Major Developments for the Week

- Bitcoin climbs 5%, but will Q4 hold the key to momentum?

- Market depth and macro trends point to a potential Bitcoin surge

- As the new generation matures, Bitcoin could experience major growth

- Will Bitcoin’s next move trigger a rally for UNI, OP, SUI and HNT?

- Crypto market braces for volatility ahead of inflation data and Trump-Harris debate

- SEC crypto enforcement in 2024 at $4.7B, up 3,000% year on year

- Could BTC hit $90K if Trump wins election? (Bernstein)

- Is XRP price quietly setting up for a rally toward $1?

- El Salvador marks 3 years of Bitcoin adoption with $31M profit

- Travala.com partners with Skyscanner, enables crypto payments at 2.2M hotels

- Elon Musk’s ‘DOGE’ gov meme sends political speculation soaring

- US companies forecast to buy $10.3B in Bitcoin over next 18 months

- Japanese power giant TEPCO explores ‘green’ Bitcoin mining

Bitcoin climbs 5%, but will Q4 hold the key to momentum?

Historically, August and September have been weak months for Bitcoin, but the fourth quarter, especially October, tends to offer more positive momentum.

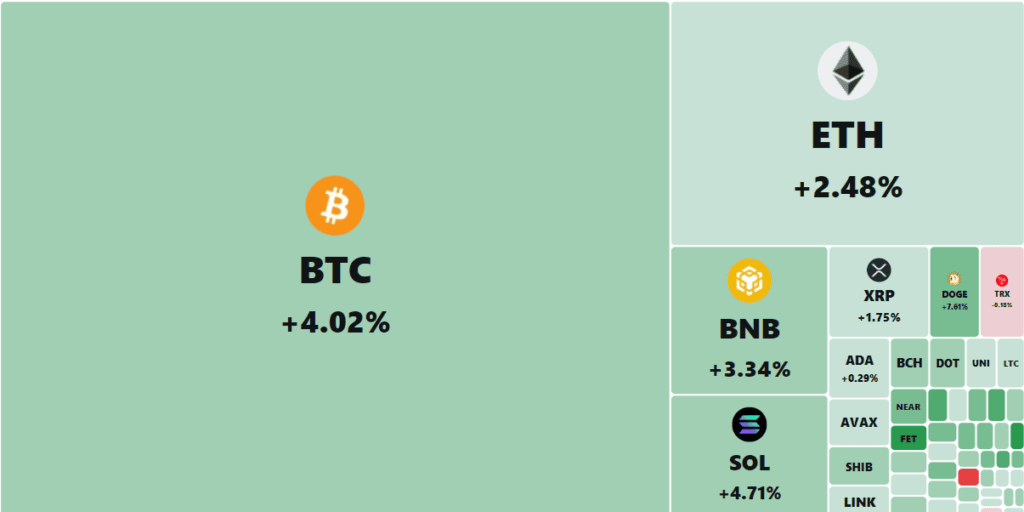

Bitcoin is showing signs of recovery after a challenging start to September, trading just above $57,000, up 5% over the past 24 hours. However, despite this bounce, Bitcoin is still down about 3% for the month and over 20% since its March high of $73,000. The broader market, including U.S. stocks, also saw gains, with the Nasdaq and S&P 500 each rising by over 1%. Ethereum (ETH) remains lagging behind, up only 3%.

Past performance is not an indication of future results

Analysts from NYDIG caution that potential short-term catalysts for Bitcoin remain limited. Historically, August and September have been weak months for Bitcoin, but the fourth quarter, especially October, tends to offer more positive momentum. Until then, Bitcoin’s price movement may be influenced by macroeconomic factors like inflation, employment data, and Federal Reserve policies. Additionally, the upcoming U.S. presidential election could impact the market, with Donald Trump expressing strong support for crypto, while Kamala Harris’ stance remains less clear.

Looking ahead, Bitcoin investors will likely have to rely on external factors and broader market trends for any significant price shifts, with potential positive catalysts being sparse in the near term.

Market depth and macro trends point to a potential Bitcoin surge

Bitcoin’s order book liquidity is showing signs that the recent price decline may be reaching its bottom, signaling a potential bullish reversal. Data from Hyblock Capital indicates a drop in market depth—both near and further from the current market price—over the weekend, a pattern typically observed at market turning points. The reduction in liquidity, which reflects the market’s ability to absorb large trades without significant price movement, suggests traders are hesitant to make decisive moves, a common indicator of a market bottom.

At the same time, Bitcoin’s perpetual futures market shows negative funding rates, reflecting a bias towards short positions. However, as Bitcoin has rebounded to $54,800, up from a recent low of $52,530, there is potential for a short squeeze, which could further drive prices upward as bears close their short positions. Analysts believe the market may experience positive macroeconomic developments, with low interest rates and liquidity injections from central banks creating a favorable environment for Bitcoin and broader crypto markets.

