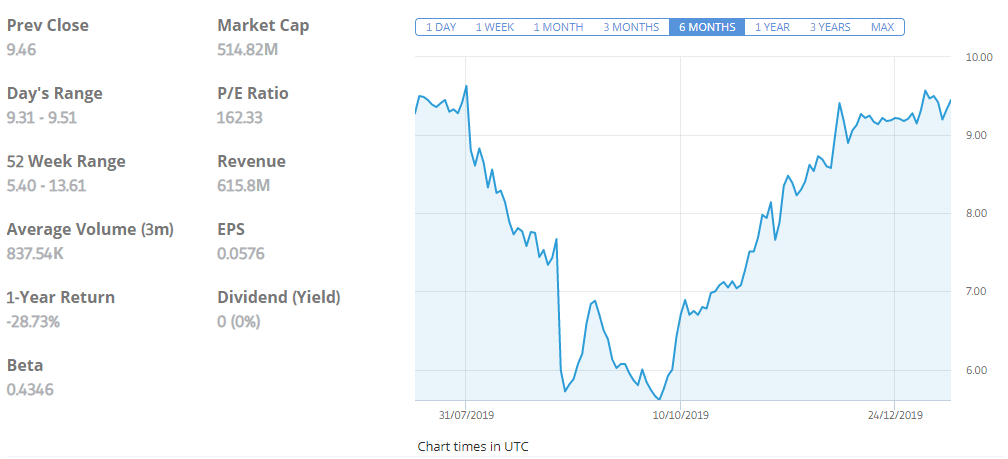

Image data from: eToro

AOBC (American Outdoor Brands Corporation) is a well-known company that manufactures firearms, produces pistols, rifles, shotguns, gunpowder firearms and corresponding accessories. Influenced by events in Iran, AOBC stock rose 9.14 percent on January 8.

Stock performance of AOBC in the last six months. Data from eToro

Based on quarterly reports published by AOBC, the company’s revenue dipped by 11 percent year-on-year in the first quarter of 2019. Both the company’s revenues and net profit last year seemed ordinary at best and the stock underperformed as compared to the S&P 500. The company’s forecasted earnings and sales in the fourth quarter were relatively optimistic, exceeding expectations. eToro data on AOBC shows that the company’s valuation jumped from $2.138 billion on October 21, 2019 to $5.871 billion in January 2020. Analysts estimate that with the recent Iran incidents as a catalyst, the stock price may rise more.

TDG

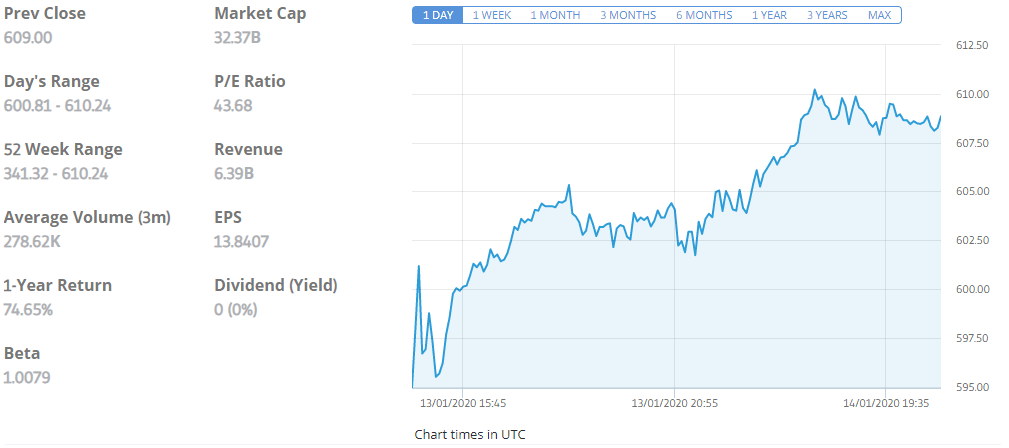

Source: eToro

Trans Digm Group (TDG), a designer, producer and leading global supplier of precision aircraft components, and the leading company of aerospace mechanical and electrical products, will directly benefit from the aforementioned crisis.

Electromechanical systems account for more than half of TDG’s main business. Since it went public 10 years ago, TDG’s stock price has risen steadily more than tenfold. Almost all commercial and military aircraft in service use the company’s products. The company is a vital high-tech patent owner. Since 2017, patented products account for 90% of the company’s net income. The company is the sole supplier of many products that account for 80% of its net profit.

Recently, TDG announced its fourth quarter report for 2019. Net profit from ongoing operations in the fourth quarter was $316 million, a year-on-year increase of 37.2%. SunTrust Robinson Humphrey and UBS both maintain a “BUY” rating for the TransDigm Group.

For this company, selling aircraft makes up only a fraction of its income. During the aircraft’s service life(25-30 years), the company can make continuous profits. As shown in the 2017 financial report, the company’s 55% of net income comes from aircraft after-sales service.

Boeing(BA)

data from the picture:eToro

Boeing has recently found itself stuck in a quagmire: with the 737 MAX aircraft grounded, and the Boeing 737 crash earlier this year, bad news keeps on coming.

However, on January 7 EST,there was a market rumour that Warren Buffett’s Berkshire Hathaway bought 5 billion shares of Boeing. He believes that Boeing has fallen to historical lows and nevertheless, has great investment value.

Fortunately, Iran did not blame the crash on Boeing, but claimed in the media that it was caused by “human factors,” which may be referring to a missile attack. Affected by this news, Boeing stock rallied on January 9, but the stock’s price fell again the very next day.

The first quarter of 2020 looks like it will be a “big start” for the defence sector. At present, the US-Iran conflict continues to ferment, and international tensions may stimulate the production of advanced US military industries, providing a powerful catalyst for the defence sector market. Of course, we still need to pay attention to the company’s new orders, industry prosperity and performance forecasts to understand which company or companies will lead this rise.

Finally, we hope that our users can share their insights with the larger eToro investor community and seize the growing opportunities in the defence sector.