Where are we in the broader four-year cycle?

April 2024. Crypto investors believe this will be an important month. What’s the big deal? The four year cycle of Bitcoin halving.

Here’s how it works: In the past Bitcoin has moved in four year patterns around macroeconomic factors and Bitcoin’s supply halving; the Halving being an event in which Bitcoin’s supply issuance is cut in half. With the next halving set to take place just around the corner in April of this year, let’s take a look at a few metrics to illustrate how closely this current cycle is tracking previous ones.

The reassurance of no surprises

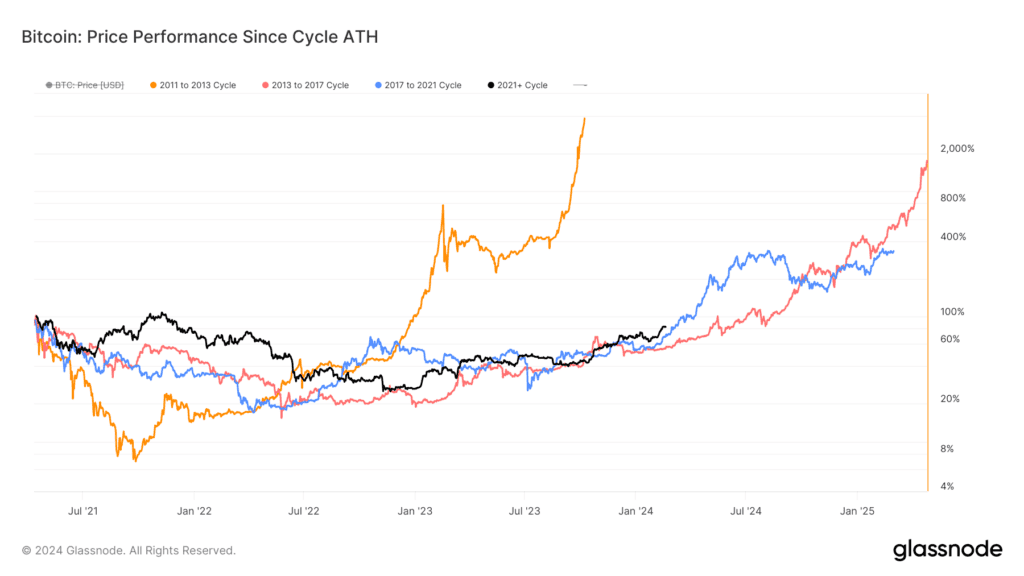

Looking at price performance alone, the cycle on the lead up to this halving (shown in the chart below in black) appears to be tracking quite closely with previous market cycles.

Past performance is not an indication of future results.

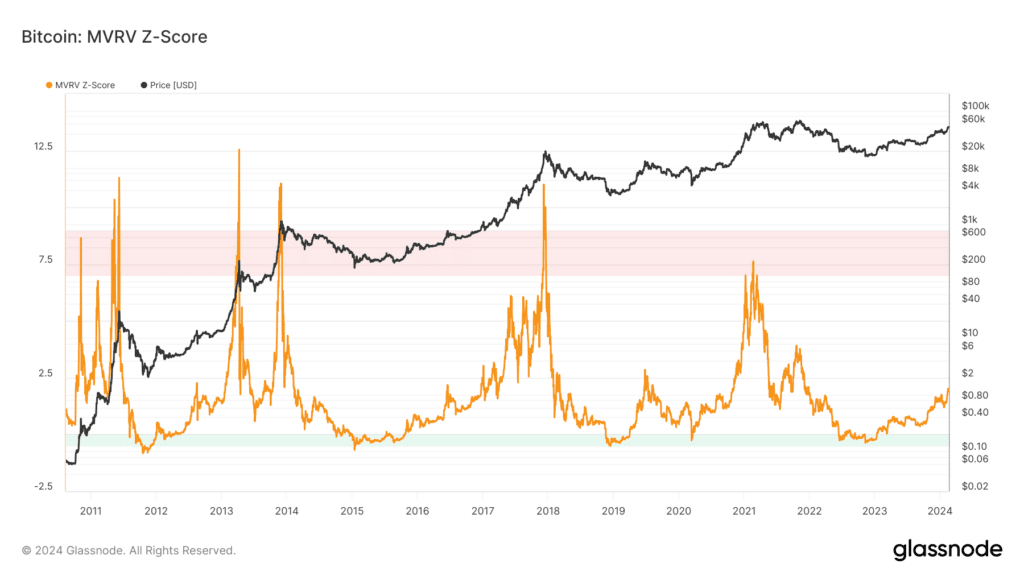

One of the most reliable valuation models for Bitcoin is market value to realized value ratio. This compares realized value, which is the aggregated cost basis of the Bitcoin network based on the price that coins were last moved relative to the current trading price. Whenever the current marginal trading price of Bitcoin vastly overshoots the aggregated cost basis of the network there is a high likelihood that market participants will look to take profits (red zone).

On the flip side, whenever the current marginal trading price is below the aggregated cost basis this means by definition that the market is underwater; which has historically proven to be a prudent time to accumulate the leading cryptoasset (green zone). After spending several months below the aggregated cost basis of the network, Bitcoin pushed out of a region of “deep value” although still in the lower bounds of historical valuation.

Past performance is not an indication of future results.

Investors are betting on Bitcoin

Last but not least, the amount of Bitcoin supply that has not moved in at least 2 years continues to reach new all-time highs. This reflects the strong belief of current BTC holders in the cryptoasset, despite market wide contagion throughout 2022-23 and a ton of headwinds in the macroeconomic landscape during the same time period.

Learn more about the Halving.

The material in this blog post was created exclusively for eToro by Reflexivity Research.