As the global economy struggles to maintain high interest rates, the opportunity for central banks to tighten liquidity has passed. Analysts expect central banks to inject more liquidity into the system soon, which could fuel a new surge in Bitcoin’s price. This combination of reduced liquidity, negative funding rates, and positive macroeconomic factors makes a Bitcoin rally increasingly likely.

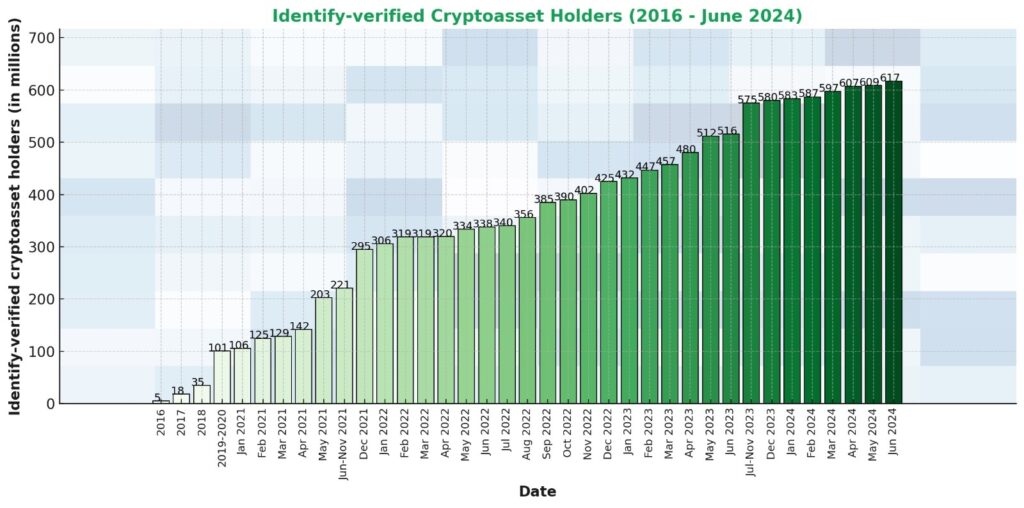

Expert predicts: As New Generation Matures, Bitcoin Could Experience Major Growth

Bitcoin should be a part of everyone’s investment portfolio, according to financial adviser Suze Orman, with its future growth potentially driven by the next generation of investors. As the next generation of investors matures, and earns more, Bitcoin is likely to become one of their investment choices. This rising interest among younger investors could significantly increase Bitcoin’s popularity and, in turn, potentially drive its value higher.

Past performance is not an indication of future results

“As younger people make more money and mature, [Bitcoin] will be one of their investments of choice, and that will cause it to go up.”

Suze Orman, 08/09/24, CNBC Interview

Orman believes Bitcoin’s growing appeal among younger investors makes it a worthwhile addition to portfolios. Acknowledging the energy and fascination younger generations have for Bitcoin, she suggests this enthusiasm could eventually ignite broader adoption. However, she is cautious, advising investors to only commit funds they are prepared to lose.

Will Bitcoin’s next move trigger a rally for UNI, OP, SUI and HNT?

Bitcoin remains below its $55,724 support level, and while selling pressure persists, signs indicate that it might ease, potentially leading to a relief rally. Experts suggest that this shift could occur after the Federal Reserve’s rate decision on Sept. 18, with Bitcoin possibly rebounding due to increased dollar liquidity. The decline in Bitcoin has impacted several altcoins, but some, like UNI, SUI, OP, and HNT, have shown resilience, positioning them for potential gains if Bitcoin rallies.

In the case of Uniswap (UNI), a relief rally could face resistance at $6.74, but if it breaks through, the price may climb towards $8.66. Similarly, Sui (SUI) is approaching a resistance level, and a breakthrough could push it to $1.20, while Optimism (OP) has bounced back, and if it surpasses $1.65, it could reach $2.50. Helium (HNT) is also gaining traction, and if it maintains momentum, it may target $10. Overall, if Bitcoin begins to recover, these altcoins are likely to follow with significant upward potential.

Crypto market braces for volatility ahead of inflation data and Trump-Harris debate

Bitcoin remained stable over the weekend, trading in a tight range between $54,000 and $55,000, despite lower trading volumes and a sudden market drop on Friday following a jobs report.

The broader crypto market also showed limited movement, with major tokens like Ethereum (ETH), Solana (SOL), Cardano (ADA), and Ripple’s XRP (XRP) rising just 0.5% in the past 24 hours. Traders believe Bitcoin is currently grossly undervalued, especially as its hashrate reached an all-time high of 679 EH/s, signaling strong network security. Miners have also been increasing capacity, which historically marks price bottoms for Bitcoin.

This week could bring significant market movement with the release of key U.S. economic data, including the Consumer Price Index (CPI) and Producer Price Index (PPI), both critical indicators of inflation and economic health. Additionally, the political landscape is in focus with a debate between crypto-friendly Republican candidate Donald Trump and Democrat Kamala Harris. Trump has been vocal about his support for making the U.S. a global leader in crypto if he wins the election, while Harris has expressed only mild support for crypto without outlining specific plans. These developments may play a role in influencing Bitcoin’s price trajectory.